Redbox 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

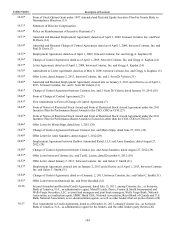

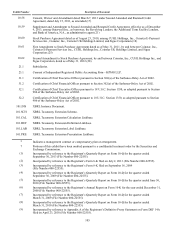

95

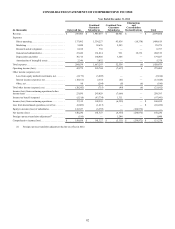

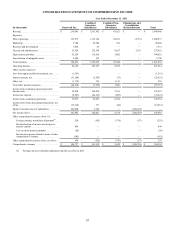

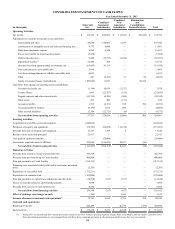

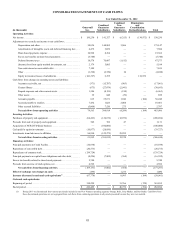

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31, 2012

(in thousands)

Outerwall

Inc.

Combined

Guarantor

Subsidiaries

Combined

Non-

Guarantor

Subsidiaries

Eliminations

and

Consolidation

Reclassifications Total

Operating Activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 150,230 $ 141,327 $ (6,355) $ (134,972) $ 150,230

Adjustments to reconcile net income to net cash flows:. . . . . . . . . . . . .

Depreciation and other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,836 144,805 3,506 — 179,147

Amortization of intangible assets and deferred financing fees . . . 4,472 3,032 — — 7,504

Share-based payments expense . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,998 8,364 — — 19,362

Excess tax benefits on share-based payments . . . . . . . . . . . . . . . . (5,740) — — — (5,740)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,578 70,607 (1,612) — 87,573

(Income) loss from equity method investments, net . . . . . . . . . . . 2,179 3,005 — — 5,184

Non-cash interest on convertible debt . . . . . . . . . . . . . . . . . . . . . . 7,109 — — — 7,109

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,390) (2,720) 10 — (4,100)

Equity in (income) losses of subsidiaries. . . . . . . . . . . . . . . . . . . . (141,327) 6,355 — 134,972 —

Cash flows from changes in operating assets and liabilities:

Accounts receivable, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (371) (15,787) (903) — (17,061)

Content library . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (673) (27,079) (2,941) — (30,693)

Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . 1,386 (8,159) (190) — (6,963)

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 848 (29) — 858

Accounts payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 815 55,671 1,946 (184) 58,248

Accrued payable to retailers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,432 1,025 2,004 — 10,461

Other accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,008) 7,520 275 — 2,787

Net cash flows from operating activities . . . . . . . . . . . . . . . . . . 79,565 388,814 (4,289) (184) 463,906

Investing Activities:

Purchases of property and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . (64,423) (130,672) (12,959) — (208,054)

Proceeds from sale of property and equipment. . . . . . . . . . . . . . . . . . . . 302 782 47 — 1,131

Acquisition of NCR DVD kiosk business . . . . . . . . . . . . . . . . . . . . . . . — (100,000) — — (100,000)

Cash paid for equity investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,877) (28,850) — — (39,727)

Investments in and advances to affiliates . . . . . . . . . . . . . . . . . . . . . . . . 96,990 (122,272) 25,282 — —

Net cash flows from investing activities . . . . . . . . . . . . . . . . . . . 21,992 (381,012) 12,370 — (346,650)

Financing Activities:

Principal payments on Credit Facility. . . . . . . . . . . . . . . . . . . . . . . . . . . (10,938) — — — (10,938)

Repurchase of convertible debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20,575) — — — (20,575)

Repurchases of common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (139,724) — — — (139,724)

Principal payments on capital lease obligations and other debt . . . . . . . (8,226) (7,802) (364) — (16,392)

Excess tax benefits related to share-based payments . . . . . . . . . . . . . . . 5,740 — — — 5,740

Proceeds from exercise of stock options, net . . . . . . . . . . . . . . . . . . . . . 4,592 — — — 4,592

Net cash flows from financing activities. . . . . . . . . . . . . . . . . . . (169,131) (7,802) (364) — (177,297)

Effect of exchange rate changes on cash . . . . . . . . . . . . . . . . . . . . . . . (196) — 1,276 — 1,080

Increase (decrease) in cash and cash equivalents(1) . . . . . . . . . . . . . . (67,770) — 8,993 (184) (58,961)

Cash and cash equivalents:

Beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 310,259 — 31,766 (170) 341,855

End of period. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 242,489 $ — $ 40,759 $ (354) $ 282,894

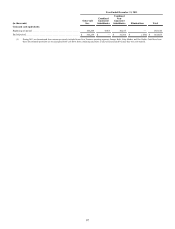

(1) During 2013 we discontinued four ventures previously included in our New Ventures operating segment, Orango, Rubi, Crisp Market, and Star Studio. Cash flows from

these discontinued operations are not segregated from cash flows from continuing operations in all periods presented because they were not material.