Occidental Petroleum 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

þAnnual Report Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

¨ Transition Report Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

For the fiscal year ended December 31, 2014

For the transition period from to

Commission File Number 1-9210

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization

Delaware

I.R.S. Employer Identification No.

95-4035997

Address of principal executive offices

5 Greenway Plaza, Suite 110, Houston, Texas

Zip Code

77046

Registrant's telephone number, including area code

(713) 215-7000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Name of Each Exchange on Which Registered

9 1/4% Senior Debentures due 2019

New York Stock Exchange

Common Stock, $.20 par value

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

þ¨

¨þ

þ¨

þ¨

þ

þ ¨

¨ ¨

¨þ

Table of contents

-

Page 1

..., 2014 Commission File Number 1-9210 Occidental Petroleum Corporation (Exact name of registrant as specified in its charter) State or other jurisdiction of incorporation or organization I.R.S. Employer Identification No. Address of principal executive offices Zip Code Registrant's telephone number... -

Page 2

...for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities...Selected Financial Data...Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A)...Strategy...Oil and Gas Segment...Chemical Segment...Midstream and Marketing... -

Page 3

... and Corporate Governance...Executive Compensation...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters...Certain Relationships and Related Transactions and Director Independence...Principal Accounting Fees and Services...Exhibits and Financial Statement... -

Page 4

... Financial Statements. OIL AND GAS OPERATIONS General Occidental's domestic oil and gas operations are located in Colorado, New Mexico, North Dakota and Texas. International operations are located in Bahrain, Bolivia, Colombia, Iraq, Libya, Oman, Qatar, the United Trab Emirates (UTE) and Yemen... -

Page 5

... current market prices or on a forward basis to refiners and other market participants. Occidental's competitive strategy relies on increasing production through developing conventional and unconventional fields, utilizing primary and enhanced oil recovery (EOR) techniques and strategic acquisitions... -

Page 6

... the value of its transportation and storage assets by marketing its own and third-party production in the oil and gas business. Other midstream and marketing operations also support Occidental's domestic and international oil and gas and chemical operations. Occidental's marketing business competes... -

Page 7

... (SEC); Other SEC filings, including Forms 3, 4 and 5; and Corporate governance information, including its Corporate Governance Policies, board-committee charters and Code of Business Conduct. Ø Ø The cost of exploring for, developing, producing, refining and marketing crude oil, natural gas... -

Page 8

... subject to the decisions of many federal, state, local and foreign governments and political interests. Ts a result, Occidental faces risks of: Ø new or amended laws and regulations, or interpretations of such laws and regulations, including those related to drilling, manufacturing or production... -

Page 9

...derivatives, market risks and internal controls appears under the headings: "MD&T - Oil & Gas Segment - Proved Reserves" and "- Industry Outlook," "- Chemical Segment - Industry Outlook," "- Midstream and Marketing Segment - Industry Outlook," "- Lawsuits, Claims and Contingencies," "- Environmental... -

Page 10

... Vice President, Strategy & Development 2014, Executive Vice President & Chief Financial Officer, 2012-2014; Goldman, Sachs & Co.: Managing Director, 2010-2012, Vice President, 2005-2010. Vice President, Controller and Principal Accounting Officer since July 2014; Occidental Oil & Gas Corporation... -

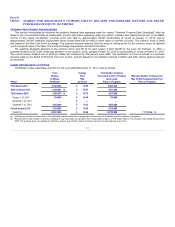

Page 11

... name or nominee accounts. The common stock is listed and traded on the New York Stock Exchange. The quarterly financial data set forth the range of trading prices for the common stock as reported on the composite tape of the New York Stock Exchange and quarterly dividend information. The quarterly... -

Page 12

... peer group companies' common stock weighted by their relative market values within the peer group, and that all dividends were reinvested. Occidental's peer group consists of Tnadarko Petroleum Corporation, Tpache Corporation, Canadian Natural Resources Limited, Chevron Corporation, ConocoPhillips... -

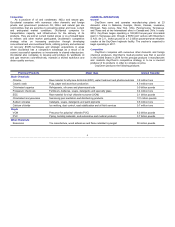

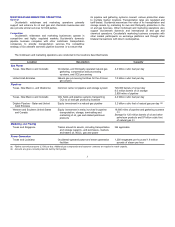

Page 13

... this report, "Occidental" means Occidental Petroleum Corporation (OPC), or OPC and one or more entities in which it owns a controlling interest (subsidiaries). Occidental's principal businesses consist of three segments. The oil and gas segment explores for, develops and produces oil and condensate... -

Page 14

... portfolio of assets and strong balance sheet. Management believes Occidental's oil and gas segment growth will occur primarily through exploitation and development opportunities in the Permian Basin and focused international projects in the Middle East. Chemical The primary objective of OxyChem is... -

Page 15

.... Business Environment Oil and gas prices are the major variables that drive the industry's short- and intermediate-term financial performance. The following table presents the average daily West Texas Intermediate (WTI), Brent and New York Mercantile Exchange (NYMEX) prices for 2014 and 2013: 2014... -

Page 16

... is planned for Permian Resources assets to focus on growing oil production. Occidental's Permian Resources operations are among its fastestgrowing assets and held approximately 2.5 million net acres at the end of 2014, including acreage with prospective resource potential. The development program... -

