Royal Caribbean Cruise Lines 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

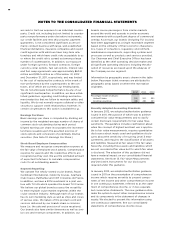

Recent Accounting Pronouncements

In July 2012, amended guidance was issued regarding

the periodic impairment testing of indefinite-lived

intangible assets. The new guidance allows an entity

to assess qualitative factors to determine if it is more-

likely-than-not that indefinite-lived intangible assets

might be impaired and, based on this assessment,

whether it is necessary to perform the quantitative

impairment tests. This guidance will be effective for

our annual and interim impairment tests for fiscal

years beginning after September 15, 2012. The adop-

tion of this newly issued guidance will not have an

impact on our consolidated financial statements.

In February 2013, amended guidance was issued over

the presentation of amounts reclassified from accu-

mulated other comprehensive income to net income.

The new guidance requires an entity to present, either

in a single note or parenthetically on the face of the

financial statements, the effect of significant amounts

reclassified from each component of accumulated

other comprehensive income based on its source

(e.g., the release due to cash flow hedges from inter-

est rate contracts) and the income statement line

items affected by the reclassification (e.g., interest

income or interest expense). This guidance must be

applied prospectively and will be effective for our

interim and annual reporting periods beginning after

December 15, 2012. The disclosures will be added to

our future filings when applicable.

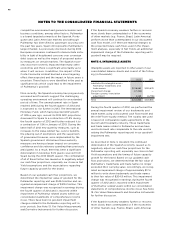

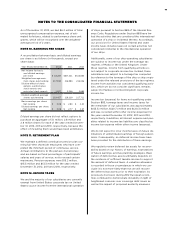

NOTE 3. GOODWILL

The carrying amount of goodwill attributable to our Royal Caribbean International and the Pullmantur reporting

units was as follows (in thousands):

Royal

Caribbean

International Pullmantur Other Total

Balance at December 31, 2010

Foreign currency translation adjustment — () ()

Balance at December 31, 2011

Impairment charge — () — ()

Foreign currency translation adjustment —

Balance at December 31, 2012

During the fourth quarter of 2012, we performed a

qualitative assessment of whether it was more-likely-

than-not that our Royal Caribbean International

reporting unit’s fair value was less than its carrying

amount before applying the two-step goodwill

impairment test. The qualitative analysis included

assessing the impact of certain factors such as gen-

eral economic conditions, limitations on accessing

capital, changes in forecasted operating results,

changes in fuel prices and fluctuations in foreign

exchange rates. Based on our qualitative assessment,

we concluded that it was more-likely-than-not that

the estimated fair value of the Royal Caribbean

International reporting unit exceeded its carrying

value as of December 31, 2012 and thus, did not pro-

ceed to the two-step goodwill impairment test. No

indicators of impairment exist primarily because the

reporting unit’s fair value has consistently exceeded

its carrying value by a significant margin, its financial

performance has been solid in the face of mixed

economic environments and forecasts of operating

results generated by the reporting unit appear suffi-

cient to support its carrying value.

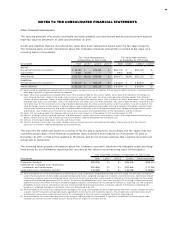

In addition, during the fourth quarter of 2012, we per-

formed our annual impairment review of goodwill for

Pullmantur’s reporting unit. We did not perform a

qualitative assessment but instead proceeded directly

to the two-step goodwill impairment test. We esti-

mated the fair value of the Pullmantur reporting unit

using a probability-weighted discounted cash flow

model. The principal assumptions used in the dis-

counted cash flow model are projected operating

results, weighted-average cost of capital, and terminal

value. The discounted cash flow model used our 2013

projected operating results as a base. To that base

we added future years’ cash flows assuming multiple

revenue and expense scenarios that reflect the impact

on Pullmantur’s reporting unit of different global

economic environments beyond 2013. We assigned

a probability to each revenue and expense scenario.

We discounted the projected cash flows using rates

specific to Pullmantur’s reporting unit based on its

weighted-average cost of capital.

The estimation of fair value utilizing discounted

expected future cash flows includes numerous uncer-

tainties which require our significant judgment when

making assumptions of expected revenues, operating

costs, marketing, selling and administrative expenses,

interest rates, ship additions and retirements as well as

assumptions regarding the cruise vacation industry’s

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS