Pep Boys 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidation among our competitors may negatively impact our business.

Our industry has experienced consolidation over time. If this trend continues or if our competitors

are able to achieve efficiencies in their mergers, the Company may face greater competitive pressures

in the markets in which we operate.

Healthcare reform legislation could have a negative impact on our business, financial condition and

results of operations.

The Patient Protection and Affordable Care Act is expected to increase our employee health care

costs. While the significant costs of the legislation enacted will occur after 2013 due to provisions of the

legislation being phased in over time, changes to our health care costs structure could adversely affect

our results of operations.

ITEM 1B UNRESOLVED STAFF COMMENTS

None.

ITEM 2 PROPERTIES

The Company owns its five-story, approximately 300,000 square foot corporate headquarters in

Philadelphia, Pennsylvania. During fiscal 2012, the Company sold a 60,000 square foot office building in

Los Angeles, California. The Company also owns the following administrative regional offices—

approximately 4,000 square feet of space in each of Melrose Park, Illinois and Bayamon, Puerto Rico.

The Company leases an administrative regional office of approximately 3,500 square feet in Los

Angeles, California.

Of the 758 store locations operated by the Company at February 2, 2013, 232 are owned and 526

are leased. As of February 2, 2013, 142 of the 232 stores owned by the Company are currently used as

collateral under our Senior Secured Term Loan, due October 2018.

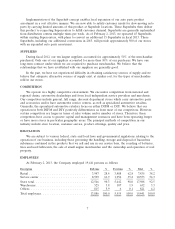

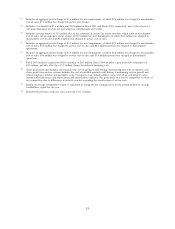

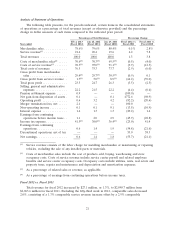

The following table sets forth certain information regarding the owned and leased warehouse space

utilized by the Company to replenish its store locations at February 2, 2013:

Approximate Owned

Products Square or Stores

Warehouse Locations Warehoused Footage Leased Serviced States Serviced

San Bernardino, CA . . . All 600,000 Leased 181 AZ, CA, NV, UT, WA

McDonough, GA ...... All 392,000 Owned 234 AL, FL, GA, LA, NC,

PR, SC, TN

Mesquite, TX ........ All 244,000 Owned 79 AR, CO, LA, MO,

NM, OK, TX

Plainfield, IN ......... All 403,000 Owned 77 IL, IN, KY, MI, MN,

OH, PA

Chester, NY ......... All 402,000 Owned 188 CT, DE, MA, MD, ME,

NH, NJ, NY, PA, RI,

VA

Philadelphia, PA ...... Tires & Batteries 74,000 Leased 63 DE, NJ, PA, VA, MD

Total ............... 2,115,000

The Company anticipates that its existing and future warehouse space and its access to outside

storage will accommodate inventory necessary to support future store expansion and any increase in

SKUs through the end of fiscal 2013.

14