Redbox 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

measure of annual performance. The performance-based restricted stock awards were earned depending on the level

of achievement of the EBITDA performance goal as follows:

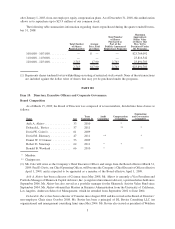

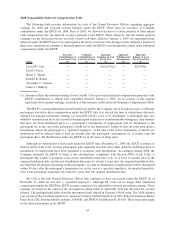

Performance Goal Minimum Target Maximum

EBITDA (excluding acquisitions and one time

charges, but including stock option expense) ..... $135 million $140 million $145 million

If the minimum specified EBITDA performance goal for 2008 had not been achieved, the performance-based

restricted stock awards would have been forfeited. An executive could earn up to 150% of the target number of

shares if the maximum specified EBITDA performance goal for 2008 was achieved, with interpolation for

achievement between specified levels. Once the performance-based restricted stock awards are earned, the shares

begin to vest in equal annual installments on each of March 1, 2009, 2010 and 2011, provided the executive

continues to provide services to us.

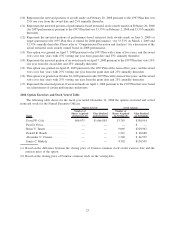

As noted above, the performance-based restricted stock awards (at target) comprised 20% of the value of long-

term incentive compensation delivered to each Named Executive Officer for 2008. The following table shows the

number of performance-based shares of restricted stock that could have been earned by an executive, depending on

the level of achievement of the performance goal:

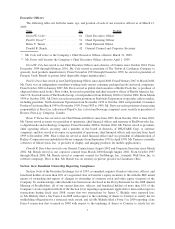

Named Executive Officer Minimum Target Maximum

David W. Cole ........................................ 3,309 6,619 9,928

Paul D. Davis ......................................... 2,627 5,253 7,880

Brian V. Turner ........................................ 1,753 3,507 5,260

Donald R. Rench ....................................... 571 1,142 1,713

Alexander C. Camara ................................... 827 1,654 2,481

James C. Blakely....................................... 827 1,654 2,481

At its meeting on February 25, 2009, the Committee determined that the Company exceeded the maximum

level of achievement with EBITDA of $159.9 million, calculated as described above under the description of the

2008 Incentive Compensation Plan. Accordingly, the Committee established the total amount of restricted stock

earned by the Named Executive Officers under their respective performance-based restricted stock awards as noted

in the table above for achievement at the maximum level.

For 2009, the Committee changed the mix of long-term incentive compensation from 60% stock options, 20%

restricted stock and 20% performance-based restricted stock to 30% stock options, 20% restricted stock and 50%

performance-based restricted stock. The Committee believes this mix places additional emphasis on performance,

while maintaining strong stockholder alignment. In addition, a second performance measure was added to the

performance-based restricted stock awards, so that 80% will be based on achievement of an EBITDA goal and 20%

will be based on achievement of an EBITDA percentage, which measures EBITDA as a fraction of revenue.

Special Long-Term Incentive

In April 2008, Mr. Blakely was awarded a special restricted stock award for 4,000 shares of Coinstar common stock

in recognition of his performance relative to establishing Coinstar’s relationship with Wal-Mart Stores, Inc. The restricted

stock award vests based on the number of Coin machine installations in Wal-Mart stores completed between January 1,

2006 and December 31, 2009, with 25% of the restricted stock vesting when the first 1,000 installations are completed

and the remaining restricted stock vesting in three equal installments for each additional 500 installations completed.

Other Benefits and Perquisites. Executive officers may receive additional benefits and limited perquisites

that are (i) similar to those offered to our employees generally or (ii) in the Committee’s view, are reasonable,

competitive and consistent with our overall executive compensation program. Perquisites are reviewed by the

Committee when made. All of our executives are reimbursed for tax-planning assistance and, in limited circum-

stances (and generally on a case-by-case basis), Coinstar pays the travel expenses associated with spousal

attendance at certain business-related conferences for our executives. We provide medical, dental, and group life

insurance benefits to each executive officer, similar to those provided to all other Coinstar employees. Also, as

provided to all other Coinstar employees, Coinstar matches a portion of each executive’s contribution to his or her

account in the Coinstar 401(k) retirement plan.

15