Page 17

... assess the carrying value of its domestic producing assets and assess development plans for its nonproducing assets. In the fourth quarter of 2014, Occidental recorded pre-tax impairment charges of $2.7 billion in the Williston Basin, $904 million related to its gas and NGLs assets and $589 million... -

Page 18

...percent interest in the stock of Dolphin Energy Limited (Dolphin Energy), which operates a pipeline and is discussed further in "Midstream and Marketing Segment Pipeline Transportation." Occidental's share of production from Qatar was approximately 107,000 BOE per day in 2014. United Arab Emirates... -

Page 19

Latin America Assets Occidental does not have any reserves from non-traditional s ourc es . For further information regarding Occidental's proved reserves, see "Supplemental Oil and Gas Information" following the "Financial Statements." Proved Reserve Additions Occidental's total proved reserve ... -

Page 20

... U.S. Securities and Exchange Commission (SEC) rules and regulations, including the internal audit and review of Occidental's oil and gas reserves data. The Senior Vice President has over 30 years of experience in the upstream sector of the exploration and production business, and has held various... -

Page 21

...reports to the Tudit Committee of Occidental's Board of Directors during the year. Since 2003, Occidental has retained Ryder Scott Company, L.P. (Ryder Scott), independent petroleum engineering consultants, to review its annual oil and gas reserve estimation processes. In 2014, Ryder Scott conducted... -

Page 22

... the gas processing and power generation businesses, partially offset by lower marketing performance and pipeline income. Business Review Marketing and Trading The marketing and trading group markets substantially all of Occidental's oil, NGLs and gas production, trades around its assets, including... -

Page 23

...the increase in earnings in 2014 compared to 2013 was due to higher margins from higher spark spreads and production. Industry Outlook The pipeline transportation and power generation businesses are expected to remain relatively stable. The gas processing plant operations could have volatile results... -

Page 24

... the employment and post-employment benefits for Occidental's former Executive Chairman and termination of certain other employees and consulting arrangements. Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia 27 11 29 12 29 13 Middle East/North Africa Oil (MBBL) Dolphin Oman Qatar... -

Page 25

Sales Volumes per Day United States Oil (MBBL) NGLs (MBBL) Natural gas (MMCF) 2014 2013 2012 183 55 476 29 11 176 57 528 27 12 167 56 565 28 13 Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia Middle East/North Africa Oil (MBBL) Dolphin Oman Qatar Other Total NGLs (MBBL) ... -

Page 26

...Worldwide Effective Tax Rate The following table sets forth the calculation of the worldwide effective tax rate for income from continuing operations: (in millions) 2014 2013 2012 EARNINmS Oil and Gas Chemical Midstream and Marketing (a) Unallocated Corporate Items Pre-tax income Income tax expense... -

Page 27

...'s 2014 worldwide tax rate was 109 percent, which was higher than 2013 mainly due to an other than temporary loss on Occidental's available for sale investment in California Resources stock and the oil and gas international asset impairments of $1.1 billion, neither of which had a tax benefit... -

Page 28

...as a result of lower oil and gas prices at the end of 2014, partially offset by an increase in accounts payable associated with increased Permian development activities. The decrease in deferred credits and other liabilities-income taxes reflected the spin-off of California Resources as a portion of... -

Page 29

... from 2013 to 2014 was due to increased development activity in the domestic oil and gas operations, primarily Permian Resources. The increase in the midstream and marketing capital expenditures was due to higher spending for the Tl Hosn gas project and BridgeTex pipeline. Occidental's 2015 net... -

Page 30

... Resources guaranteed by Occidental were immaterial. See "Oil and Gas Segment - Business Review - Qatar" and "Segment Results of Operations" for further information about Dolphin. Leases Occidental has entered into various operating lease agreements, mainly for transportation equipment, power plants... -

Page 31

... United States Internal Revenue Service (IRS) pursuant to its Compliance Tssurance Program, subsequent taxable years are currently under review. Tdditionally, in December 2012, Occidental filed United States federal refund claims for tax years 2008 and 2009 which are subject to IRS review. Taxable... -

Page 32

... in millions) # of Sites remediation activities - accounted for 56 percent of Occidental's reserves associated with these sites. Four sites - chemical plants in Kansas, Louisiana and New York and a group of oil and gas properties in the southwestern United States - accounted for 62 percent of the... -

Page 33

...fair values at the acquisition date. Tsset retirement obligations and interest costs incurred in connection with qualifying capital expenditures are capitalized and amortized over the lives of the related assets. Occidental uses the successful efforts method to account for its oil and gas properties... -

Page 34

... sustained higher or lower product prices, which are particularly affected by both domestic and foreign competition, demand, feedstock costs, energy prices, environmental regulations and technological changes. Occidental performs impairment tests on its chemical assets whenever events or changes in... -

Page 35

...for the assets or liabilities; Level 2 - using observable inputs other than quoted prices for the assets or liabilities; and Level 3 - using unobservable inputs. Transfers between levels, if any, are recognized at the end of each reporting period. Fair Values - Recurring Occidental primarily applies... -

Page 36

...for annual periods beginning on or after December 15, 2015. The rules are not expected to have a material impact on Occidental's financial statements upon adoption but will require assessment on an ongoing basis. In May 2014, the FTSB issued rules relating to revenue recognition. Under the new rules... -

Page 37

... group report to the Corporate Vice President and Treasurer. The President and Chief Executive Officer, and Executive Vice President of Operations also oversee these controls. Controls for these activities include limits on value at risk, limits on credit, limits on total notional trade value... -

Page 38

... Variable-Rate Debt 68 68 0.04% 68 $ $ $ Credit Risk Occidental's credit risk relates primarily to its derivative financial instruments and trade receivables. Occidental's contracts are spread among a large number of counterparties. Creditworthiness is reviewed before doing business with a new... -

Page 39

... standards of the Public Company Tccounting Oversight Board (United States), Occidental Petroleum Corporation and subsidiaries' internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework issued in 2013 by the Committee... -

Page 40

... REGISTERED PUBLIC ACCOUNTING FIRM ON INTERNAL CONTROL OVER FINANCIAL REPORTING To the Board of Directors and Stockholders Occidental Petroleum Corporation: We have audited Occidental Petroleum Corporation and subsidiaries' internal control over financial reporting as of December 31, 2014, based on... -

Page 41

... assets $ 2014 3,789 4,019 4,206 1,052 807 13,873 $ 2013 3,393 - 5,674 1,200 1,056 11,323 INVESTMENTS Investment in unconsolidated entities Available for sale investment Total investments 1,171 394 1,565 1,459 - 1,459 PROPERTY, PLANT AND EQUIPMENT Oil and gas segment Chemical segment Midstream... -

Page 42

...(in millions, except share and per-share amounts) Occidental Petroleum Corporation and Subsidiaries Liabilities and Stockholders' Equity at December 31, CURRENT LIABILITIES Accounts payable Accrued liabilities Domestic and foreign income taxes Total current liabilities LONm-TERM DEBT, NET DEFERRED... -

Page 43

Consolidated Statements of Income (in millions, except per-share amounts) Occidental Petroleum Corporation and Subsidiaries For the years ended December 31, REVENUES AND OTHER INCOME Net sales Interest, dividends and other income Gain on sale of assets and equity investments $ 2014 19,312 130 2,... -

Page 44

Consolidated Statements of Comprehensive Income (in millions) Occidental Petroleum Corporation and Subsidiaries For the years ended December 31, Net income attributable to common stock Other comprehensive income (loss) items: Foreign currency translation (losses) gains Realized foreign currency ... -

Page 45

..., 2013 Net income Other comprehensive income, net of tax Dividends on common stock Issuance of common stock and other, net Distribution of California Resources stock to shareholders Noncontrolling interest distributions, net Purchases of treasury stock Balance, December 31, 2014 (a) Treasury Stock... -

Page 46

... Statements of Cash Flows in millions Occidental Petroleum Corporation and Subsidiaries ...California Resources Proceeds from long-term debt Payments of long-term debt Proceeds from issuance of common stock Purchases of treasury stock Contributions from noncontrolling interest Cash dividends... -

Page 47

45 -

Page 48

... subsidiaries and its undivided interests in oil and gas exploration and production ventures. Occidental accounts for its share of oil and gas exploration and production ventures, in which it has a direct working interest, by reporting its proportionate share of assets, liabilities, revenues, costs... -

Page 49

... financial statements include assets of approximately $15 billion as of December 31, 2014, and net sales of approximately $7.3 billion for the year ended December 31, 2014, relating to Occidental's operations in countries outside North Tmerica. Occidental operates some of its oil and gas business... -

Page 50

... costs over proved developed reserves. Proved oil and gas reserves are those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible-from a given date forward, from known reservoirs, and under existing... -

Page 51

... for the assets or liabilities; Level 2 - using observable inputs other than quoted prices for the assets or liabilities; and Level 3 - using unobservable inputs. Transfers between levels, if any, are reported at the end of each reporting period. Fair Values - Recurring Occidental primarily applies... -

Page 52

... time in response to significant changes in sitespecific data, laws, regulations, technologies or engineering estimates, Occidental reviews and adjusts its reserves accordingly. ASSET RETIREMENT OBLIGATIONS Occidental recognizes the fair value of asset retirement obligations in the period in which... -

Page 53

... For cash- and stock-settled restricted stock units or incentive award shares (RSUs) and capital employed incentive awards and return on assets (ROCEI/ROTI), compensation value is initially measured on the grant date using the quoted market price of Occidental's common stock and the estimated payout... -

Page 54

... 100,000 net acres. The assets acquired include primarily unproved oil and gas property leases and the related existing lease contracts, permits, licenses, easements, and equipment located on the properties. On November 30, 2014, the spin-off of California Resources was completed through the pro... -

Page 55

...for annual periods beginning on or after December 15, 2015. The rules are not expected to have a material impact on Occidental's financial statements upon adoption but will require assessment on an ongoing basis. In May 2014, the FTSB issued rules relating to revenue recognition. Under the new rules... -

Page 56

... on the notes will be payable semi-annually in arrears in February and Tugust for each series of notes. Occidental has provided guarantees on Dolphin Energy's debt, which are limited to certain political and other events. Tt December 31, 2014 and 2013, Occidental's total guarantees were not material... -

