Polaris 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

For Polaris, 2010 was about

Making Growth Happen. Our plans centered on

leveraging our industry-leading innovation, speed

to market and burgeoning international presence to

drive growth and gain market share, despite weak

economies and a still-sluggish powersports industry.

Through the Polaris team’s extraordinary execution,

our recovery attained exceptional velocity, leading

to solid growth across our portfolio of products. We

finished the year with record sales and earnings and,

most importantly, strong business fundamentals

that provide a foundation for profitable growth

in 2011 and beyond.

Our success in delivering the results stakeholders

expect is similar to our success in satisfying

customers; we do it by developing and executing

sound operational and business practices.

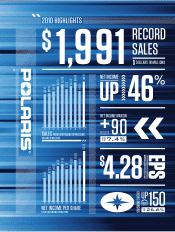

We are certainly proud of our 27 percent revenue

growth, which yielded sales of $1,991 million for

2010, as well as the 46 percent improvement in net

income and corresponding 40 percent improvement

in earnings per diluted share of a record $4.28;

but underneath these results are some equally

impressive ‘fundamental’ numbers:

» Gross profit margin percentage improved

150 basis points to 26.6 percent.

» Net income margins improved 90 basis points

to 7.4 percent.

» Increased market share in every product line

and region.

» North American dealer inventory decreased

20 percent.

» Warranty claims paid decreased 17 percent.

» We hired 51 salaried employees outside of

the United States.

» Engineering and R&D spend increased

35 percent to $84.9 million.

» Inventory turns improved 21 percent.

As a result, investors enjoyed their ride with

Polaris in 2010, with overall shareholder returns

up 82 percent.

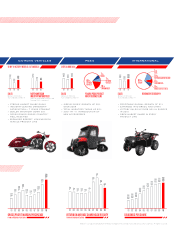

A key reason for our success in 2010 was the

stellar performance of the Off-Road vehicle (ORV)

division. Delivering on our commitment to be the

Best in Powersports PLUS requires us to win

with our RANGER® and RANGER RZR® side-by-side

vehicles and Sportsman® ATVs, and our team and

dealers did just that. Riding leading-edge innovation

and the broadest product offering in the industry, our

largest business began 2010 on a high note with the

January launch of the world’s first-ever four-seat

recreational side-by-side vehicle, and never looked

back. Consumer demand for the RZR 4 was very

high, just as we have seen in other ORV products in

our portfolio. Overall, ORV sales were up 35 percent

in 2010, and with the 2011 New Year’s Day launch of

the world’s first XTREME PERFORMANCE side-by-

side, the RANGER RZR XP,

TM there is great potential

for another year of strong growth.

Innovation also fuels growth across our other product

lines, from the market-leading 800 PRO-RMK®

snowmobiles in the mountains to the new Victory

Cross Roads® touring bikes for the road. New

products like these were the primary drivers of

success in our international markets (outside United

States and Canada), where revenues increased

21 percent to $305.9 million. You can read more about

how our product innovation and breadth continue to

drive core powersports market growth on Page 3.

We made significant investments to support our

Global Market Leadership objectives, including a

new Swiss headquarters for our European, Middle

Eastern and African business, where we maintain

our #1 ORV market share position. The Chinese

powersports market, in particular, is emerging, and

Polaris is well positioned to be the brand of choice

in that growing market. In 2010, we strengthened

our China team and expanded our business there

to include three new dealerships.

Additionally, we have strong new business leaders

in Brazil and India, and will continue to invest to

grow our business in those emerging markets.

Our objective is to create a $700-plus million

international business in the next four years, and

we are well on our way in both our established and

developing global markets. For more about our work

in emerging markets, see Page 5.

An important element of our international expansion

is our focus on Growth Through Adjacencies,

wherein we plan to leverage acquisitions and

DEAR FELLOW SHAREHOLDERS