SanDisk 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 . Sa n D is k C o r p o ra t io n . 2 0 0 0 A n n ua l Re p o r t

m o nths o f 200 0, due to inc re ased d em and in the con-

sum er ele c tro nic s and c ellular pho ne m arke ts. This

inc re ase d dem and c aused supply c o nstraints fo r m o st

o f 200 0. H o w ever, sem ic ond uc tor m anufac ture rs,

inc luding UM C and Toshib a have b een ad din g new

ad vanced w afer fab c apac ity. This ad d itio nal cap ac ity,

alo ng w ith slow ing ec o nom ic c o n d itio ns e xp e rienc ed

late in the fo urth q uarter o f 2 000 and into 200 1, has

resulte d in e xc ess sup p ly and inte nse pricing pressure .

If ind ustry- w ide d em and fo r o ur produc ts c o ntinues to

b e b e lo w the industry- w id e availab le supply, o ur prod-

uc t p ric es could dec re ase furthe r c ausing o ur reve nues

and p ro fits to d e c line sig nific antly. Und e r o ur w afer

sup ply ag re em ents, there are lim its o n the num ber o f

w afers w e can o rd er and o ur ab ility to c hang e that

q uantity, e ither up o r d o w n, is restric te d . Ac c o rd ingly,

o ur ab ility to react to signific ant fluctuatio ns in d em and

fo r o ur produc ts is lim ite d . If c usto m e r dem and falls

b elow o ur fo re c ast and w e are unab le to re sc hed ule o r

c ancel o ur orders for w afers o r o ther long lead- tim e

ite m s suc h as c o ntro ller c hip s o r p rinte d circuit b o ard s,

w e m ay end up w ith excess invento ries, w hich c ou ld

result in hig he r operating exp ense s and red uc ed g ro ss

m arg ins. If c usto m er d e m and e xc e eds o ur forec asts,

w e m ay b e unab le to o b tain an ad e q uate supply o f

w afers to fill c usto m e r o rd e rs, w hich could result in lost

sale s and lo w e r re venue s. If w e are unab le to o b tain

ad e q uate q uantities o f flash m e m o ry w afe rs w ith

ac c e p table p ric es and yie ld s fro m o ur c urrent and

future w afe r fo undrie s, o ur b usine ss, financ ial c o nd ition

and results o f o p e rations c o uld b e harm ed .

W e have fro m tim e to tim e taken w rite- d o w ns for

exc ess invento rie s, and m ay b e fo rc ed to d o so ag ain

if the current d eterio ratio n in m arke t d em and fo r o ur

p ro d uc ts c o n tinues an d o ur inve ntory levels exc e ed

c usto m er o rd ers. In ad d ition, w e m ay have to w rite-

d o w n o ur invento rie s if c o ntinued p ric ing p re ssure

results in a ne t realizab le value that is low er than our

c o st, or if p art o f the inve ntory b ecom es o b solete. Due

to the current m arke t d em and fo r o ur produc ts c hang -

ing so rap id ly, w e e nd e d the fo urth q uarte r w ith sig nifi-

c ant am ounts o f e xc e ss inve ntory. Althoug h w e are

w o rking to reduc e this invento ry in line w ith the c urre nt

leve l of business, w e are ob lig ate d to ho no r existing

p urc hase o rd e rs, w hich w e have plac ed w ith our sup -

p liers. Furtherm o re , to assure favo rab le future b usi-

ne ss relatio ns w ith our m ajo r sup p liers, w e m ay

c ho o se no t to shut dow n the ir p ro d uc tio n o f o ur p ro d -

uc ts. In the case o f FlashVisio n m anufac turing at

Do m inio n in Virg inia, b o th Tos hib a and SanDisk are

o b lig ated to purc hase their share o f the p ro d uc tion

o utp ut, w hich m ay m ake it m o re d iffic ult fo r us to

red uc e o ur invento ry.

Exc e ss inve ntory no t o nly tie s up our c ash, b ut

also c an re sult in substantial lo sses if suc h invento ry, o r

larg e p o rtions the reof, has to be revalued d ue to low er

m arket p ric ing o r p ro d u c t obso le sc e nc e . The se inven-

to ry ad justm ents d ec rease g ro ss m argins and have

resulte d , and c o uld in the future re sult in, fluctuatio ns in

g ro ss m arg ins and net earning s in the quarter in w hic h

the y occur. Se e “ Fac to rs That M ay Affec t Future

Results – Our Operating Results M ay Fluctuate

Sig nific antly.”

