Plantronics 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

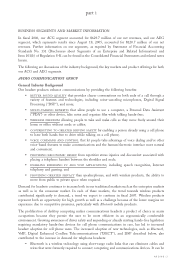

FINANCIAL HIGHLIGHTS

Return on Sales

25%

20%

15%

10%

5%

Investment in Research and Development

(in millions)

$60

$50

$40

$30

$20

Cash from Operating Activities

(in millions)

Total Operating Income

(in millions)

Diluted Earnings per Common Share

$2.00

$1.50

$1.00

$0.50

$0.0

Operations

Net revenues $559,995 $750,394

-----------------------------------------------------------------------------------------------------------------------

Net income $97,520 $81,150

-----------------------------------------------------------------------------------------------------------------------

Diluted earnings per common share $1.92 $1.66

-----------------------------------------------------------------------------------------------------------------------

Shares used in diluted per-share calculations 50,821 48,788

-----------------------------------------------------------------------------------------------------------------------

Financial position

Total assets $487,929 $612,249

-----------------------------------------------------------------------------------------------------------------------

Net working capital $335,523 $201,420

-----------------------------------------------------------------------------------------------------------------------

Stockholders’ equity $405,719 $435,621

-----------------------------------------------------------------------------------------------------------------------

Selected ratios

Gross Profit 51.5% 43.5%

-----------------------------------------------------------------------------------------------------------------------

Operating margin 22.6% 14.7%

-----------------------------------------------------------------------------------------------------------------------

Return on sales 17.4% 10.8%

-----------------------------------------------------------------------------------------------------------------------

Return on average equity 27.7% 19.3%

-----------------------------------------------------------------------------------------------------------------------

Average days sales outstanding 49 50

-----------------------------------------------------------------------------------------------------------------------

Average inventory turns 5.4 5.1

-----------------------------------------------------------------------------------------------------------------------

2005 2006

Net Revenues

(in millions)

$800

$700

$600

$500

$400

$300

$200

$100

--------------------------------------------------------------------------------------------------------------------

$150

$100

$50

$25

$0

‘04 ‘05 ‘06‘02 ‘03 ‘04 ‘05 ‘06‘02 ‘03

‘04 ‘05 ‘06‘02 ‘03

$125

$100

$75

$50

$25

Fiscal year ended March 31 (in thousands, except per-share data).

‘04 ‘05 ‘06‘02 ‘03 ‘04 ‘05 ‘06‘02 ‘03

‘04 ‘05 ‘06‘02 ‘03

$417

$560

$311

$338

$750

$85

$127

$110

$41

$54

$1.31

$1.92

$1.66

$0.74

$0.89

14.9%

17.4%

10.8%

11.6%

12.3%

$35

$45

$63

$30

$34

$72

$94

$78

$77

$50