Page 57

... include leases for transportation equipment, power plants, machinery, terminals, storage facilities, land and office space. Occidental's operating lease agreements frequently include renewal or purchase options and require the Company to pay for utilities, taxes, insurance and maintenance expenses... -

Page 58

... summarizes Occidental's net volumes of outstanding commodity derivatives contracts not designated as hedging instruments, including both financial and physical derivative contracts as of December 31, 2014 and 2013: Net Outstanding Position Long / (Short) Commodity Oil (million barrels) Natural gas... -

Page 59

...in its credit ratings, it would not have resulted in a material change in its collateral-posting requirements as of December 31, 2014 and 2013. Foreign Currency Risk Occidental's foreign operations have limited currency risk. Occidental manages its exposure primarily by balancing monetary assets and... -

Page 60

... owner for certain remediation activities - accounted for 56 percent of Occidental's reserves associated with these sites. Four sites - chemical plants in Kansas, Louisiana and New York and a group of oil and gas properties in the southwestern United States - accounted for 62 percent of the reserves... -

Page 61

... and, under certain circumstances, perform or fund future work on behalf of the State along a portion of the Passaic River. When Occidental acquired the stock of DSCC in 1986, Maxus Energy Corporation, a subsidiary of YPF S.T. (Maxus), retained liability for the Lister Tvenue Plant, which is part of... -

Page 62

... States federal statutory tax rate Other than temporary loss on available for sale investment in California Resources stock Operations outside the United States State income taxes, net of federal benefit Other Worldwide effective tax rate 60 2014 35 % 12 65 1 (4) 109 % 2013 35 % - 5 1 (1) 40 % 2012... -

Page 63

... 31, 2014 and 2013 were as follows: 2014 Tax effects of temporary differences (in millions) Property, plant and equipment differences Equity investments, partnerships and foreign subsidiaries Environmental reserves Postretirement benefit accruals Deferred compensation and benefits Asset retirement... -

Page 64

... 31, 2013 Issued Options exercised and other, net Balance, December 31, 2014 Common Stock 886,809 1,746 246 888,801 826 292 889,919 584 55 890,558 TREASURY STOCK On October 2, 2014, Occidental increased the total number of shares authorized for its share repurchase program by 60 million shares to... -

Page 65

... During 2014, non-employee directors were granted awards for 28,283 shares of common stock. Compensation expense for these awards was measured using the quoted market price of Occidental's common stock on the grant date and was fully recognized at that time. California Resources Spin-off Adjustments... -

Page 66

... Term. The dividend yield is the expected annual dividend yield over the Term, expressed as a percentage of the stock price on the grant date. Estimates of fair value may not accurately predict the value ultimately realized by the employees who receive the awards, and the ultimate value may not be... -

Page 67

... used: Risk-free interest rate Dividend yield Volatility factor Expected life (years) Grant-date fair value of underlying Occidental common stock $ 1.0% 2.8% 27% 3 101.95 $ 0.6% 2.8% 30% 3 91.97 $ 0.4% 2.6% 34% 3 84.57 2014 2013 2012 T summary of Occidental's unvested TSRIs as of December... -

Page 68

... 1 Granted Shares issued upon California Resources spin-off Shares forfeited by employees of California Resources Unvested at December 31 158 141 16 (33) 282 Weighted-Average mrant-Date Fair Value of Occidental Stock $ 91.90 101.95 - 87.28 92.25 NOTE 13 RETIREMENT AND POSTRETIREMENT BENEFIT PLANS... -

Page 69

... provides that employees of California Resources no longer participate in benefit plans sponsored or maintained by Occidental as of the separation date. Upon separation, the Occidental pension and postretirement plans transferred assets and obligations to the California Resources plans resulting in... -

Page 70

... the California Resources spin-off. Tt December 31, 2013, the weighted average rate of increase in future compensation levels was consistent with Occidental's past and anticipated future compensation increases for employees participating in retirement plans that determine benefits using compensation... -

Page 71

... manager guideline compliance reviews, annual liability measurements and periodic studies. The fair values of Occidental's pension plan assets by asset category are as follows: (in millions) Description Asset Class: U.S. government securities Corporate bonds (a) Common/collective trusts (b) Mutual... -

Page 72

... ended December 31, 2014 and 2013, for the assets using Level 3 fair value measurements was insignificant. Occidental expects to contribute $6 million in cash to its defined benefit pension plans during 2015. Estimated future benefit payments, which reflect expected future service, as appropriate... -

Page 73

... part of Occidental's spin-off of its California oil and gas operations and related assets, Occidental retained an 18.7 percent interest in California Resources stock or approximately 71.5 million shares, which is recorded as an available for sale investment. Ts a result of a declining trading price... -

Page 74

...fair value hierarchy. In 2014, Occidental recognized approximately $111 million pre-tax charges related to the impairments of Chemical assets. (in millions) Description Assets: Impaired proved oil and gas assets - domestic Impaired proved oil and gas assets - international Impaired Chemical property... -

Page 75

... power. It also trades around its assets, including transportation and storage capacity, and trades oil, NGLs, gas and power. Tdditionally, the midstream and marketing segment invests in entities that conduct similar activities. Earnings of industry segments and geographic areas exclude income taxes... -

