Pep Boys 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

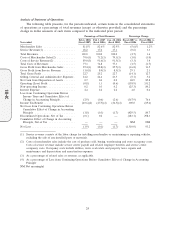

We attribute this improvement to our continued focus on our service center productivity, improved

service manager retention and a renewed focus on tire sales.

Our net loss per share for the year ended February 2, 2008 was $0.79 per share or a $0.74 per

share increase over the $0.05 loss per share recorded in 2006. A significant portion of this loss was

attributable to the initial steps taken in accordance with our long-term strategic plan. During fiscal

2007, we also incurred approximately $7,700,000 in severance and inducement compensation expense in

order to strengthen our management team. These actions, which we believe strengthen our future,

contributed to our disappointing fiscal 2007 financial results.

We completed a sale-leaseback transaction on 34 Company-owned locations in the fourth quarter

resulting in the repayment of $162,558,000 in long term debt. On March 25, 2008, we consummated a

sale and leaseback transaction on 18 properties for an aggregate purchase price of $63,600,000. On

April 10, 2008, we consummated a sale-leaseback transaction on 23 properties for an aggregate

purchase price of $74,300,000. The proceeds from these two additional transactions are expected to be

used to reduce indebtedness. Each of the properties sold in these three transactions have been leased

back to be operated as Pep Boys stores for a term of 15 years, with four 5-year renewal options.

Our cash flow from operating activities was $52,784,000 in fiscal 2007 and our capital expenditure

program was $41,953,000.

During fiscal 2007 we grand reopened 136 Stores in the following markets: Portland, ME; Boston,

MA; Providence, RI; Springfield, MA; Hartford, CT; Shreveport, LA; Baton Rouge, LA; Lafayette, LA;

New Orleans, LA; Yuma, CA; Santa Barbara, CA; Bakersfield, CA; Fresno, CA; Sacramento, CA;

Chico, CA; San Francisco, CA; Reno, NV—totaling 65 (first quarter); Houston, TX; Austin, TX;

San Antonio, TX; Corpus Christi, TX; Laredo, TX; Harlingen, TX; Atlanta, GA; Macon, GA;

Savannah, GA—totaling 44 (second quarter); Puerto Rico—totaling 27 (fourth quarter).

CAPITAL & LIQUIDITY

Capital Resources and Needs

Our cash requirements arise principally from the purchase of inventory, capital expenditures

related to existing stores, offices and distribution centers, service our debt and contractual obligations.

Our fiscal 2007 capital expenditures totaled $41,953,000, including the remodeling of 130 stores

and the opening of two new SUPERCENTERS. Our fiscal 2008 capital expenditures are expected to be

similar to fiscal 2007, including comparable inventory levels.

In fiscal 2007, we received $30,045,000 from the cancellation of certain company-owned life

insurance policies. The proceeds from the surrender of these non-core assets were used to repay

borrowings under our revolving credit facility and general corporate purposes.

In fiscal 2007, we repurchased $50,841,000 of Pep Boys stock and paid an additional $7,300,000 to

settle shares purchased in the fourth quarter of 2006.

In the fourth quarter of fiscal 2007, we prepaid $162,558,000 of debt under our Senior Secured

Term Loan facility due in 2013 with the net proceeds from a sale-leaseback transaction on 34

Company-owned locations.

On or before August 1, 2008, we are obligated to purchase 29 properties that we currently rent

under a master operating lease. We believe that the market value of these properties exceeds their

18

10-K