Exp o rt sales are an im p o rtant part of o ur business,

rep re se nting 5 7% , 53% and 56% o f o ur total reve nue s

in 20 0 0, 1999 , and 19 9 8, re sp ec tive ly. Our sales m ay

b e im p acted b y changes in econo m ic c o nd itions in our

inte rnatio nal m arkets. Ec o nom ic c o nditio ns in o ur inte r-

national m arkets, inc luding Asia and the Euro p e an

Unio n, m ay adverse ly affect o u r re venues to the e xte nt

that dem and fo r our p ro d uc ts in the se reg io ns

d eclines. Give n the re c e nt econo m ic c o nd itions in Asia

and the Euro p e an Unio n and the w e akness of the

Euro , Ye n and o ther c urrenc ies relative to the Unite d

States d o llar, our p ro d uc ts m ay b e relative ly m o re

exp ensive in these regions, w hic h could result in a

d ecrease o f o ur sales in the se reg io ns. W hile m o st o f

o ur sale s are d e no m inate d in U.S. Do llars, w e invo ic e

c ertain Jap anese c usto m e rs in Japane se Ye n and are

sub jec t to exc hang e rate fluctuatio ns o n the se transac -

tio ns w hic h could affect our b usine ss, financ ial c o nd i-

tio n and results of operatio ns. See “ Fac tors That M ay

Affe c t Future Results – Our international op eratio ns

m ake us vulnerab le to changing c ond itio ns and c urren-

c y fluc tuatio ns.”

Fo r the foresee ab le future, w e exp ect to re alize a

sig nific ant p ortion of our re venue s fro m rec ently

intro d uc ed and new p ro d uc ts. Typ ic ally, n ew p ro d uc ts

initially have lo w er g ro ss m argins than m ore m ature

p ro d uc ts b e c au se the m an ufac turing yie ld s are lo w e r

at the start o f m anufac turing eac h suc c e ssive p ro d uc t

g eneratio n. In additio n, m anufac turing yield s are gener-

ally low er at the start o f m anufac turing any p ro d uc t at

a new fo und ry. To rem ain c o m p e titive , w e are fo c using

o n a num b e r o f p ro g ram s to lo w er m anufacturing

c o sts, inc luding deve lo p m e nt o f fu ture generatio ns o f

D2 flash and ad vanc ed tec hno lo g y w afe rs. There c an

b e no assuranc e that w e w ill suc c essfully d evelo p such

p ro d uc ts o r p ro c esse s o r that d evelo p m ent o f suc h

p ro c esse s w ill lo w er m anufacturing c o sts. If the c urre nt

ind ustry- w ide and w o rld w id e ec o nom ic slow d o w n c o n-

tinues fo r the rest o f fiscal 2 0 01, w e m ay b e unab le to

effic iently utilize the N AN D flash w afer p ro d uc tion fro m

FlashVision, w hic h w o uld fo rc e us to am o rtize the fix ed

c o sts o f the fab ric ation fac ility o ver a reduc ed w afe r

o utp ut, m aking the se w afe rs sig nific antly m ore expen-

sive. See “ Facto rs That M ay Affe c t Future Re sults – W e

m ust achieve ac c e p table m anufac turing yie ld s.”

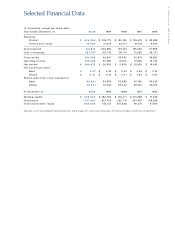

R e s u lt s o f O p e r a t io n s

Prod uc t Revenue s. In 2 000 , o ur p rod uc t revenues

inc re ase d 156% to $ 5 26.4 m illio n fro m $20 5 .8 m illion in

19 99. The inc re ase c o nsisted o f an in c rease o f 173% in

unit sales, w hic h w as p artially offset by a 7% d e c line in

averag e selling p ric es per unit. In 20 00, the larg e st

inc re ase in unit vo lum e cam e from sales o f

Co m p actFlash Pro d uc ts that re p resente d 4 7% o f p ro d -

uc t reve nu es and M ultiM e d iaCard p ro d uc ts that rep re -

se nte d 21% o f p ro d uc t re venues. The c o ntinuing m o ve

to w ard s higher c ap ac ity card s in 20 00 p artially o ffset a

d ecline in the averag e se lling p ric e p e r m e g ab yte o f