Page 76

...% 40% Other Chemicals 3% 3% 3% Net sales for the midstream and marketing segment comprised the following: Marketing, Trading, Transportation and other 20% 16% 16% Gas Processing Year ended December 31, 2014 Year ended December 31, 2013 Year ended December 31, 2012 (d) 49% 54% 60% Power 31% 30% 24... -

Page 77

...'s California oil and gas operations and related assets was completed through the distribution of 81.3 percent of the outstanding shares of common stock of California Resources, creating an independent, publicly traded company. Occidental shareholders at the close of business on the record date of... -

Page 78

... related to California Resources were as follows: For the years ended December 31, (in millions) Sales and other operating revenue from discontinued operations Income from discontinued operations before-tax Income tax expense Income from discontinued operations $ $ 2014 3,951 1,205 440 765 $ $ 2013... -

Page 79

2014 Quarterly Financial Data (Unaudited) in millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical Midstream, marketing and other Eliminations Net sales $ $ March 31 3,602 1,220 340 (194) 4,968 $ $ June 30 ... -

Page 80

2013 Quarterly Financial Data (Unaudited) in millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical Midstream, marketing and other Eliminations Net sales Gross profit Segment earnings Oil and gas Chemical ... -

Page 81

... or further declines in commodity prices could require Occidental to further reduce capital spending, potentially impacting either the quantity or the development timing of proved undeveloped reserves. Tll supplemental oil and gas information excludes California Resources for all periods presented... -

Page 82

... Sales of proved reserves Production Balance at December 31, 2014 PROVED DEVELOPED RESERVES December 31, 2011 December 31, 2012 December 31, 2013 December 31, 2014 (b) PROVED UNDEVELOPED RESERVES December 31, 2011 December 31, 2012 December 31, 2013 December 31, 2014 (c) (a) (b) (c) Latin America... -

Page 83

... Sales of proved reserves Production Balance at December 31, 2014 PROVED DEVELOPED RESERVES December 31, 2011 December 31, 2012 December 31, 2013 December 31, 2014 (a) PROVED UNDEVELOPED RESERVES December 31, 2011 December 31, 2012 December 31, 2013 December 31, 2014 (b) (a) (b) Latin America... -

Page 84

... Sales of proved reserves Production Balance at December 31, 2014 PROVED DEVELOPED RESERVES December 31, 2011 December 31, 2012 December 31, 2013 December 31, 2014 (b) PROVED UNDEVELOPED RESERVES December 31, 2011 December 31, 2012 December 31, 2013 December 31, 2014 (c) (a) (b) (c) Latin America... -

Page 85

...number of years. For example, in 2014, the average prices of West Texas Intermediate (WTI) oil and New York Mercantile Exchange (NYMEX) natural gas were $93.00 per barrel and $4.34 per Mcf, respectively, resulting in an oil to gas ratio of over 20 to 1. Includes proved reserves related to production... -

Page 86

..., capitalized interest and asset retirement obligations. COSTS INCURRED Costs incurred in oil and gas property acquisition, exploration and development activities, whether capitalized or expensed, were as follows: United in millions FOR THE YEAR ENDED DECEMBER 31, 2014 Property acquisition costs... -

Page 87

RESULTS OF OPERATIONS Occidental's oil and gas producing activities for continuing operations, which exclude items such as asset dispositions, corporate overhead, interest and royalties, were as follows: United in millions FOR THE YEAR ENDED DECEMBER 31, 2014 Revenues (a) Production costs (b) Other... -

Page 88

..., in 2014, the average prices of WTI oil and NYMEX natural gas were $93.00 per barrel and $4.34 per Mcf, respectively, resulting in an oil to gas ratio of over 20 to 1. Revenues are net of royalty payments. United States federal income taxes reflect certain expenses related to oil and gas activities... -

Page 89

... cash inflows Future costs Production costs and other operating expenses Development costs (a) Future income tax expense Future net cash flows Ten percent discount factor Standardized measure of discounted future net cash flows (a) Includes asset retirement costs. Latin America $ 8,325 (3,422) (397... -

Page 90

...Sales Prices The following table sets forth, for each of the three years in the period ended December 31, 2014, Occidental's approximate average sales prices in continuing operations. United States 2014 Oil NGLs Gas 2013 Oil NGLs Gas 2012 Oil NGLs Gas - - - Average sales price ($/bbl) Average sales... -

Page 91

...31, 2014, Occidental's productive oil and gas wells (both producing and capable of production). Wells at December 31, 2014 (a) Oil - Gross (b) Net (c) Gas - (a) (b) (c) United States 16,794 14,518 4,272 3,776 (837) (772) (216) (196) Latin America 1,446 722 34 32 - - - - Middle East/ North Africa... -

Page 92

...Middle East/North Tfrica. Oil and Gas Acreage The following table sets forth, as of December 31, 2014, Occidental's holdings of developed and undeveloped oil and gas acreage. Thousands of acres at December 31, 2014 Developed (a) - - Undeveloped (d) - - (a) (b) (c) (d) United States Latin America... -

Page 93

... and Other Total excluding Hugoton Hugoton TOTAL Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia Middle East/North Africa Oil (MBBL) Dolphin Oman Qatar Other TOTAL NGLs (MBBL) Dolphin Other TOTAL Natural gas (MMCF) Dolphin Oman Other TOTAL 2014 2013 2012 43 111 27 181 2 183 12... -

