Royal Caribbean Cruise Lines 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

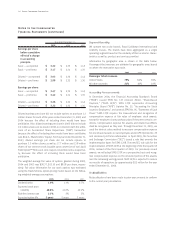

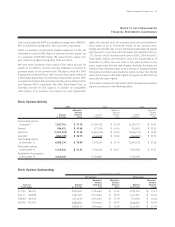

Note 3. Property and Equipment

Property and equipment consists of the following (in thousands):

2005 2004

Land $ 7,056 $ 7,056

Ships 11,952,626 11,056,851

Ships under capital leases – 773,562

Ships under construction 377,065 153,415

Other 512,904 415,785

12,849,651 12,406,669

Less — accumulated

depreciation and

amortization (2,572,703) (2,213,226)

$ 10,276,948 $ 10,193,443

In August 2005, we exercised our purchase options on capital lease

obligations for

Legend of the Seas

and

Splendour of the Seas

(see

Note 5.

Long-Term Debt

).

Ships under construction include progress payments for the con-

struction of new ships as well as planning, design, interest, commit-

ment fees and other associated costs. We capitalized interest costs

of $17.7 million, $7.2 million and $15.9 million for the years 2005,

2004 and 2003, respectively. Accumulated amortization related to

ships under capital leases was $206.5 million at December 31,

2004.

Note 4. Other Assets

We held redeemable convertible preferred stock in First Choice

denominated in British pound sterling valued at approximately

$300 million. The redeemable convertible preferred stock carried a

6.75% coupon. Dividends of $14.2 million, $24.7 million and $21.5

million were earned in 2005, 2004 and 2003, respectively, and

recorded in other income. In July 2005, First Choice redeemed in full

its convertible preferred shares. We received $348.1 million in cash,

resulting in a net gain of $44.2 million, primarily due to foreign

exchange, which was recorded as a component of other income.

We have determined that one of our minority interests, a ship repair

facility in which we invested in April 2001, is a variable interest enti-

ty; however, we are not the primary beneficiary and accordingly we

do not consolidate this entity. As of December 31, 2005, our invest-

ment in this entity including equity and loans, which is also our max-

imum exposure to loss, was approximately $44.8 million.

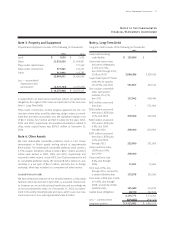

Note 5. Long-Term Debt

Long-term debt consists of the following (in thousands):

2005 2004

Unsecured revolving

credit facility $ 135,000 $–

Unsecured senior notes

and senior debentures,

6.75% to 8.75%,

due 2006 through 2013,

2018 and 2027 2,096,286 2,258,436

Liquid Yield Option™ Notes

with yield to maturity

of 4.875%, due 2021 531,857 694,316

Zero coupon convertible

notes with yield to

maturity of 4.75%,

due 2021 137,942 408,484

$625 million unsecured

term loan –575,000

$360 million unsecured

term loan, LIBOR plus

1.0%, due 2006 270,000 360,000

$300 million unsecured

term loan, LIBOR plus

0.8%, due 2009

through 2010 200,000 200,000

$225 million unsecured

term loan, LIBOR plus

1.0%, due 2006

through 2012 225,000 225,000

Unsecured term loans,

LIBOR plus 0.8%,

due 2010 200,000 –

Unsecured term loan,

8.0%, due through

2006 11,811 35,694

Term loan, 8.0%, due

through 2010, secured by

a certain Celebrity ship 172,979 225,964

Term loans, LIBOR plus 0.45%

to 0.85%, due through

2008, secured by certain

Celebrity ships 125,580 401,390

Capital lease obligations 48,320 347,660

4,154,775 5,731,944

Less — current portion (600,883) (905,374)

Long-term portion $ 3,553,892 $ 4,826,570

Royal Caribbean Cruises Ltd. 37

Notes to the Consolidated

Financial Statements (continued)