Overstock.com 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

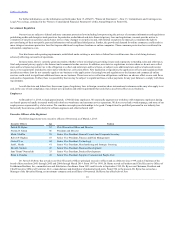

Table of Contents

maintaining BFPP status. Its failure to do so could expose us to environmental liabilities which could be material. Further, in connection with the credit

facility we recently entered into with U.S. Bank and other banks, we entered into a broad environmental indemnity agreement pursuant to which we made

detailed representations about the environmental status of the land and agreed to indemnify and defend U.S. Bank and other banks and other persons against

a broad array of potential environmental claims, liabilities and exposures relating to the property we purchased and the headquarters we intend to build. Any

such environmental liabilities, and any liabilities under the environmental indemnity agreement, could be material and could have a material adverse effect

on our business, prospects, financial condition and results of operations.

We have entered into contracts and plan to spend approximately $95 million to build, equip and furnish a facility to serve as our future headquarters, and

expect to incur risks, expense and debt in connection with the project.

As we proceed with the design, development and construction of a facility for our new headquarters, we will incur the risks and expense of doing so.

The design and construction of the headquarters we are planning will be complicated. We may encounter unanticipated developments affecting our estimates

regarding the expense of the project. We may also encounter unanticipated delays in the negotiation of definitive agreements and/or the construction of the

new facility. Any such difficulties could result in our default under the Loan Agreement and related agreements we have entered into with U.S. Bank and

other banks, and could result in material liabilities and expense and could have a material adverse effect on our business, prospects, financial condition and

results of operations.

In connection with our design, development and construction of a facility for our new headquarters, we have entered into a syndicated senior secured

credit facility, and may need to obtain additional financing as well.

Our current estimate of the total cost of the development and construction and related equipment and furniture of our new headquarters is

approximately $95 million. We have entered into a syndicated senior secured credit facility with U.S. Bank and other banks that is intended to provide us

with construction and term financing of $45.8 million. The facility is designed to convert to an approximately 6.75 year term loan upon completion of

construction. We will need to maintain compliance with the requirements governing the facility, including compliance with financial and other covenants,

certain of which may be subject to events outside of our control. If we fail to comply with any of such covenants, we may be unable to obtain or utilize the

financing contemplated by the facility. If the financing we anticipate under the facility is not fully available to us for any reason, it would have a material

adverse effect on our liquidity and could have a material adverse effect on our business, prospects, financial condition and results of operations.

We have pledged the land and our new headquarters and all related assets, as well as our inventory and accounts receivable and related assets, to secure

our obligations under the syndicated senior secured credit facility.

We have pledged all of our assets relating to the new headquarters and the site on which it is to be located, as well as our inventory, accounts

receivable and related assets, and most of our deposit accounts, to secure our obligations under the syndicated senior secured credit facility. The real estate

loan and the revolving loan facilities included within the facility are cross-collateralized and cross-defaulted. If we were to default on either loan or have an

Event of Default under the facility, the lenders would have the right to, among other things, foreclose on the collateral for our obligations under the facility,

which would have a material adverse effect on our liquidity and could have a material adverse effect on our business, prospects, financial condition and

results of operations.

We have entered into long-term interest rate swaps covering a period of approximately nine years.

In connection with the syndicated senior secured credit facility described above, we have entered into interest rate swaps with U.S. Bank and

Compass Bank. The interest rate swaps are intended to manage the interest rate risk on the indebtedness we expect to incur in 2015 and 2016 for the Real

Estate Loan. However, if for any reason the notional amounts subject to the swaps fail to substantially match our indebtedness for the Real Estate Loan at any

time until the October 2023 maturity of the interest rate swaps, we would be exposed to potential liabilities under the swaps that might not be substantially

offset by the interest payments we would owe under the loan agreement. If the lenders under the senior secured credit facility were to fail to fund the Real

Estate Loan for any reason, we would remain liable for payments due under the swaps unless we were to settle the swaps. If we were to settle the swaps at a

time when interest rates have fallen (relative to the swaps' inception), the price to settle the swaps could be material. Any such adverse developments could

result in material liabilities and expense and could have a material adverse effect on our business, prospects, financial condition and results of operations.

We may fail to qualify for hedge accounting treatment.

20