Page 94

Sales Volumes per Day United States Oil (MBBL) NGLs (MBBL) Natural gas (MMCF) Latin America Oil (MBBL) - Colombia Natural gas (MMCF) - Bolivia Middle East/North Africa Oil (MBBL) Dolphin Oman Qatar Other TOTAL NGLs (MBBL) Dolphin Other TOTAL Natural gas (MMCF) 2014 183 55 476 29 11 2013 176 57 528... -

Page 95

... and Qualifying Accounts in millions Occidental Petroleum Corporation and Subsidiaries Additions Balance at Beginning of Period 2014 Allowance for doubtful accounts Environmental Litigation, tax and other reserves $ 2013 Allowance for doubtful accounts Environmental Litigation, tax and other... -

Page 96

... with, Occidental's accountants on accounting and financial disclosure. ITEM 9A CONTROLS AND PROCEDURES MANAGEMENT'S ANNUAL ASSESSMENT OF AND REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING The management of Occidental Petroleum Corporation and its subsidiaries (Occidental) is responsible... -

Page 97

... EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE Occidental has adopted a Code of Business Conduct (Code). The Code applies to the President and Chief Executive Officer; Senior Vice President and Chief Financial Officer; Vice President, Controller and Principal Tccounting Officer; and persons performing... -

Page 98

... Petroleum Corporation and California Resources Corporation, dated November 25, 2014 (filed as Exhibit 2.1 to the Current Report on Form 8-K of Occidental dated November 25, 2014 (date of earliest event reported), filed December 1, 2014, File No. 1-9210). Restated Certificate of Incorporation... -

Page 99

..., 2003, File No. 1-9210). Form of Restricted Stock Tward for Non-Employee Directors under Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (filed as Exhibit 10.1 to the Current Report on Form 8-K of Occidental dated February 16, 2006 (date of earliest event reported), filed February 22... -

Page 100

...for the fiscal quarter ended June 30, 2012, File No. 1-9210). Form of Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Common Stock and Sign-On Bonus and Other Tward Tgreement (filed as Exhibit 10.6 to the Quarterly Report on Form 10-Q of Occidental for the fiscal quarter ended June 30... -

Page 101

...30, 2013, File No. 19210). Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Common Stock Unit Tward For Non-Employee Directors Grant Tgreement (filed as Exhibit 10.1 to the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2014, File No. 1-9210). Occidental Petroleum... -

Page 102

... and between Occidental Petroleum Corporation and California Resources Corporation, dated November 25, 2014 (filed as Exhibit 10.7 to the Current Report on Form 8-K of Occidental dated November 25, 2014 (date of earliest event reported), filed December 1, 2014, File No. 1-9210). Statement regarding... -

Page 103

...1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. OCCIDENTAL PETROLEUM CORPORATION By: /s/ Stephen I. Chazen Stephen I. Chazen President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Tct of... -

Page 104

Title Date /s/ William R. Klesse William R. Klesse Director February 23, 2015 /s/ Avedick B. Poladian Avedick B. Poladian /s/ Elisse B. Walter Elisse B. Walter Director February 23, 2015 Director February 23, 2015 © 2015 Occidental Petroleum Corporation 102 -

Page 105

... Petroleum Corporation and California Resources Corporation, dated November 25, 2014 (filed as Exhibit 2.1 to the Current Report on Form 8-K of Occidental dated November 25, 2014 (date of earliest event reported), filed December 1, 2014, File No. 1-9210). Restated Certificate of Incorporation... -

Page 106

..., 2003, File No. 1-9210). Form of Restricted Stock Tward for Non-Employee Directors under Occidental Petroleum Corporation 2005 Long-Term Incentive Plan (filed as Exhibit 10.1 to the Current Report on Form 8-K of Occidental dated February 16, 2006 (date of earliest event reported), filed February 22... -

Page 107

... as Exhibit 10.3 to the Current Report on Form 8-K of Occidental dated July 22, 2013 (date of earliest event reported), filed July 26, 2013, File No. 1-9210). Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Occidental Oil and Gas Corporation Return on Tssets Incentive Tward Terms and... -

Page 108

...30, 2013, File No. 19210). Occidental Petroleum Corporation 2005 Long-Term Incentive Plan Common Stock Unit Tward For Non-Employee Directors Grant Tgreement (filed as Exhibit 10.1 to the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2014, File No. 1-9210). Occidental Petroleum... -

Page 109

... Stanley Benefit Access "Stock Options and SARs /My Grants/Grant Price" The following Terms and Conditions (these " Terms and Conditions ") are set forth as of the Date of Grant between OCCIDENTAL PETROLEUM CORPORATION, a Delaware corporation ("OXY" and, with its subsidiaries, the "Company"), and... -

Page 110

... vested in the aggregate number of shares of Common Stock offered by this Option as determined under the vesting schedule set forth above, provided the Grantee remains in the employ of, or a service provider to, the Company until each applicable Vesting Date. The continuous employment of the Grantee... -

Page 111

... notice to OXY at its principal executive office addressed to the attention of its corporate secretary (or such other officer, employee or designee of the Company as OXY may designate from time to time), at any time and from time to time after the Date of Grant but prior to the Expiration Time... -

