Pep Boys 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

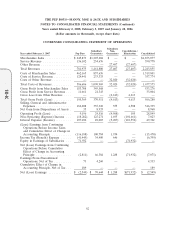

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

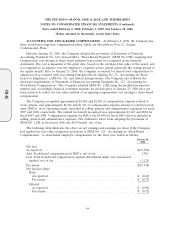

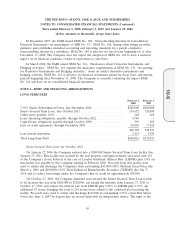

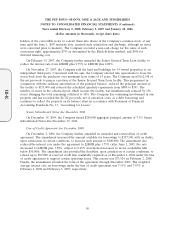

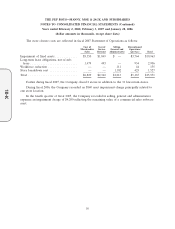

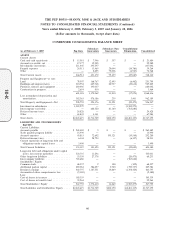

NOTE 3—ACCRUED EXPENSES

The Company’s accrued expenses as of February 2, 2008 and February 3, 2007, were as follows:

February 2, February 3,

2008 2007

Casualty and medical risk insurance .......................... $164,435 $173,826

Accrued compensation and related taxes ...................... 46,376 44,317

Sales tax payable ....................................... 12,367 11,286

Other ............................................... 69,445 62,851

Total ................................................ $292,623 $292,280

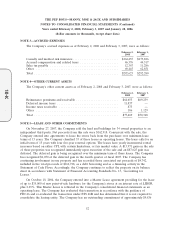

NOTE 4—OTHER CURRENT ASSETS

The Company’s other current assets as of February 2, 2008 and February 3, 2007, were as follows:

February 2, February 3,

2008 2007

Reinsurance premiums and receivable ........................ $64,653 $69,239

Deferred income taxes ................................... 11,837 —

Income taxes receivable .................................. 873 —

Other ............................................... 106 1,129

Total ................................................ $77,469 $70,368

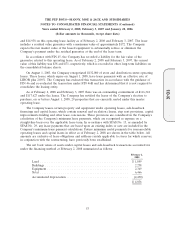

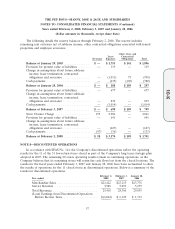

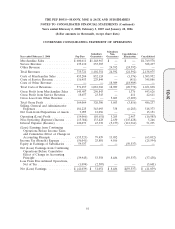

NOTE 5—LEASE AND OTHER COMMITMENTS

On November 27, 2007, the Company sold the land and buildings for 34 owned properties to an

independent third party. Net proceeds from this sale were $162,918. Concurrent with the sale, the

Company entered into agreements to lease the stores back from the purchaser over minimum lease

terms of 15 years. The Company classified 33 of these leases as operating leases. The lease calls for an

initial term of 15 years with four five-year renewal options. The leases have yearly incremental rental

increases based on either CPI, with certain limitations, or fair market value. A $13,971 gain on the sale

of these properties was recognized immediately upon execution of the sale and an $87,625 gain was

deferred. The deferred gain is being recognized over the minimum term of these leases. The Company

has recognized $1,030 of the deferred gain in the fourth quarter of fiscal 2007. The Company has

continuing involvement in one property and has recorded those associated net proceeds of $4,742,

included in the total proceeds of $162,918, as a debt borrowing and as a financing activity in the

Statement of Cash Flows. Accordingly, the Company continues to reflect the property on its balance

sheet in accordance with Statement of Financial Accounting Standards No. 13, ‘‘Accounting for

Leases.’’

On October 18, 2004, the Company entered into a Master Lease agreement providing for the lease

of up to $35,000 of new point-of-sale hardware for the Company’s stores at an interest rate of LIBOR

plus 2.25%. This Master Lease is reflected in the Company’s consolidated financial statements as an

operating lease. The Company has evaluated this transaction in accordance with the guidance of

FIN 46 and re-evaluated the transaction under FIN 46R and has determined that it is not required to

consolidate the leasing entity. The Company has an outstanding commitment of approximately $9,836

52

10-K