Plantronics 2001 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2001 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Income. Operating income in fiscal 2001 increased 9.3% to $102.0 million (25.4% of

net sales), compared to $93.3 million (29.6% of net sales) in fiscal 2000. Operating income

in fiscal 2000 increased 11.7% compared to $83.5 million (29.2% of net sales) in fiscal 1999.

The increase in operating income over the past two fiscal years was primarily due to higher

net sales and the increase in gross profit.

Interest Expense. Interest expense in fiscal 2001 increased 24.4% to $107 thousand, compared

to $86 thousand in fiscal 2000, which in turn decreased 98.5% from $5.8 million in fiscal 1999.

Interest expense for 1999 principally represented interest payable on our 10% Senior Notes

Due 2001 (Senior Notes), which were redeemed on January 15, 1999. The early redemption

of these Senior Notes was the reason for the decrease in interest expense in fiscal 2000 and

2001, and management expects interest expense to be minimal in fiscal 2002. In November

1999, we entered into a credit agreement to borrow up to $100 million with a major bank.

This agreement has been renewed annually and expires in November 2001. We currently

have no borrowings under this agreement.

Interest and Other Income. Interest and other income in fiscal 2001 decreased 85.2% to $0.2

million compared to $1.7 million in fiscal 2000, which in turn decreased 52.9% compared to

$3.5 million in fiscal 1999. The decrease in interest and other income in fiscal 2001 was

primarily attributable to foreign exchange losses of $2.2 million from declining Great British

Pound and Euro values.

Income Tax Expense. In fiscal 2001, fiscal 2000 and fiscal 1999, income tax expense was

$28.6 million, $30.4 million and $26.0 million, respectively, representing effective tax rates

of 28% in fiscal 2001 and 32% in fiscal 2000 and 1999. Due to the economic slowdown, the

distribution of our income fell into lower rate regions and we had a retroactive adjustment

in the fourth quarter to bring the tax rate down for fiscal 2001.

Financial Condition

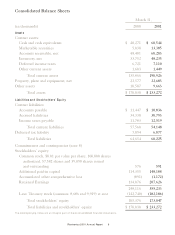

Liquidity. As of March 31, 2001, we had working capital of $136.8 million, including $73.9

million of cash and cash equivalents and marketable securities, compared with working

capital of $78.3 million, including $45.3 million of cash and cash equivalents and marketable

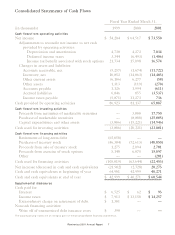

securities, as of March 31, 2000. During the fiscal year ended March 31, 2001, we generated

$65.8 million of cash from operating activities, due primarily to $73.6 million in net income,

and an income tax benefit of $16.6 million associated with the exercise of employee and former

employee options, offset by increases of $11.7 and $14.5 million in accounts receivable and

inventory, respectively. In comparison, we generated $81.1 million in cash from operating

activities for the fiscal year ended March 31, 2000, due mainly to $64.5 million in net income,

an increase of $11.3 million in income taxes payable, and an income tax benefit of $15.1 mil-

lion associated with the exercise of options, offset by a $14.9 million increase in inventory.

Plantronics 2001 Annual Report 3