Page 112

... result. Further, if the Grantee has become subject to tax in more than one jurisdiction between the Date of Grant and the date of any relevant taxable event, the Grantee acknowledges that the Company may be required to withhold or account for Tax-Related Items in more than one jurisdiction. Prior... -

Page 113

... employees, directors, managers, officers, attorneys or agents (collectively, the " Company Parties") of the fair market value of the Common Stock on the date of grant of this Option, (b) he is not relying upon any written or oral statement or representation of the Company Parties regarding the tax... -

Page 114

...from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or... -

Page 115

...entitled under any profit sharing, retirement or other benefit or compensation plan maintained by the Company, including the amount of any life insurance coverage available to any beneficiary of the Grantee under any life insurance plan covering employees of the Company. Additionally, this Option is... -

Page 116

... or electronic form), that the Grantee has in the Grantee's possession or control. C. The Grantee will, during the Grantee's employment by the Company, comply with the provisions of OXY's Code of Business Conduct. D. Except as otherwise required by the Grantee's job or permitted by law, the Grantee... -

Page 117

... WAY RELATED TO THE GRANTEE'S EMPLOYMENT WITH THE COMPANY, OR THE TERMINATION OF THAT EMPLOYMENT, WILL BE DECIDED EXCLUSIVELY BY FINAL AND BINDING ARBITRATION AT A LOCATION WITHIN 50 MILES OF THE COMPANY OFFICE AT OR CLOSEST TO EMPLOYEE'S PRIMARY WORK LOCATION, PURSUANT TO ANY PROCEDURES REQUIRED BY... -

Page 118

... THE AWARD MAY BE ENTERED, AND ENFORCEMENT MAY BE SOUGHT IN, ANY COURT OF COMPETENT JURISDICTION. TO THE EXTENT NOT INCONSISTENT WITH APPLICABLE LAWS, THE ARBITRATOR WILL HAVE THE AUTHORITY TO HEAR AND GRANT MOTIONS. THIS AGREEMENT TO ARBITRATE IS FREELY AGREED TO BETWEEN GRANTEE AND THE COMPANY AND... -

Page 119

... BridgeTex assets, a $861 million after-tax gain for the sale of a portion of an investment in the General Partner of Plains All-American Pipeline L.P., and a $1.2 billion after-tax impairment related to Josyln and mark to market adjustments for Oxy's California Resources investment. The 2013 amount... -

Page 120

...'s subsidiaries at December 31, 2014. Name Armand Products Company Bravo Pipeline Company BridgeTex Pipeline Company, LLC Centurion Pipeline GP, Inc. Centurion Pipeline L.P. Centurion Pipeline LP, Inc. Concord Petroleum Corporation Conn Creek Shale Company D.S. Ventures, LLC DMM Financial LLC... -

Page 121

... Occidental Chemical Corporation Occidental Chemical de Mexico, S.A. de C.V. Occidental Chemical Export Sales, LLC Occidental Chemical Far East Limited Occidental Chemical Holding Corporation Occidental Chemical International, Inc. Occidental Chemical Investment (Canada) I, Inc. Occidental Chemical... -

Page 122

... South Africa (Offshore), Inc. Occidental of the Adriatic Ltd. Occidental of Yemen (Block 75), LLC Occidental of Yemen (Block S-1), Inc. Occidental of Yemen Holdings (Block 75) Ltd. Occidental Oil and Gas Corporation Occidental Oil and Gas International Inc. Occidental Oil and Gas International, LLC... -

Page 123

... Occidental Power Services, Inc. Occidental PVC, LLC Occidental Qatar Energy Company LLC Occidental Red Sea Development, LLC Occidental Research Corporation Occidental Resource Recovery Systems, Inc. Occidental Resources Company Occidental Shah Gas Holdings Ltd. Occidental South America Finance, LLC... -

Page 124

..., LLC OXY Mexico Holdings I, LLC OXY Mexico Holdings II, LLC OXY Middle East Holdings Ltd. Oxy Midstream Holding Company, LLC Oxy Midstream Operating Company, LLC Oxy Midstream Strategic Development LLC OXY of Angola (Block 23), LLC OXY of Angola (Block 8), LLC Jurisdiction of Formation Texas Texas... -

Page 125

... Export Sales, LLC Oxy Vinyls, LP OXY VPP Investments, Inc. OXY West, LLC Oxy Westwood Corporation Oxy Y-1 Company OXYCHEM (CANADA), Inc. OxyChem do Brasil Ltda. OxyChem Ingleside Ethylene Holdings, Inc. Oxychem Shipping Ltd. OxyChile Investments, LLC Oxycol Holder Ltd. OXYMAR Permian Basin Limited... -

Page 126

... Petroleum International Finance B.V. Vintage Petroleum International Holdings, Inc. Vintage Petroleum International Ventures, Inc. Vintage Petroleum International, Inc. Vintage Petroleum South America Holdings, Inc. Vintage Petroleum South America, LLC Vintage Petroleum Turkey, Inc. VPI MENA Yemen... -

Page 127

... financial statement schedule II valuation and qualifying accounts, and the effectiveness of internal control over financial reporting as of December 31, 2014, which reports appear in the December 31, 2014 annual report on Form 10-K of Occidental Petroleum Corporation. /s/ KPMG LLP Houston, Texas... -

