Royal Caribbean Cruise Lines 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

PART II

names and certain long-lived assets, consisting of

three aircraft owned and operated by Pullmantur Air,

to their fair value. In addition, we recognized a $33.7

million charge to record a 100% valuation allowance

related to our deferred tax assets for Pullmantur

and we reduced the deferred tax liability related to

Pullmantur’s trademarks and trade names by $5.2

million. As a result, our net income for 2012 was

$18.3 million as compared to $607.4 million for 2011.

• We took delivery of Celebrity Reflection. To finance

the purchase, we borrowed $673.5 million under our

previously committed 12-year unsecured term loan

which is 95% guaranteed by Hermes. See Note 7.

Long-Term Debt to our consolidated financial state-

ments under Item 8. Financial Statements and

Supplementary Data for further information.

• We exercised our option under our agreement with

Meyer Werft to construct Anthem of the Seas, the

second Quantum-class ship for Royal Caribbean

International with approximately 4,100 berths which

is expected to enter service in the second quarter

of 2015. We have a committed bank financing agree-

ment to finance the purchase of the ship which

includes a sovereign financing guarantee. See Note

14. Commitments and Contingencies to our consoli-

dated financial statements under Item 8. Financial

Statements and Supplementary Data for further

information.

• We reached a conditional agreement with STX

France to build the third Oasis-class ship for Royal

Caribbean International. The agreement is subject

to certain closing conditions and is expected to

become effective in the first quarter of 2013. The

ship will have a capacity of approximately 5,400

berths and is expected to enter service in the sec-

ond quarter of 2016. If the agreement becomes

effective, Pullmantur’s Atlantic Star, which has been

out of operation since 2009, will be transferred to

an affiliate of STX France as part of the consider-

ation. The transfer is not expected to result in a gain

or a loss. See Note 5. Property and Equipment to

our consolidated financial statements under Item 8.

Financial Statements and Supplementary Data for

further information.

Other Items:

• TUI Cruises, our 50% joint venture, entered into

an agreement with STX Finland to build its second

newbuild ship, scheduled for delivery in the second

quarter of 2015. TUI Cruises has entered into a credit

agreement providing financing for up to 80% of the

contract price of the ship.

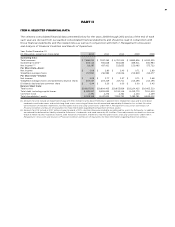

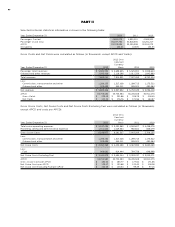

We reported historical total revenues, operating income,

net income, non-GAAP net income (excluding the

impairment related charges), earnings per share and

non-GAAP earnings per share (excluding the impair-

ment related charges) as shown in the following table

(in thousands, except per share data):

Year Ended

December 31, 2012 2011 2010

Total revenues

Operating income

Net income

Pullmantur impair-

ment related

charges — —

Non-GAAP

Net income

Basic earnings

per share:

Net income

Non-GAAP

Net income

Diluted earnings

per share:

Net income

Non-GAAP

Net income

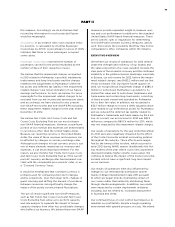

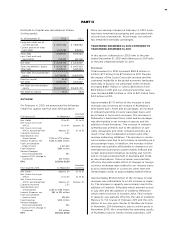

The following table presents historical operating

data as a percentage of total revenues for the last

three years:

Year Ended

December 31,

Passenger ticket revenues

Onboard and other revenues

Total revenues

Cruise operating expenses:

Commissions, transportation

and other

Onboard and other

Payroll and related

Food

Fuel

Other operating

Total cruise operating

expenses

Marketing, selling and admin-

istrative expenses

Depreciation and amortization

expenses

Impairment of Pullmantur

related assets — —

Operating income

Other expense () () ()

Net income