Polaris 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

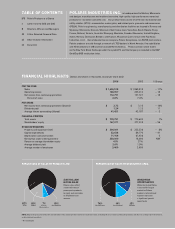

$1.99

03

$1.81

02

$1.64

01

$1.48

00

$1.40

9998

$3.15

$2.72

97 04 06

$2.28

$2.97

05

$2.58

$1,327

02

$1,245

01

$1,106

00

$948

999897

$1,773

$1,870

03 05

$1,657

06

$1,427

$1,552

04

$1,468

SALES

(dollars in millions)

NET INCOME

FROM CONTINUING OPERATIONS

PER SHARE(1)

(dollars)

THE

SCORECARD

46%

02

50%

01

47%

00

46%

999897

38%

37%

03 05

41%

06

42%

38%

04

41%

RETURN ON AVERAGE SHAREHOLDER EQUITY

FROM CONTINUING OPERATIONS

21.0%

03

21.2%

02

20.1%

01

18.8%

00

20.1%

9998

22.0%

21.7%

97 04 06

22.1%

23.5%

05

22.9%

GROSS MARGIN PERCENTAGE

FROM CONTINUING OPERATIONS

Polaris’ productivity strategies historically have resulted in consistent

gross margins. The 2006 gross margin decline was due to lower sales volume

for ATVs and snowmobiles, in addition to higher promotional and floor plan

financing costs partially offset by savings from cost reduction initiatives.

–4%

16%

Polaris

19%

S&P

500

–2%

Russell

2000

19%

Recreational

Vehicles

Index

Dow

Jones

10%

Nasdaq

80%

35%

Polaris

73%

S&P

500

23%

Russell

2000

39%

Recreational

Vehicles

Index

Dow

Jones

Nasdaq

24%

TOTAL RETURN TO SHAREHOLDERS – POLARIS VS. MARKET INDICES

One-Year Total Return

(2006)

Five-Year Total Return

(2002–2006)

$0.50

03

$0.44

02

$0.40

01

$0.36

00

$0.32

9998

$1.12

$1.24

97 04 06

$0.56

$0.92

05

$0.62

$151

03

$130

02

$120

01

$110

00

$101

9998

$211

$178

97 04 06

$177

$202

05

$179

DIVIDENDS PER SHARE

(dollars)

In January 2007, Polaris announced a 10 percent increase

in the regular quarterly dividend, the 12th straight year of increases.

CASH FLOW PROVIDED

FROM CONTINUING OPERATIONS(1,2)

(dollars in millions, before changes in current

operating items and deferred taxes)

2.4

02

3.0

01

2.2

00

2.9

999897

1.4

2.4

03 05

6.9

06

2.2

2.5

04

2.4

$40

02

$52

01

$38

00

$40

999897

$67

$132

03 05

$308

06

$49

$73

04

$76

POLARIS SHARES REPURCHASED

Since inception of the share repurchase program in 1996, approximately 29.2 million shares

have been repurchased at an average price of $30.41 per share.

(shares in millions) (dollars in millions)

(1) In 1998, Polaris entered into a settlement agreement related to

a trade secret infringement claim brought by Injection Research

Specialists, Inc. The one-time provision for litigation loss of

$61.4 million, or $0.77 per diluted share, has been excluded from

the 1998 financial data presented.

(2) A reconciliation of the Company’s calculation of Cash Flow Provided

to the most directly comparable cash flow measure, as required by

Regulation G, appears on page 11 of this Annual Report.

NOTE: All periods presented reflect the classification of the

marine products division’s financial results, including the loss from

discontinued operations and the loss on disposal of the division,

as discontinued operations.

2006 was a difficult year for Polaris. For the first time in the last 25 years, the Company did not produce record earnings

per share from continuing operations. Our two core businesses, ATVs and snowmobiles, were both negatively impacted by

declining industry trends in each of these markets in 2006. But there were also some positives in 2006 for the Company.

Polaris had another good year in

RANGER

™ utility vehicles, Victory®motorcycles and financial services. And although the

2006 results were below expectations, 2006 was still the third-best year in the Company’s 53-year history.