Nucor 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Nucor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4TO OUR STOCKHOLDERS

4

John J. Ferriola

Chairman, Chief Executive Officer

and President

NUCOR’S FOCUS ON MOVING UP THE VALUE CHAIN AND ACHIEVING

COMMERCIAL EXCELLENCE ARE PARTICULARLY IMPORTANT IN OUR EFFORTS

TO GROW OUR MARKET SHARE IN THE AUTOMOTIVE SECTOR, WHICH

CONTINUES TO BE ONE OF THE STRONGEST MARKETS FOR STEELMAKERS.

Fellow Stockholders:

One of the greatest reasons for Nucor’s success is our culture, and a core element of our

culture is seizing opportunities. Throughout our history, Nucor and its teammates have seized

the opportunities that challenging market conditions create. That was true again in 2015, when

global steel markets provided plenty of challenges. Production overcapacity, particularly in

China, plagued the entire industry. For the American steel market, that meant a flood of steel

imports that negatively impacted production and prices. As a result, Nucor’s financial results

were down from the previous year. While that is disappointing, Nucor is focused on seizing

the opportunities we have in front of us. I am extremely proud of the Nucor team and the

performance they achieved in one of the toughest steel markets in decades.

Our success begins with being safe, and I want to thank my 23,700 teammates at Nucor,

Harris Steel, David J. Joseph, Duferdofin, NuMit Steel Technologies and Skyline Steel for

their commitment to working safely. Thank you for your commitment to being sustainable

by driving down costs while reducing emissions and increasing our energy efficiency.

Nucor continues to be North America’s largest recycler, converting 16.9 million tons of

scrap steel into new steel products in 2015.

Nucor’s performance in this difficult market positions us very well for the future. We made tremendous progress executing our

company’s strategy for long-term profitable growth. This strategy, which I will detail on the next page, includes five growth drivers

that highlight where we are directing our energies to build long-term earnings power and provide our shareholders with attractive

returns on their valuable capital. In 2015, this strategy began to bear fruit. Despite the down market, Nucor continued to generate

profits and outperform our peers.

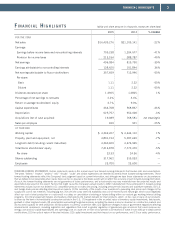

Financial Highlights

In 2015, Nucor earned $357.7 million, or $1.11 per

diluted share, compared with consolidated net earnings

of $713.9 million, or $2.22 per diluted share, in 2014.

High levels of steel imports put downward pressure on

prices and depressed capacity utilization rates.

Consolidated net sales decreased 22% to $16.44 billion compared with $21.11 billion in 2014. Total tons shipped to outside

customers decreased. The average scrap and scrap substitute cost per ton used decreased 29% to $270 from $381.

Even with the weak market conditions in 2015, several Nucor business groups saw improved performance over the prior year,

including our bar and structural steel divisions and our steel products group. Unfortunately, significant market headwinds resulted

in lower performance for our sheet and plate divisions compared to 2014.

At the end of the year, the Board of Directors elected to increase the regular quarterly cash dividend on our common stock from

$0.3725 to $0.375 per share. This marks 43 consecutive years that the Board has voted to increase the base cash dividend.

Nucor has made 171 consecutive quarterly cash dividend payments. Total return on invested capital from 2005 through the end

of 2015 was 13%.

The company generated robust operating cash flow. Cash provided by operations was $2.16 billion, a substantial increase from

2014 operating cash flow of $1.34 billion. We ended the year with a strong balance sheet. Cash and short-term investments totaled

$2.04 billion dollars. Adding to Nucor’s strong liquidity, our $1.5 billion unsecured revolving credit facility is undrawn, and it does

not mature until August 2018.

Imports Weigh Down U.S. Steel Market

Finished imports last year captured 29% market share, the second consecutive year that figure was at a historically high level.

While imports were down slightly from 2014, they were still 27% higher than they were in 2013. Globally, China’s record level

of steel exports reverberated across the entire industry with Chinese steel displacing steel products in local markets, causing a

domino effect on trade flows. China exported 123 million net tons of steel in 2015. To put that number into perspective, China

exported more steel than the U.S. and Canada produced combined.