Royal Caribbean Cruise Lines 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 Royal Caribbean Cruises Ltd.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Certain of our unsecured ship financing term loans

are guaranteed by the export credit agency in the

respective country in which the ship is constructed.

In consideration for these guarantees, depending on

the financing arrangement, we pay to the applicable

export credit agency fees that range from either

(1) 0.88% to 1.48% per annum based on the outstand-

ing loan balance semi-annually over the term of the

loan (subject to adjustment under certain of our facili-

ties based upon our credit ratings) or (2) an upfront

fee of approximately 2.3% to 2.37% of the maximum

loan amount. We amortize the fees that are paid

upfront over the life of the loan and those that are paid

semi-annually over each respective payment period.

We classify these fees within Debt issuance costs in

our consolidated statements of cash flows and within

Other assets in our consolidated balance sheets.

Under certain of our agreements, the contractual

interest rate, facility fee and/or export credit agency

fee vary with our debt rating.

The unsecured senior notes and senior debentures are

not redeemable prior to maturity, except that certain

series may be redeemed upon the payment of a make-

whole premium.

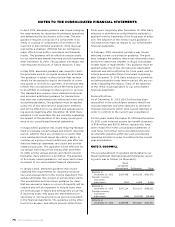

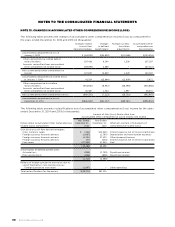

Following is a schedule of annual maturities on long-

term debt including capital leases as of December 31,

2014 for each of the next five years (in thousands):

Year

Thereafter

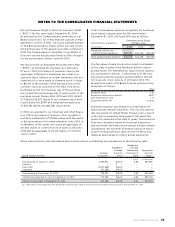

NOTE 8. SHAREHOLDERS’ EQUITY

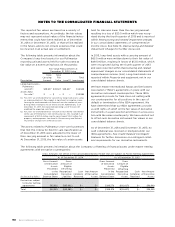

During the fourth quarter of 2014, we repurchased

from A. Wilhelmsen AS, our largest shareholder, 3.5

million shares of our common stock directly from

them in a private transaction at $67.45 per share,

which was equal to the price paid by a third-party

financial institution for the simultaneous purchase of

an additional 3.5 million shares from A. Wilhelmsen

AS. Total consideration paid to repurchase such

shares was approximately $236.1 million and was

recorded in shareholders’ equity as a component of

treasury stock.

In December 2014, we declared a cash dividend on

our common stock of $0.30 per share which was

paid in the first quarter of 2015. We declared a cash

dividend on our common stock of $0.30 per share

during the third quarter of 2014 which was paid in the

fourth quarter of 2014. We declared and paid a cash

dividend on our common stock of $0.25 per share

during the first and second quarters of 2014.

During the fourth quarter of 2013, we declared a cash

dividend on our common stock of $0.25 per share

which was paid in the first quarter of 2014. We declared

a cash dividend on our common stock of $0.25 per

share during the third quarter of 2013 which was paid

in the fourth quarter of 2013. We declared and paid

a cash dividend on our common stock of $0.12 per

share during the first and second quarters of 2013.

During the first quarter of 2013, we also paid a cash

dividend on our common stock of $0.12 per share

which was declared during the fourth quarter of 2012.

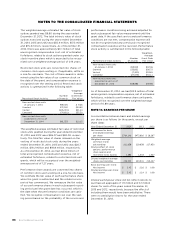

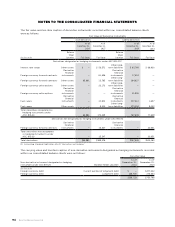

NOTE 9. STOCK-BASED EMPLOYEE

COMPENSATION

We currently have awards outstanding under two

stock-based compensation plans, which provide for

awards to our officers, directors and key employees.

The plans consist of a 2000 Stock Award Plan and

a 2008 Equity Plan. Our ability to issue new awards

under the 2000 Stock Award Plan terminated in

accordance with the terms of the plan in September

2009. The 2008 Equity Plan, as amended, provides

for the issuance of up to 11,000,000 shares of our

common stock pursuant to grants of (i) incentive and

non-qualified stock options, (ii) stock appreciation

rights, (iii) restricted stock, (iv) restricted stock units

and (v) performance shares. During any calendar year,

no one individual shall be granted awards of more

than 500,000 shares. Options and restricted stock

units outstanding as of December 31, 2014 generally

vest in equal installments over four years from the

date of grant. In addition, performance shares gener-

ally vest in three years. With certain limited exceptions,

options, restricted stock units and performance shares

are forfeited if the recipient ceases to be a director or

employee before the shares vest. Options are granted

at a price not less than the fair value of the shares on

the date of grant and expire not later than ten years

after the date of grant.

Prior to 2012, our officers received a combination of

stock options and restricted stock units. Beginning

in 2012, our officers instead receive their long-term

incentive awards through a combination of perfor-

mance shares and restricted stock units. Each perfor-

mance share award is expressed as a target number

of performance shares based upon the fair market

value of our common stock on the date the award is

issued. The actual number of shares underlying each

award (not to exceed 200% of the target number of

performance shares) will be determined based upon

the Company’s achievement of a specified perfor-

mance target range. For the grants awarded in 2014,