Oki 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

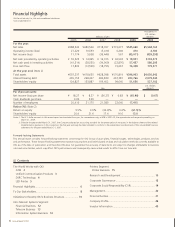

10 Annual Report 2009

Initiatives to Revamp OKI’s Business Structure

Procedures for Selecting and Concentrating Businesses

Businesses have been divided into four categories based on business performance indicators that include net sales,

operating income ratio (3%), market potential, market share, synergy, and differentiation factors (technology, products,

and know-how). OKI is carrying out business operations based on each of these strategies.

Within the telecom and information systems businesses in particular, OKI has been promoting the reduction of and

withdrawal from low-profit businesses. As a result, earnings in the fiscal year ended March 31, 2009 improved, despite

drops in net sales compared with the previous fiscal year.

Spin Off of the Semiconductor Segment and Transfer of Shares

On October 1, 2008, OKI spun off its semiconductor business through a company split (total assets: approximately

¥130.0 billion), transferring 95% of shares from applicable subsidiaries to ROHM CO., LTD. Remuneration for the trans-

ferred shares (¥85.8 billion) has been aggressively invested towards focus businesses, while a portion of this amount

has been used to repay interest-bearing debt, strengthening OKI’s financial standing.

Focus Business Following the Transfer of Semiconductor Subsidiary Shares

From here on, OKI will focus on its core competencies, the info-telecom convergence and mechatronics (ATMs,

printers, and others) businesses. OKI will also work to expand the concentration of overseas businesses, particularly

in the mechatronics business.

Splitting Up the Areas Related NGN Operations in the Telecom Business

Deeming it important to formulate a business structure that heightens management agility and is capable of rapidly

responding to environmental changes, OKI established OKI Networks Co., Ltd. on October 1, 2008 with the purpose of

gaining an advantage in the fiercely competitive network market and achieving additional growth in the telecom business.

Abolishing the Internal Company System and Making the Transition to a Business Divisions System

OKI established business divisions that have market-oriented business management functions and business control

functions as well as divisions that possess product planning functions. By establishing a structure that is capable of

consolidating each business domain as it creates mutual linkage, OKI is taking steps to enhance its competitiveness

and strengthen its management style.

Thorough Optimization of Fixed Costs

Amid dramatically changing business conditions, OKI is thoroughly optimizing fixed costs to further bolster its corporate

structure. As a result, OKI reduced fixed costs during the fiscal year ended March 31, 2009 by approximately ¥10.0 billion

compared to the previous fiscal year. By implementing the following measures in the fiscal year ending March 31, 2010,

the Company projects that additional reductions of approximately ¥14.0 billion can be achieved.

In March 2007, OKI formulated three basic strategies to revamp its business structure

with the aim of recovering profitability. Since then, the Company has been steadily

implementing measures that follow these basic strategies.

Basic Strategy

1

Basic Strategy

2

Business Category Business Policy

Focus businesses Existing Sales expansion based on existing “strong products”

New New business creation and expansion based on synthesizing and integrating advanced technologies

Stable earnings businesses Maintain and expand stable earnings through greater efficiency

Businesses becoming profitable Make every effort to become profitable / Businesses lacking profit potential will be consolidated

Accelerate Business Selection and Concentration

Shift to a More Efficient Management Style