Royal Caribbean Cruise Lines 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 76

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

all of fiscal year 2011. The adoption of this guidance

did not have an impact on our consolidated financial

statements.

In September 2011, we adopted authoritative guidance

regarding the periodic testing of goodwill for impair-

ment. The new guidance allows an entity to assess

qualitative factors to determine if it is more-likely-

than-not that goodwill might be impaired and based

on this assessment determine whether it is necessary

to perform the two-step goodwill impairment test.

This guidance is effective for our annual and interim

goodwill impairment tests performed for fiscal years

beginning after December 15, 2011 and early adoption

is permitted. We early adopted this guidance when

performing our annual goodwill impairment testing in

the fourth quarter of 2011. See Note 3. Goodwill for

our disclosures related to this guidance.

Recently Adopted Accounting Pronouncements

In May 2011, authoritative guidance was issued to

achieve consistent fair value measurements and to

clarify certain disclosure requirements for fair value

measurements. The new guidance includes clarifica-

tion about when the concept of highest and best use

is applicable to fair value measurements, requires

quantitative disclosures about inputs used and quali-

tative disclosures about the sensitivity of recurring

Level 3 measurements, and requires the classification

of all assets and liabilities measured at fair value in

the fair value hierarchy, including those assets and

liabilities which are not recorded at fair value but for

which fair value is disclosed. The guidance will be

effective for our interim and annual reporting periods

beginning after December 15, 2011. Based on our cur-

rent fair value measurements, the adoption of this

issued guidance is not expected to have an impact

on our consolidated financial statements.

In June 2011, authoritative guidance was issued on the

presentation of comprehensive income. Specifically,

the guidance allows an entity to present components

of net income and other comprehensive income in one

continuous statement, referred to as the statement of

comprehensive income, or in two separate but con-

secutive statements. The new guidance eliminates the

current option to report other comprehensive income

and its components in the statement of changes in

equity. This guidance must be applied retrospectively

and will be effective for our interim and annual report-

ing periods beginning after December 15, 2011. We

expect to add a new primary consolidated statement

of other comprehensive income which will immediately

follow our consolidated statements of operations to

our filings beginning in the first quarter of 2012. In

addition, the original guidance issued required that

any reclassifications from comprehensive income to

net income to be shown on the face of the income

statement by income statement line item, however,

in December 2011, this guidance was deferred until

further notice.

Reclassifications

During 2011, we separately presented gains on our

fuel call options of $18.9 million in our consolidated

statement of cash flows. As a result, the related prior

year amounts were reclassified from other, net to

(gain) loss on fuel call options within net cash flows

provided by operating activities in order to conform to

the current year presentation.

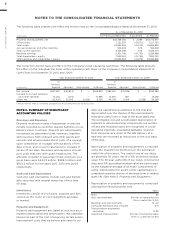

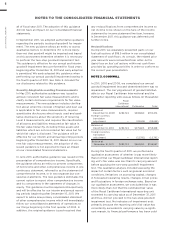

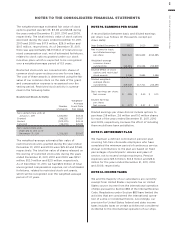

NOTE 3. GOODWILL

In 2011, 2010 and 2009, we completed our annual

goodwill impairment test and determined there was no

impairment. The carrying amount of goodwill attribut-

able to our Royal Caribbean International and the

Pullmantur reporting units was as follows (in thousands):

Royal

Caribbean

International

Pullmantur Total

Balance at

December 31, 2009

Foreign currency

translation

adjustment — () ()

Balance at

December 31, 2010

Foreign currency

translation

adjustment — () ()

Balance at

December 31, 2011

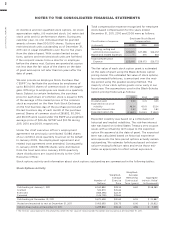

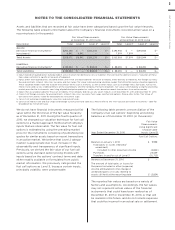

During the fourth quarter of 2011, we performed a

qualitative assessment of whether it was more-likely-

than-not that our Royal Caribbean International report-

ing unit’s fair value was less than its carrying amount

before applying the two-step goodwill impairment

test. The qualitative analysis included assessing the

impact of certain factors such as general economic

conditions, limitations on accessing capital, changes

in forecasted operating results, changes in fuel prices

and fluctuations in foreign exchange rates. Based on

our qualitative assessment, we concluded that it was

more-likely-than-not that the estimated fair value

of the Royal Caribbean International reporting unit

exceeded its carrying value as of December 31, 2011

and thus, did not proceed to the two-step goodwill

impairment test. No indicators of impairment exist

primarily because the reporting unit’s fair value has

consistently exceeded its carrying value by a signifi-

cant margin, its financial performance has been solid