Royal Caribbean Cruise Lines 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

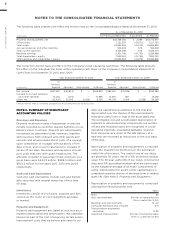

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 73

We review long-lived assets for impairment whenever

events or changes in circumstances indicate, based

on estimated undiscounted future cash flows, that

the carrying amount of these assets may not be fully

recoverable. We evaluate asset impairment for our

ships on an individual basis in accordance with ASC

360-10-35-23 (Property, Plant and Equipment), which

requires that, for purposes of recognition and mea-

surement of an impairment loss, long-lived assets be

grouped with other assets and liabilities at the lowest

level for which identifiable cash flows are largely inde-

pendent of the cash flows of other assets and liabilities.

The lowest level for which we maintain identifiable

cash flows that are independent of the cash flows of

other assets and liabilities is at the ship level.

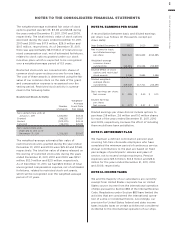

We use the deferral method to account for drydocking

costs. Under the deferral method, drydocking costs

incurred are deferred and charged to expense on a

straight-line basis over the period to the next sched-

uled drydock, which we estimate to be a period of

thirty to sixty months based on the vessel’s age as

required by Class. Deferred drydock costs consist

of the costs to drydock the vessel and other costs

incurred in connection with the drydock which are

necessary to maintain the vessel’s Class certification.

Class certification is necessary in order for our cruise

ships to be flagged in a specific country, obtain liabil-

ity insurance and legally operate as passenger cruise

ships. The activities associated with those drydocking

costs cannot be performed while the vessel is in service

and, as such, are done during a drydock as a planned

major maintenance activity. The significant deferred

drydock costs consist of hauling and wharfage ser-

vices provided by the drydock facility, hull inspection

and related activities (e.g., scraping, pressure cleaning,

bottom painting), maintenance to steering propulsion,

stabilizers, thruster equipment and ballast tanks, port

services such as tugs, pilotage and line handling, and

freight associated with these items. We perform a

detailed analysis of the various activities performed

for each drydock and only defer those costs that are

directly related to planned major maintenance activi-

ties necessary to maintain Class. The costs deferred

are not otherwise routinely periodically performed to

maintain a vessel’s designed and intended operating

capability. Repairs and maintenance activities are

charged to expense as incurred.

Goodwill

Goodwill represents the excess of cost over the fair

value of net tangible and identifiable intangible assets

acquired. We review goodwill for impairment at the

reporting unit level annually or, when events or cir-

cumstances dictate, more frequently. The impairment

review for goodwill consists of a qualitative assess-

ment of whether it is more-likely-than-not that a

reporting unit’s fair value is less than its carrying

amount, followed by a two-step process of determining

the fair value of the reporting unit and comparing it to

the carrying value of the net assets allocated to the

reporting unit. Factors to consider when performing

the qualitative assessment include general economic

conditions, limitations on accessing capital, changes

in forecasted operating results, changes in fuel prices

and fluctuations in foreign exchange rates. If the quali-

tative assessment demonstrates that it is more-likely-

than-not that the estimated fair value of the reporting

unit exceeds its carrying value, it is not necessary to

perform the two-step goodwill impairment test. We

began performing this qualitative assessment in the

fourth quarter of 2011 as allowable per the newly

issued authoritative guidance described under the

heading Recently Adopted Accounting Standards

below. We may elect to bypass the qualitative assess-

ment and proceed directly to step one, for any report-

ing unit, in any period. We can resume the qualitative

assessment for any reporting unit in any subsequent

period. When performing the two-step process, if the

fair value of the reporting unit exceeds its carrying

value, no further analysis or write-down of goodwill is

required. If the fair value of the reporting unit is less

than the carrying value of its net assets, the implied

fair value of the reporting unit is allocated to all its

underlying assets and liabilities, including both recog-

nized and unrecognized tangible and intangible assets,

based on their fair value. If necessary, goodwill is then

written down to its implied fair value.

Intangible Assets

In connection with our acquisitions, we have acquired

certain intangible assets of which value has been

assigned to them based on our estimates. Intangible

assets that are deemed to have an indefinite life are

not amortized, but are subject to an annual impair-

ment test, or when events or circumstances dictate,

more frequently. The indefinite-life intangible asset

impairment test consists of a comparison of the fair

value of the indefinite-life intangible asset with its

carrying amount. If the carrying amount exceeds its

fair value, an impairment loss is recognized in an

amount equal to that excess. If the fair value exceeds

its carrying amount, the indefinite-life intangible asset

is not considered impaired.

Other intangible assets assigned finite useful lives are

amortized on a straight-line basis over their estimated

useful lives.

Contingencies—Litigation

On an ongoing basis, we assess the potential liabilities

related to any lawsuits or claims brought against us.

While it is typically very difficult to determine the tim-

ing and ultimate outcome of such actions, we use our

best judgment to determine if it is probable that we

will incur an expense related to the settlement or final

adjudication of such matters and whether a reason-

able estimation of such probable loss, if any, can be