Overstock.com 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

also cannot provide any assurance that any insurance we may desire to purchase will be available to us on terms we find acceptable or at all. Similarly, we are

not indemnified by all our suppliers, nor can we be certain that any indemnification rights we may have are enforceable or would be adequate to cover actual

losses we may incur as a result of the sale or use of products our indemnitors provide to us. Actual losses for which we are not insured or indemnified, or

which exceed our insurance coverage or the capacity of our indemnitors, could harm our business, prospects, financial condition and results of operations.

We face intense competition and may not be able to compete successfully against existing or future competitors.

The online retail market is rapidly evolving and intensely competitive. Barriers to entry are minimal, and current and new competitors can launch

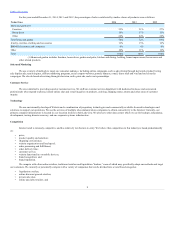

new websites at a relatively low cost. We currently compete with numerous competitors, including:

• liquidation e-tailers such as SmartBargains;

• online retailers with discount departments such as AliExpress (part of the Alibaba Group), Amazon.com, Inc., eBay, Inc., and

Rakuten.com, Inc. (formerly Buy.com, Inc.);

• private sale sites such as Gilt Groupe and Rue La La;

• online specialty retailers such as Blue Nile, Inc., Bluefly, Inc., Wayfair, LLC, Zappos.com, and Zulily, Inc.; and

• traditional general merchandise and specialty retailers and liquidators such as Barnes and Noble, Inc., Best Buy Co. Inc., Costco Wholesale

Corporation, Home Depot, Inc., J.C. Penny Company, Inc., Ross Stores, Inc., Sears Holding Corporation, T.J. Maxx, Target Corporation, and

Wal-Mart Stores, Inc. all of which also have an online presence.

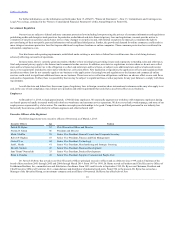

We expect the online retail market to become even more competitive as traditional liquidators and online retailers continue to develop and improve

services that compete with our services. In addition, more traditional manufacturers and retailers may continue to add or improve their e-commerce offerings.

Traditional or online retailers may create proprietary, store-based distribution and returns channels. Competitive pressures, including same-day delivery

capabilities, from any of our competitors, many of whom have longer operating histories, larger customer bases, greater brand recognition and significantly

greater financial, marketing and other resources than we do, could harm our business.

Further, as a strategic response to changes in the competitive environment, we may from time to time make competitive pricing, service, marketing

or other decisions that could harm our business. For example, to the extent that we enter new lines of businesses such as third party logistics or discount brick

and mortar retail, we are or would be competing with large established businesses such as APL Logistics and Ross Stores, Inc. We are currently offering

insurance products, and as such face competition from large established businesses with substantially more experience than we have. In the past we have

entered the online auctions, car listing and real estate listing businesses in which we compete or competed with large established businesses including eBay,

Inc., and AutoTrader.com, Inc. We no longer offer online auctions services or real estate listing services.

Mobile commerce and our Club O offerings are becoming increasingly significant to us.

Mobile commerce and our Club O offerings are becoming increasingly significant to us. Customers who use mobile devices and customers who join

Club O may behave differently from our other customers. For example, the conversion rate of purchases from mobile devices is lower than from other sources.

If our mobile customers or our Club O customers are less profitable to us than our other customers, our business could be harmed.

If one or more states successfully assert that we should collect sales or other taxes on the sale of our merchandise or the merchandise of third parties that

we offer for sale on our Website, or that we should pay commercial activity taxes, our business could be harmed.

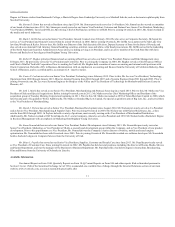

We do not currently collect sales or other similar taxes on sales of goods into states where we have no duty to do so under federal court decisions

construing applicable constitutional law. One or more local, state or foreign jurisdictions may seek to impose sales tax collection obligations on us because

we are engaged in online commerce, even though to do so would be contrary to existing court decisions. The future location of our fulfillment or customer

service centers networks, or any other operation, service contracts with third parties located in another state, channel distribution arrangements or other

agreements with third party sellers, or any act that may be deemed by a state to have established a physical presence in states where we are not now present,

may result in additional sales and other tax obligations. New York and other states have passed so-called “Internet affiliate advertising” statutes, which

require a remote seller, with no physical presence in the state, to collect state sales tax if the remote seller contracted for advertising services with an Internet

advertiser in that state. In New York and states passing similar laws, we have terminated our use of locally based Internet advertisers. Many other states

currently have passed

17