Occidental Petroleum 2008 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2008 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part I

ITEMS 1 AND 2 BUSINESS AND PROPERTIES

In this report, "Occidental" refers to Occidental Petroleum Corporation, a Delaware corporation (OPC), and/or one or more entities in

which it owns a majority voting interest (subsidiaries). Occidental conducts its operations through various oil and gas, chemical, midstream,

marketing and other subsidiaries and affiliates. Occidental’s executive offices are located at 10889 Wilshire Boulevard, Los Angeles,

California 90024; telephone (310) 208-8800.

GENERAL

Occidental’s principal businesses consist of three segments. The oil and gas segment explores for, develops, produces and markets

crude oil, natural gas liquids (NGLs), condensate and natural gas. The chemical segment (OxyChem) manufactures and markets basic

chemicals, vinyls and performance chemicals. The midstream, marketing and other segment (midstream and marketing) gathers, treats,

processes, transports, stores, trades and markets crude oil, natural gas, NGLs, condensate and carbon dioxide (CO 2) and generates and

markets power. Unless otherwise indicated hereafter, discussion of oil or oil and liquids refers to crude oil, NGLs and condensate.

Occidental changed its alignment of operating segments at the beginning of 2008. In previous years, oil and gas and a portion of the

midstream and marketing operations were reported as a single oil and gas segment and some of the corporate-directed midstream and

marketing operations were reported under corporate and other. In the past two years, the Dolphin Project (Dolphin) pipeline began

transporting natural gas to the United Arab Emirates (UAE) and Occidental acquired a common carrier pipeline system in the Permian

Basin, various gas processing plants and the remaining ownership interest in a cogeneration facility. The addition of these operations to the

existing midstream and marketing infrastructure caused management to realign its operating segments to increase its focus on these

operations. All segment information for prior periods has been revised to retrospectively reflect the current segment reporting structure. The

change to segment reporting had no effect on Occidental's reported consolidated earnings. Each of the reportable segments represents

separate and distinct operations, is managed and receives resource allocation as a separate business unit and has its performance separately

evaluated. For financial information by segment and by geographic area, see Note 16 to the Consolidated Financial Statements of Occidental

(Consolidated Financial Statements).

For information regarding Occidental's current developments, see the information in the "Management’s Discussion and Analysis of

Financial Condition and Results of Operations" (MD&A) section of this report.

OIL AND GAS OPERATIONS

General

Occidental’s domestic oil and gas operations are located in Texas, New Mexico, California, Kansas, Oklahoma, Utah and Colorado.

International operations are located in Argentina, Bolivia, Colombia, Libya, Oman, Qatar, the UAE and Yemen. For additional information

regarding Occidental's oil and gas segment, see the information under the caption "Oil and Gas Segment" in the MD&A section of this

report.

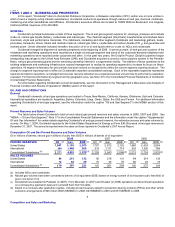

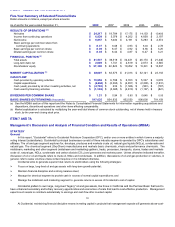

Proved Reserves and Sales Volumes

The table below shows Occidental’s total oil and natural gas proved reserves and sales volumes in 2008, 2007 and 2006. See

"MD&A — Oil and Gas Segment," Note 17 to the Consolidated Financial Statements and the information under the caption "Supplemental

Oil and Gas Information" for certain details regarding Occidental’s oil and gas proved reserves, the estimation process and sales volumes by

country. On May 1, 2008, Occidental reported to the United States Department of Energy on Form EIA-28 proved oil and gas reserves at

December 31, 2007. The amounts reported were the same as those reported in Occidental’s 2007 Annual Report.

Comparative Oil and Gas Proved Reserves and Sales Volumes

Oil in millions of barrels; natural gas in billions of cubic feet; BOE in millions of barrels of oil equivalent

2008 2007 2006

PROVED RESERVES Oil (a) Gas BOE (b) Oil (a) Gas BOE (b) Oil (a) Gas BOE (b)

United States 1,547 3,153 2,073 1,707 2,672 2,152 1,660 2,424 2,064

International 664 1,448 905 519 1,171 714 553 1,300 769

Consolidated Subsidiaries (c) 2,211 4,601 2,978(d) 2,226 3,843 2,866(d) 2,213 3,724 2,833(d)

SALES VOLUMES

United States 96 215 132 95 216 131 94 214 130

International 74 92 89 70 45 78 66 23 70

Consolidated Subsidiaries (c) 170 307 221 165 261 209 160 237 200

(a) Includes NGLs and condensate.

(b) Natural gas volumes have been converted to barrels of oil equivalent (BOE) based on energy content of six thousand cubic feet (Mcf) of

gas to one barrel of oil.

(c) Occidental has classified its Pakistan (in 2007), Horn Mountain (in 2007) and Ecuador (in 2006) operations as discontinued operations

on a retrospective application basis and excluded them from this table.

(d) Stated on a net basis after applicable royalties. Includes proved reserves related to production-sharing contracts (PSCs) and other similar

economic arrangements of 826 million BOE (MMBOE) in 2008, 603 MMBOE in 2007 and 657 MMBOE in 2006.

3

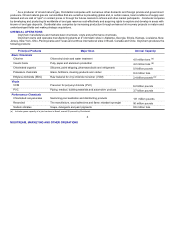

Competition and Sales and Marketing