Redbox 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our operating costs included in our shared service functions, which consist primarily of field operations, sales,

finance, legal, human resources, and information technology, are allocated to our four segments. We will

continually evaluate the shared service allocations for segment reporting purposes, which may result in changes

to segment allocations in future periods. Because our field operations are fully integrated with our Coin and

Entertainment services, our CEO allocates resources and evaluates Coin and Entertainment services results, as well

as makes strategic decisions, on a combined basis. Therefore, our Coin and Entertainment services are considered

one segment for reporting purposes. In addition, our CEO manages our business by evaluating the financial results

of the four operating segments, focusing primarily on segment revenue and segment operating income (loss) before

depreciation and amortization and unallocated expenses (“segment operating income (loss)”). We utilize segment

revenue and segment operating income (loss) because we believe they provide useful information for effectively

allocating resources among business segments, evaluating the health of our business segments based on metrics that

management can actively influence, and gauging our investments and our ability to service, incur or pay down debt.

Specifically, our CEO evaluates segment revenue and segment operating income (loss), and assesses the perfor-

mance of each business segment based on these measures, as well as, among other things, the prospects of each of

the segments and how they fit into the Company’s overall strategy. Our CEO then decides how resources should be

allocated among our business segments. Stock-based compensation expense and depreciation and amortization

expenses are not allocated to our four operating segments. As we changed our internal organization structure during

the first quarter of 2008, resulting in the change of reportable segments, we did not restate the prior period under the

new basis because it was not practical to do so.

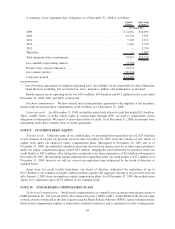

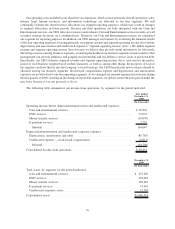

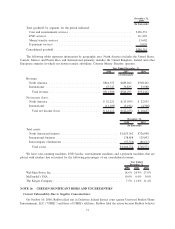

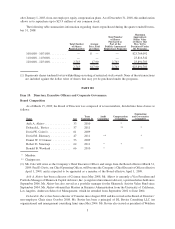

The following table summarizes our income from operations, by segment, for the period indicated:

Year Ended

December 31,

2008

(In thousands)

Operating income before depreciation/amortization and unallocated expenses:

Coin and entertainment services ....................................... $ 98,891

DVD services..................................................... 72,974

Money transfer services ............................................. (10,070)

E-payment services ................................................ 2,252

Subtotal ....................................................... 164,047

Depreciation/amortization and unallocated corporate expenses:

Depreciation, amortization and other .................................... (85,785)

Unallocated expense — stock-based compensation .......................... (8,811)

Subtotal ....................................................... (94,596)

Consolidated income from operations ..................................... $ 69,451

December 31,

2008

(In thousands)

Total assets, by segment, for the period indicated:

Coin and entertainment services ....................................... $ 473,256

DVD services..................................................... 378,092

Money transfer services ............................................. 105,645

E-payment services ................................................ 35,963

Unallocated corporate assets . . ........................................ 73,758

Consolidated assets .................................................. $1,066,714

76