Omron 1999 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1999 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

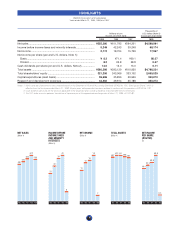

RESULTS OF STRUCTURAL REFORMS

According to its Seventh Medium-Term Management

Plan, from April 1996 to March 1999, OMRON promoted

structural reforms to create a growth-oriented structure, estab-

lish an innovative cost structure, and revitalize corporate

resources.

In fiscal 1999, the final year of the Seventh Medium-Term

Management Plan, we had set our overall management goal

as 7% return on equity (ROE) and intended to prepare a plan

for achieving a two-digit ROE in the Eighth Medium-Term

Management Plan. However, OMRON was unable to achieve

this target, recording a 0.7% ROE in the fiscal year under

review. Moreover, OMRON has postponed the start of its

Eighth Medium-Term Management Plan, which had been set to

begin in April 1999, because drawing up a new management

plan was difficult amid the uncertain prospects of the Japanese

economy. Therefore, we will start fiscal 2000 with a short-term

management plan, which covers the current fiscal year.

Regarding the creation of a growth-oriented structure,

through the Seventh Medium-Term Management Plan,

although the business environment appeared daunting,

OMRON executed its corporate growth strategies—a set of

visionary concepts comprising the areas of intelligent transport

systems (ITSs); multimedia-oriented factory automation (FA);

and cyber-community-related, total healthcare, and informa-

tion sensing businesses.

In line with the current business trend of prioritization and

focus, OMRON reviewed each operation from the viewpoints

of future growth and profit potential, identifying its strengths

and working to tighten its focus on the most important issues.

As for establishing an innovative cost structure, we have

integrated various administrative systems to create a new

infrastructure. OMRON will continue to streamline the func-

tions of its Head Office by simplifying its organizational roles,

relocating personnel for strengthening line functions, stream-

lining business offices, and constantly reviewing its balance

sheets. Regarding revitalizing corporate resources, we will

continue the structural reform of fixed costs but with more

emphasis in certain areas, as described in detail later in this

report.

In addition, we have reorganized our sales system by re-

structuring sales channels, reinforcing direct sales promotion,

and concentrating corporate resources on the sensing business.

In fiscal 1999, within our initial budget, we created a growth-

oriented structure and strengthened our sales force. We also

placed high priority on sharpening our management focus on

securing profits and reviewing major projects that affect profits.

To be more growth oriented, we revised business projects

and worked on improving our business infrastructure (by such

means as suspending the OMRON Total Fair, reviewing office

integration, and cutting personnel costs and general expenses).

Furthermore, we restructured our business based on the con-

cepts of prioritization and focus, selling off three businesses:

OMRON Microcomputer Systems Co., Ltd. (OMS), a company

that sells personal computers and peripherals; a semiconduc-

tor sales business in Japan; and an electronic cash register

business in Europe.

PERSPECTIVES

By designating fiscal 2000 as “Year One of OMRON’s

Corporate Transformation,” the Company will further

progress with reforms in management, business, and fixed

cost structures, leading to improved corporate value.

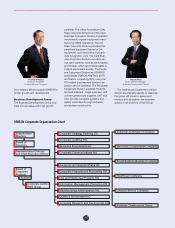

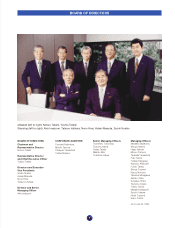

REFORMING THE MANAGEMENT STRUCTURE

As described on pages 5 to 8, the transformation of our

management structure is a prerequisite for both employ-

ees and divisional units to become self-reliant, eliminating an

excessive codependence among management, divisional

units, and staff members. To not only survive but to beat the

competition in the global market, we urgently need to set up

corporate governance systems and execute them through

customer-oriented business strategies.

To realize this, while aiming at achieving a simple manage-

ment style that emphasizes speed and flexibility, we will reform

the roles of individual directors and the Board of Directors as a

whole by adding the new position of executive director, whose

3

39,239

40,905

46,032

11,849

OPERATING INCOME

(Million ¥)

’96

’97

’98

’99

FY

Operating income

Ratio of operating income to net sales

7.5

6.9

7.5

2.1