Sallie Mae 2009 Annual Report Download - page 109

Download and view the complete annual report

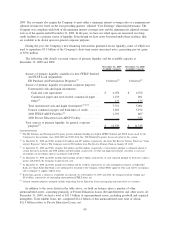

Please find page 109 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Unrecognized tax benefits were $101 million and $81 million for the years ended December 31, 2009 and

2008, respectively. For additional information, see Note 19, “Income Taxes,” to the consolidated financial

statements.

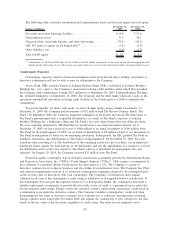

OFF-BALANCE SHEET LENDING ARRANGEMENTS

We have issued lending-related financial instruments, including lines of credit, to meet the financing

needs of our institutional customers. In connection with these agreements, the Company also enters into a

participation agreement with the institution to participate in the loans as they are originated. In the event that a

line of credit is drawn upon, the loan is collateralized by underlying student loans and is usually participated

on the same day. The contractual amount of these financial instruments, $850 million at December 31, 2009,

represents the maximum possible credit risk should the counterparty draw down the commitment, the

Company does not participate in the loan, and the counterparty subsequently fails to perform according to the

terms of our contract. The remaining total contractual amount available to be borrowed under these

commitments is $850 million. All commitments mature in 2010. We do not believe that these instruments are

representative of our actual future credit exposure. To the extent that the lines of credit are drawn upon, the

balance outstanding is collateralized by student loans. At December 31, 2009, there were no outstanding draws

on lines of credit. For additional information, see Note 17, “Commitments, Contingencies and Guarantees,” to

the consolidated financial statements.

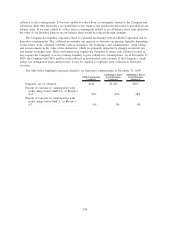

The Company maintains forward contracts to purchase loans from our lending partners at contractual

prices. These contracts typically have a maximum amount we are committed to buy, but lack a fixed or

determinable amount as it ultimately is based on the lending partner’s origination activity. FFELP forward

purchase contracts typically contain language relieving us of most of our responsibilities under the contract

due to, among other things, changes in student loan legislation. These commitments are not accounted for as

derivatives under ASC 815 as they do not meet the definition of a derivative due to the lack of a fixed and

determinable purchase amount. At December 31, 2009, there were $1.3 billion originated loans (FFELP and

Private Education Loans) in the pipeline that the Company was committed to purchase.

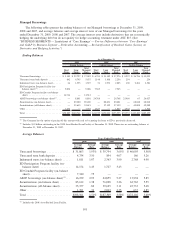

MANAGEMENT OF RISKS

Significant risks that affect the Company may be grouped into the following categories: (1) funding and

liquidity; (2) operations; (3) political/reputation; (4) market competition; (5) credit and counterparty; and

(6) regulatory and compliance. These risks are discussed in the “Item 1A. Risk Factors” section of this

document. Management’s strategies for managing these risks are discussed below.

Risk Management Processes

Risk management is a shared responsibility throughout the Company. The Board of Directors and its

committees oversee significant risks and review the Company’s risk management practices. Executive

management is responsible for monitoring and assessing the Company’s significant risks. Committees

composed of management oversee many of these risks. Also, senior managers of each business division have

direct and primary responsibility and accountability for managing risks specific to their operations by

identifying and assessing risks, implementing internal controls and reporting control issues to the Company’s

Risk Assessment Department. The Risk Assessment Department monitors these efforts, identifies areas that

require increased focus and resources, and reports significant control issues to executive management and the

Audit Committee of the Board. The Company’s centralized staff functions, such as accounting, compliance,

credit risk, human resources and legal, further strengthen our risk controls.

At least annually, the Risk Assessment Department performs a risk assessment to identify the Company’s

top risks, which supports the development of the internal audit plan. The risk assessment process is based on

the risk universe of the Company and solicits input from over 200 managers in the Company regarding

effectiveness of internal controls, compliance with laws and regulations and the adequacy of anti-fraud

programs, and is the basis for the Company’s internal audit plan. Risks are rated on significance and likelihood

of occurrence. Risks with the greatest significance and highest likelihood of occurrence are prioritized for

108