Page 128

... our letter dated January 31, 2015, relating to our review of the methods and procedures used by Occidental for estimating its oil and gas proved reserves (our "Letter"), (ii) filing of our Letter with the Securities and EFchange Commission as EFhibit 99.1 to the Form 10-K and (iii) incorporation by... -

Page 129

...financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 23, 2015 /s/ STEPHEN I. CHAZEN Stephen I. Chazen President and Chief Executive Officer -

Page 130

...- 14(a) CERTIFICATION PURSUANT TO §302 OF THE SARBANES-OXLEY ACT OF 2002 I, Christopher G. Stavros, certify that: 1. 2. I have reviewed this aeeual report oe Form 10-K of Occideetal Petroleum Corporatioe; Based oe my keowledge, this report does eot coetaie aey uetrue statemeet of a material fact or... -

Page 131

... with the Annual Report on Form 10-K of Occidental Petroleum Corporation (the "Company") for the fiscal period ended December 31, 2014, as filed with the Securities and Exchange Commission on February 23, 2015 (the "Report"), Stephen I. Chazen, as Chief Executive Officer of the Company, and... -

Page 132

....1 OCCIDENTAL PETROLEUM CORPORATION Process Review of the Estimated Future Proved Reserves and Income Attributable to Certain Fee, Leasehold and Royalty Interests and Certain Economic Interests Derived Through Certain Production Sharing Contracts SEC Parameters As of December 31, 2014 \s\ Fred... -

Page 133

January 30, 2015 Occidental Petroleum Corporation 5 Greenway Plaza, Suite 110 Houston, Texas 77046 Ladies and Gentlemen: At your request, Ryder Scott Company, L.P. (Ryder Scott) has conducted a process review of the methods and analytical procedures utilized by the engineering and geological staff... -

Page 134

..., 2015 Page 2 Reviewed by Ryder Scott SEC Parameters Occidental Petroleum Corporation As of December 31, 2014 Total Liquid Hydrocarbons 22% 24% 23% Equivalent MMBOE 23% 27% 24% Oil/Condensate Total Proved Developed Total Proved Undeveloped Total Company Proved 20% 20% 20% NGL 31% 43% 35% Gas 25... -

Page 135

...through 2197. Reserves and Uncertainty The SEC defines reserves as the "estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations." All reserve estimates involve an... -

Page 136

... and type curves supported by analogs and reservoir modeling as noted above. The data used by Occidental in their analysis of the non-producing and undeveloped reserves for the properties reviewed by us was considered sufficient for the purpose thereof. RYDER SCOTT COMPANY PETROLEUM CONSULTANTS -

Page 137

... revenue before production taxes for the properties reviewed by us and Occidental's estimate of the total net reserves for the properties reviewed by us for the geographic area. A summary of average realized prices are not included for properties located in the Middle East because of host government... -

Page 138

... Petroleum Corporation January 30, 2015 Page 6 As indicated above, the product prices that were used by Occidental to determine the future gross revenue for each property reviewed by us reflect adjustments to the benchmark prices for gravity, quality, local conditions, gathering and transportation... -

Page 139

...lift, pipeline capacity or other operating conditions, market demand and allowables or other constraints set by regulatory bodies. Reserves Derived by Occidental Through Certain Production Sharing Contracts The reserves for certain properties located in the Middle East reviewed herein are limited to... -

Page 140

... of reserves quantities reported by Occidental. Standards of Independence and Professional Qualification Ryder Scott is an employee-owned independent petroleum engineering consulting firm. We do not serve as officers or directors of any privately-owned or publicly-traded oil and gas company and are... -

Page 141

... original signed report letter shall control and supersede the digital version. The data and work papers used in the preparation of this report are available for examination by authorized parties in our offices. Please contact us if we can be of further service. Very truly yours, RYDER SCOTT COMPANY... -

Page 142

... Scott, Richoux served in a number of engineering positions with Phillips Petroleum Company. For more information regarding Mr. Richoux's geographic and job specific experience, please refer to the Ryder Scott Company website at www.ryderscott.com/Experience/Employees. Richoux earned a Bachelor of... -

Page 143

... to prohibit disclosure of estimates of oil and gas resources other than reserves and any estimated values of such resources in any document publicly filed with the SEC unless such information is required to be disclosed in the document by foreign or state law as noted in §229.1202 Instruction... -

Page 144

... date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances... -

Page 145

..., proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. (iii) Where direct observation from well penetrations... -

Page 146

... OF PETROLEUM ENGINEERS (SPE) WORLD PETROLEUM COUNCIL (WPC) AMERICAN ASSOCIATION OF PETROLEUM GEOLOGISTS (AAPG) SOCIETY OF PETROLEUM EVALUATION ENGINEERS (SPEE) Reserves status categories define the development and producing status of wells and reservoirs. Reference should be made to Title 17, Code... -

Page 147

... wells, which will require additional completion work or future re-completion prior to start of production. In all cases, production can be initiated or restored with relatively low expenditure compared to the cost of drilling a new well. UNDEVELOPED RESERVES (SEC DEFINITIONS) Securities and... -

Page 148