Redbox 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

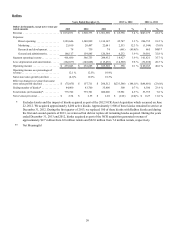

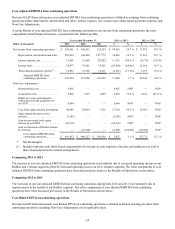

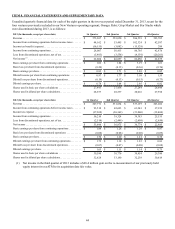

Net Cash from Operating Activities

Our net cash from operating activities decreased by $139.8 million primarily due to the following:

• $24.6 million increase in net income to $174.8 million primarily due to a gain upon the re-measurement of our

previously held equity interest upon the acquisition of ecoATM offset by higher interest expense; offset by

• A $66.0 million decrease in net non-cash expenses included in net income primarily due to the impacts of deferred

taxes, the non-cash gain on our previously held equity interest in ecoATM and the loss from extinguishment of callable

convertible debt and a $32.7 million increase in non-cash reconciling items due to impairment charges associated with

discontinued operations; and

• A $98.3 million increase in net cash outflows from changes in working capital primarily due to changes in prepaid

expenses and other current assets, accounts payable and other accrued liabilities.

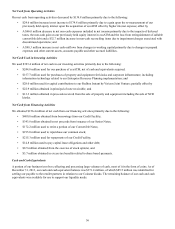

Net Cash Used in Investing Activities

We used $393.4 million of net cash in our investing activities primarily due to the following:

• $244.0 million used for our purchase of ecoATM, net of cash and equivalents acquired;

• $157.7 million used for purchases of property and equipment for kiosks and corporate infrastructure, including

information technology related to our Enterprise Resource Planning implementation; and

• $28.0 million used for capital contributions to our Redbox Instant by Verizon Joint Venture; partially offset by

• $22.9 million obtained in principal of note receivable; and

• $13.3 million obtained in proceeds received from the sale of property and equipment including the sale of NCR

kiosks.

Net Cash from Financing Activities

We obtained $156.4 million of net cash from our financing activities primarily due to the following:

• $400.0 million obtained from borrowings from our Credit Facility;

• $343.8 million obtained in net proceeds from issuance of our Senior Notes;

• $172.2 million used to retire a portion of our Convertible Notes;

• $195.0 million used to repurchase our common stock;

• $215.3 million used for repayments of our Credit Facility;

• $14.8 million used to pay capital lease obligations and other debt;

• $8.5 million obtained from the exercise of stock options; and

• $3.7 million obtained in excess tax benefits related to share based payments.

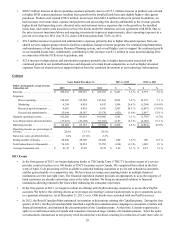

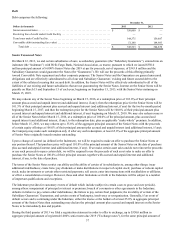

Cash and Cash Equivalents

A portion of our business involves collecting and processing large volumes of cash, most of it in the form of coins. As of

December 31, 2013, our cash and cash equivalent balance was $371.4 million, of which $85.5 million was identified for

settling our payable to the retailer partners in relation to our Coinstar kiosks. The remaining balance of our cash and cash

equivalents was available for use to support our liquidity needs.