Pep Boys 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal Year 2007 vs. Fiscal Year 2006

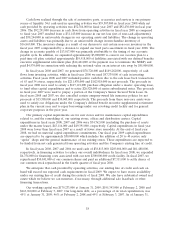

Total revenues for fiscal 2007 decreased 4.7% to $2,138,075,000 from $2,243,855,000 in fiscal year

2006. This decrease was primarily the result of weaker sales in our retail business stemming from lower

customer counts and the de-emphasis of non-core automotive merchandise. On a 52-week basis,

comparable revenues decreased by 3.1%, consisting of a 1.8% increase in comparable service revenue

and a 4.2% decrease in comparable merchandise sales. Upon reaching its 13th month of operation, a

store is added to our comparable sales store base. Stores are removed from the comparables sales store

base upon their relocation or closure. Once a relocated store reaches its 13th month of operation at its

new location, it is added back into our comparable sales store base. Square footage increases are

infrequent and immaterial and, accordingly are not considered in our calculations of comparable sales

data.

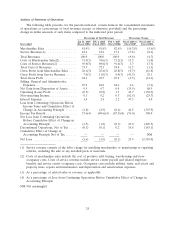

Gross profit from merchandise sales decreased, as a percentage of merchandise sales, to 25.4% in

fiscal 2007 from 28.8% in fiscal 2006. This decrease in dollars was $89,650,000 or a 16.8% decrease

from the prior year. This decrease, as a percentage of merchandise sales, resulted primarily from

decreased product margins, higher occupancy costs and higher rent expense offset, in part, by lower

warehousing and distribution costs. The 2.5% decrease in product margins resulted from recording a

$32,803,000 inventory impairment charge associated with the markdown and discontinuance of certain

non core products as part of our longer term-strategic plan. Occupancy costs increased by $7,242,000

primarily due to the impairment charges of $5,350,000 related to the 20 stores identified for closure

that operated as clearance centers during the fourth quarter and rent expense increased by $4,128,000

primarily related to the change in fair value of the cash flow hedge associated with variable lease

payments on certain stores, partially offset by lower equipment rental. Warehousing and distribution

costs decreased by $7,083,000 due to a more efficient store replenishment schedule and lower

occupancy costs.

Gross profit from service revenue increased, as a percentage of service revenue, to 11.0% in fiscal

2007 from 8.4% in fiscal 2006. The increase in dollars was $9,607,000 or a 29.1% increase from the

prior year. This increase as a percentage of service revenue resulted primarily from lower service

associate costs (positive experience in workers compensation and medical claims) of $15,124,000,

partially offset by higher service associate compensation expense resulting from increased staffing levels

in our service centers and impairment charges of $1,849,000 related to the 20 closed stores.

Selling, general and administrative expenses, as a percentage of total revenues, decreased to 24.2%

for fiscal 2007 as compared to 24.4% for fiscal 2006. The decrease in dollars was $28,026,000 or a 5.1%

decrease from the prior year. The dollar decrease resulted primarily from lower retail associate

compensation expense of $15,744,000, lower retail associate costs of $8,349,000 (workers compensation

and medical) and reduced media expenditures of $5,700,000, partially offset by increased legal

settlements and reserves.

Net gain from disposition of assets increased, as a percentage of total revenue, to 0.7% for fiscal

2007 as compared to 0.4% for fiscal 2006. The $6,183,000 increase resulted from the $13,971,000 gain

realized upon the consummation of our 34 store sale leaseback transaction which was required to be

immediately recognized (the remaining portion of the gain is being amortized over the lease term).

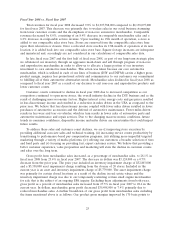

Interest expense increased $1,951,000 or 4.0% to $51,293,000 in fiscal 2007 from $49,342,000 in

fiscal 2006. Included in fiscal 2007 was $5,900,000 in expense incurred due to the write off of deferred

financing costs resulting from the repayment of $162,558,000 of our Senior Secured Term Loan facility

and the reclassification from other comprehensive loss for the portion of the related interest rate swap

that is no longer designated as a hedge. Included in fiscal 2006 was $4,200,000 of expense associated

with the early satisfaction and discharge of $119,000,000 4% Senior Convertible Notes due in June,

2007. In fiscal 2007, we experienced a lower weighted average interest rate and lower debt levels

27