Royal Caribbean Cruise Lines 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

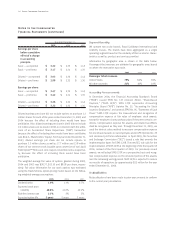

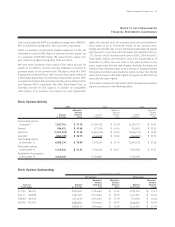

Note 7. Earnings Per Share

A reconciliation between basic and diluted earnings per share is as

follows (in thousands, except per share data):

Year Ended December 31,

2005 2004 2003

Income before cumulative

effect of a change in

accounting principle $ 663,465 $ 474,691 $ 280,664

Cumulative effect of a

change in accounting

principle (Note 2) 52,491 ––

Net income 715,956 474,691 280,664

Interest on dilutive

convertible notes 48,128 54,530 18,893

Net income for diluted

earnings per share $ 764,084 $ 529,221 $ 299,557

Weighted-average common

shares outstanding 206,217 198,946 194,074

Dilutive effect of stock

options and restricted

stock awards 2,725 4,161 3,267

Dilutive effect of

convertible notes 25,772 31,473 13,834

Diluted weighted-average

shares outstanding 234,714 234,580 211,175

Basic earnings per share:

Income before cumulative

effect of a change in

accounting principle $ 3.22 $ 2.39 $ 1.45

Cumulative effect

of a change in

accounting principle $ 0.25 $–$ –

Net income $ 3.47 $ 2.39 $ 1.45

Diluted earnings per share:

Income before cumulative

effect of a change in

accounting principle $ 3.03 $ 2.26 $ 1.42

Cumulative effect

of a change in

accounting principle $ 0.22 $–$ –

Net income $ 3.26 $ 2.26 $ 1.42

Diluted earnings per share did not include options to purchase 1.3

million shares for each of the years ended December 31, 2005 and

2004 because the effect of including them would have been antidi-

lutive. For the year ended December 31, 2003, diluted earnings per

share did not include options to purchase 5.3 million shares as well

as 17.7 million shares of our common stock issuable upon conver-

sion of our Liquid Yield Option™ Notes because the effect of includ-

ing them would have been antidilutive. Also, diluted earnings per

share in 2005 did not include 0.2 million shares we received in 2006

in connection with the settlement of an ASR transaction because the

effect of including them would have been antidilutive (see Note 6.

Shareholders’ Equity

).

Note 8. Retirement Plan

We maintain a defined contribution pension plan covering full-time

shoreside employees who have completed the minimum period of

continuous service. Annual contributions to the plan are based on

fixed percentages of participants’ salaries and years of service, not

to exceed certain maximums. Pension cost was $12.8 million, $12.2

million and $9.4 million for the years ended December 31, 2005,

2004 and 2003, respectively.

Note 9. Income Taxes

We and the majority of our subsidiaries are currently exempt from

United States corporate tax on income from the international opera-

tion of ships pursuant to Section 883 of the Internal Revenue Code.

Income tax expense related to our remaining subsidiaries was not

significant for the years ended December 31, 2005, 2004 and 2003.

Final regulations under Section 883 were published on August 26,

2003, and were effective for the year ended December 31, 2005.

These regulations confirmed that we qualify for the exemption pro-

vided by Section 883, but also narrowed the scope of activities

which are considered by the Internal Revenue Service to be inciden-

tal to the international operation of ships. The activities listed in the

regulations as not being incidental to the international operation of

ships include income from the sale of air and other transportation

such as transfers, shore excursions and pre and post cruise tours. To

the extent the income from such activities is earned from sources

within the United States, such income will be subject to United

States taxation. The application of these new regulations reduced

our net income for the year ended December 31, 2005 by approxi-

mately $14 million.

40 Royal Caribbean Cruises Ltd.

Notes to the Consolidated

Financial Statements (continued)