Plantronics 2001 Annual Report Download - page 16

Download and view the complete annual report

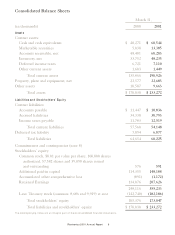

Please find page 16 of the 2001 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fair Value of Financial Instruments. The carrying value of our financial instruments, including

cash, cash equivalents, marketable securities, accounts receivable, accrued expenses and

liabilities, approximate fair value due to their short maturities.

Income Taxes. We account for income taxes under the liability method, which recognizes

deferred tax assets and liabilities for the expected future tax consequences of temporary

differences between the tax basis of assets and liabilities and their financial statement

reported amounts. We account for tax credits as a reduction of tax expense in the year in

which the credits reduce taxes payable.

Foreign Operations and Currency Translation. We have foreign assembly and manufacturing

operations in Mexico, light assembly, research and development, sales and marketing

operations in the United Kingdom, an international finance, customer service and logistics

headquarters in the Netherlands, an international procurement office in Taiwan, and sales

offices in Canada, Asia, Europe, Australia and South America. For fiscal 1999, 2000 and the

first three quarters of 2001, the functional currency of all foreign operations was the U.S.

dollar. Accordingly, gains or losses arising from the translation of foreign currency statements

and transactions were included in determining consolidated results of operations.

Effective January 1, 2001, the functional currency for foreign sales and research and

development operations was changed from the U.S. dollar to the respective operations’ local

currency. The change was driven by increased investment in foreign operations through

headcount, research and development and sales and marketing programs. As a result of this

change, we recorded a $0.3 million net decrease in currency translation adjustments as a

component of other comprehensive loss. The functional currencies of all revenue and related

cost of goods sold derived from international operations are still denominated in U.S. dollars.

Aggregate exchange losses for fiscal 1999, 2000 and 2001 were $0.2 million, $0.8 million and

$2.2 million, respectively.

Earnings Per Share. Basic Earnings Per Share (“EPS”) is computed by dividing net income

available to common stockholders (numerator computed as net income before and after

extraordinary item) by the weighted average number of common shares outstanding (denom-

inator) during the period. Basic EPS excludes the dilutive effect of stock options. Diluted

EPS gives effect to all dilutive potential common shares outstanding during a period. In

computing diluted EPS, the average stock price for the period is used in determining the

number of shares assumed to be purchased from exercise of stock options.

Plantronics 2001 Annual Report 12