Progressive 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

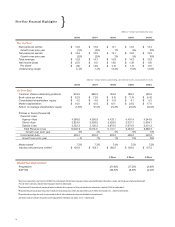

Falling frequency and explanatory theories have been a

topic in these pages and for many industry commentators

throughout the current decade, but the sudden turn in 2008

was an entirely different event. The graph makes the point bet-

ter than my words.

By later in the year, gas prices were less than half their peaks

and one might assume with perfect elasticity of demand all

would

be as it once was. But, the country was now in an economic

tailspin and, at a minimum, consumer uncertainty prevailed.

Consumer behavior did not show perfect elasticity and the re-

turn to frequency levels of even the first quarter was dampened.

Modeling certain response variables important to us against

external data, such as unemployment rates, is critical, but chal-

lenging statistically. Rates of uninsured drivers, changes in

valuation of vehicles and parts, fleet aging dynamics, bad debt

propensity, medical treatment patterns, and the like are all

subject to change in the current environment. Our models, while

interesting, will never substitute for our ability to observe and

respond quickly. Our internal response is to assume change is

at an all-time high, be nimble in responding, reduce the time to

implement rate change, and assume that with any change we

may need to iterate quickly to match the environment.

10

Profit

Our 94.6 combined ratio for the year is testament to our respon

-

siveness and respect for the conditions. The result is well in-line

with our target of a 96, and needs no qualifying statements re-

garding prior year development or storm adjustments.42 of our

established 50 states, which includes the District of Columbia,

were profitable for the year as were 8of our largest 10 states,

including New York auto, which was a definite concern in 2007. Du

-

plicating this profit margin next year will be very pleasing, but will

take incredible vigilance. In my view, that’s Progressive at its best.

I distinguish established states to make special mention of our

entry into Massachusetts, which occurred on May1st. Progressive

is now available in every state of the nation. Additional commen-

tary on Massachusetts is included in the Operations Summary.

Growth

Growth, by our standards, has been stalled for some time. Meas-

ured by premiums written that statement is undeniable; our 1,3,

and 5year written premium growth has been (1)%, (1)%, and 3%,

respectively. Corresponding industry growth has been less than

1% for the three year period,1% for five, and an estimated .5%

for the past year.As noted earlier a prolonged period of nega-

tive price adjustments is part of the explanation. In 2008 we saw

our average auto premiums on our new Agency busi

ness appli-

cations increase slightly over the prior year for the first

time in 2

years, while the similar measure in our Direct business still lags

the prior year by 6%.

A healthier measure and our preferred one is the number of

customers served. Unfortunately there is no consistently reliable

comparative measure for the industry. Our results here are

considerably more encouraging with continuous increases in

numbers of policies in force. We ended the year up 3%, which

Frequency

Progressive: Auto Claim Frequency

Jan–Dec 2006 Jan–Dec 2007 Jan–Dec 2008