Sallie Mae 2009 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

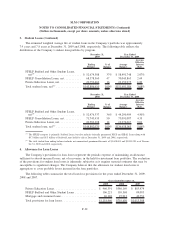

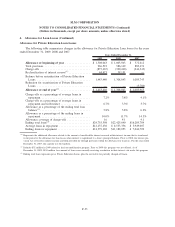

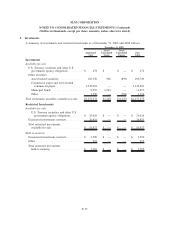

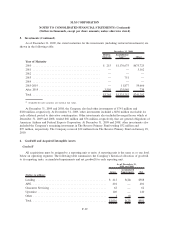

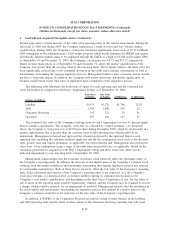

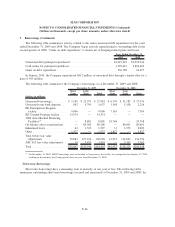

5. Investments (Continued)

As of December 31, 2009, the stated maturities for the investments (including restricted investments) are

shown in the following table:

Held-to-

Maturity

Available-for-

Sale

(1)

Other

December 31, 2009

Year of Maturity

2010 ........................................... $ 215 $1,176,675 $675,725

2011 ........................................... — — 5,162

2012 ........................................... — — —

2013 ........................................... — 751 —

2014 ........................................... — — —

2015-2019 . . ..................................... — 11,877 59,666

After 2019 . . ..................................... 3,550 135,949 739

Total ........................................... $3,765 $1,325,252 $741,292

(1)

Available-for-sale securities are stated at fair value.

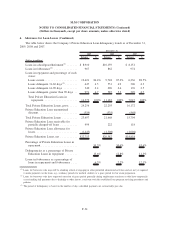

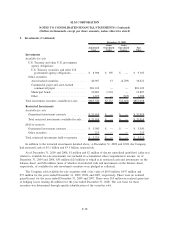

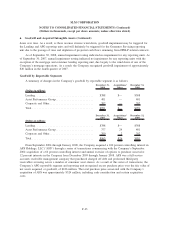

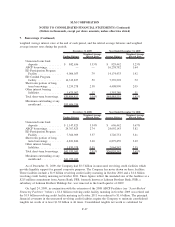

At December 31, 2009 and 2008, the Company also had other investments of $741 million and

$180 million, respectively. At December 31, 2009, other investments included a $636 million receivable for

cash collateral posted to derivative counterparties. Other investments also included leveraged leases which at

December 31, 2009 and 2008, totaled $66 million and $76 million, respectively, that are general obligations of

American Airlines and Federal Express Corporation. At December 31, 2009 and 2008, other investments also

included the Company’s remaining investment in The Reserve Primary Fund totaling $32 million and

$97 million, respectively. The Company received $32 million from The Reserve Primary Fund on January 29,

2010.

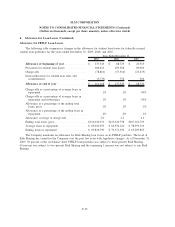

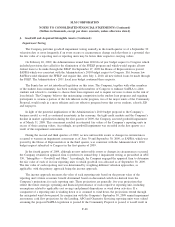

6. Goodwill and Acquired Intangible Assets

Goodwill

All acquisitions must be assigned to a reporting unit or units. A reporting unit is the same as or one level

below an operating segment. The following table summarizes the Company’s historical allocation of goodwill

to its reporting units, accumulated impairments and net goodwill for each reporting unit.

Gross

Accumulated

Impairments Net

As of December 31,

2009 and 2008

(Dollars in millions)

Lending ............................................. $ 412 $(24) $388

APG................................................ 401 — 401

Guarantor Servicing .................................... 62 — 62

Upromise ............................................ 140 — 140

Other ............................................... 1 (1) —

Total................................................ $1,016 $(25) $991

F-39

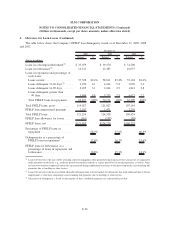

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)