Sallie Mae 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. Derivative Financial Instruments (Continued)

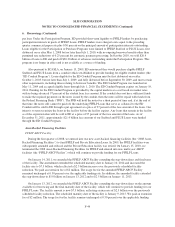

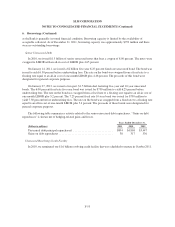

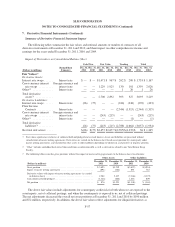

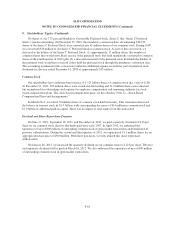

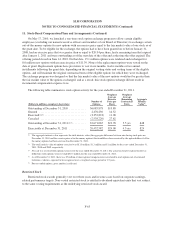

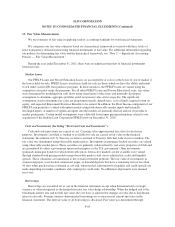

Impact of Derivatives on Consolidated Statements of Changes in Stockholders’ Equity (net of tax)

Years Ended

December 31,

(Dollars in millions) 2011 2010 2009

Total losses on cash flow hedges ................................... $(4)$(35) $(22)

Realized losses recognized in interest expense(1)(2)(3) .................... 35 40 63

Hedge ineffectiveness reclassified to earnings(1)(4) ..................... — — (1)

Total change in stockholders’ equity due to gains (losses) on derivatives . . . $31 $ 5 $ 40

(1) Amounts included in “Realized gain (loss) on derivatives” in the “Impact of Derivatives on Consolidated Statements of

Income” table above.

(2) Includes net settlement income/expense.

(3) We expect to reclassify $1 million of after-tax net losses from accumulated other comprehensive income to earnings during

the next 12 months related to net settlement accruals on interest rate swaps.

(4) Recorded in “Gains (losses) derivatives and hedging activities, net” in the consolidated statements of income.

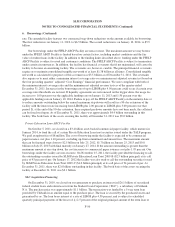

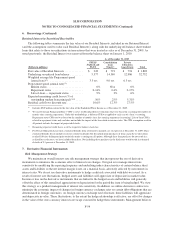

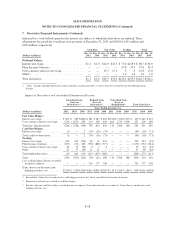

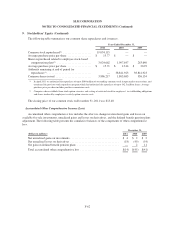

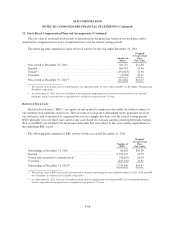

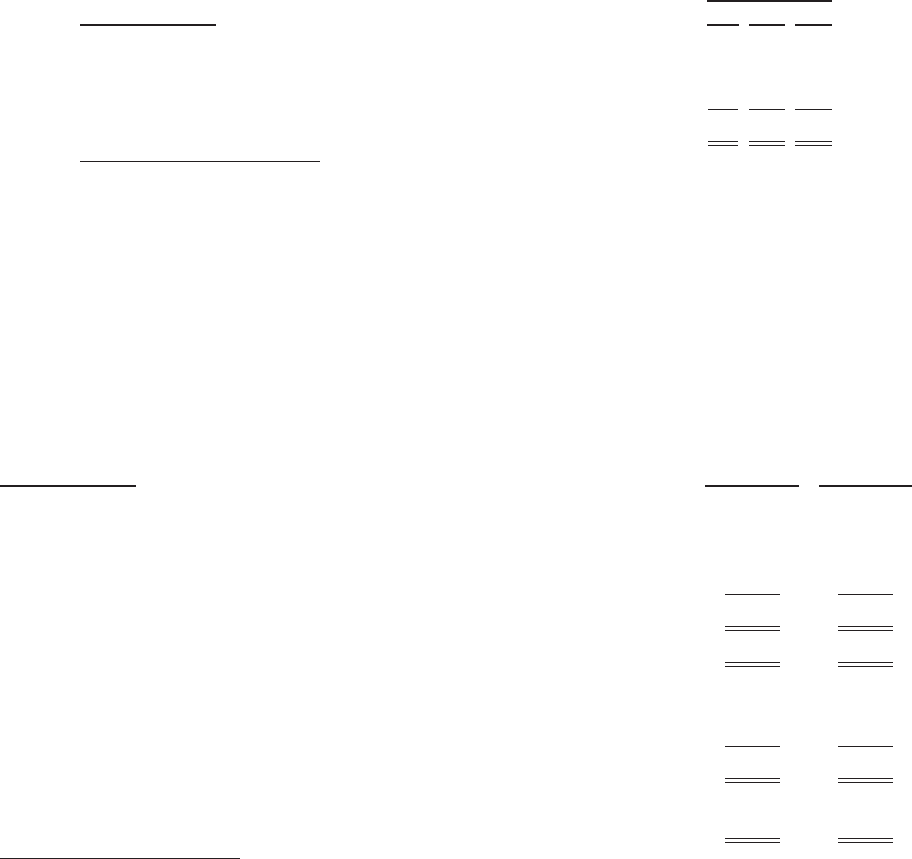

Collateral

Collateral held and pledged related to derivative exposures between us and our derivative counterparties are

detailed in the following table:

(Dollars in millions)

December 31,

2011

December 31,

2010

Collateral held:

Cash (obligation to return cash collateral is recorded in short-term borrowings)(1) . . . $1,326 $ 886

Securities at fair value — on-balance sheet securitization derivatives (not recorded in

financial statements)(2) ................................................ 841 585

Total collateral held .................................................... $2,167 $1,471

Derivative asset at fair value including accrued interest ........................ $2,607 $2,540

Collateral pledged to others:

Cash (right to receive return of cash collateral is recorded in investments) ......... $1,018 $ 809

Securities at fair value (recorded in restricted investments)(3) .................... — 36

Total collateral pledged ................................................. $1,018 $ 845

Derivative liability at fair value including accrued interest and premium

receivable .......................................................... $1,223 $ 747

(1) At December 31, 2011 and 2010, $26 million and $108 million, respectively, were held in restricted cash accounts.

(2) The trusts do not have the ability to sell or re-pledge securities they hold as collateral.

(3) Counterparty has the right to sell or re-pledge securities.

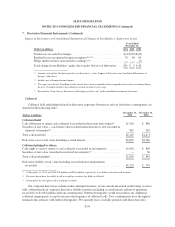

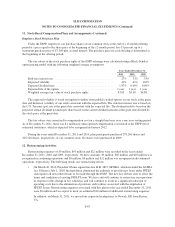

Our corporate derivatives contain credit contingent features. At our current unsecured credit rating, we have

fully collateralized our corporate derivative liability position (including accrued interest and net of premiums

receivable) of $1,034 million with our counterparties. Further downgrades would not result in any additional

collateral requirements, except to increase the frequency of collateral calls. Two counterparties have the right to

terminate the contracts with further downgrades. We currently have a liability position with these derivative

F-59