Nucor 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Nucor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Fellow Stockholders:

Having completed my first year as Nucor’s CEO, I am very proud of the work of all of our

teammates. While the difficult economic environment of the last few years has caused

many of our competitors to make defensive moves, Nucor’s strong financial position and

dedicated teammates have allowed us to invest and continuously improve in order to grow

and strengthen our earnings potential in the future.

This year we achieved several important milestones in our core strategy of investing in down

markets. In 2013, several major capital projects started up and others will be coming online in

the first part of 2014. These projects will help us gain greater control of our raw material costs

and expand our offerings of specialized, higher-margin products, which position us very well in

the current economic climate and will lead to even better days when the economy improves.

These strategic moves are why I am so excited about Nucor’s future. We are not waiting for

things to turn around. We are finding ways to grow our company and be successful despite

the lackluster economy by continually looking for ways to improve our performance and lower

our costs, investing in projects that will move us up the value chain and providing superior

customer service. The can-do, take-charge attitude of Nucor teammates will enable us to

realize these goals.

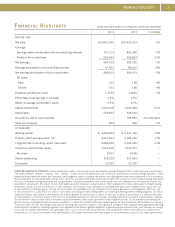

Financial Highlights

In 2013, Nucor earned $488.0 million, or $1.52 per diluted share, compared with consolidated net earnings of $504.6 million,

or $1.58 per diluted share, in 2012. The slow pace of the economic recovery and increased level of steel imports have kept

earnings lower than they were during the five-year growth period that preceded the Great Recession in 2008.

Consolidated net sales decreased 2% to $19.05 billion compared with $19.43 billion in 2012. Total tons shipped to outside

customers increased 3% from 2012 levels. The average scrap and scrap substitute cost per ton used decreased 8% to $376

from $407. The overall operating rate at

our steel mills was 74%, well under the

pre-recession 91% utilization rate for the

first nine months of 2008.

Forty years ago, Nucor began paying cash

dividends. Each year since then the board

of directors has increased the base cash

dividend, and 2013 was no different. In December, the board increased the regular quarterly cash dividend on our common stock

to $0.37 per share from $0.3675. Through the end of 2013, Nucor has made 162 consecutive quarterly cash dividend payments.

Nucor’s total shareholder return from 2004 through the end of 2013 was 15.5%.

We are always looking for ways to strengthen our financial position. Last year, we issued a total of $1 billion in debt, which effectively

refinanced $900 million of maturing debt that we retired between the fourth quarter of 2012 and the second quarter of 2013. The

weighted average coupon rate of the new debt is 35 basis points lower than the retired debt and the new debt had a weighted average

maturity term of 20 years at inception versus the retired debt, which had a weighted average maturity term of 7 years at inception.

Cash and cash equivalents and short-term investments totaled more than $1.51 billion at the end of 2013. Adding to Nucor’s

strong liquidity, our $1.5 billion unsecured revolving credit facility is undrawn and it does not mature until August 2018. We have

no commercial paper outstanding.

Executing Our Strategy to Grow Long-Term Earnings

Conditions in the steel industry in 2013 looked much like they did in 2012. The U.S. economy grew slowly. Overcapacity in global

steel production and the resulting flood of imports kept steel prices depressed. With additional steel production coming online

around the world, the overcapacity problem will not ease up anytime soon. We are pursuing trade cases for a number of products

where our trade laws are being abused and we continue to urge our policymakers in Washington to enact pro-growth policies that

will get the economy growing at a faster pace.

TO OUR STOCKHOLDERS

4

John J. Ferriola

Chairman, President and

Chief Executive Officer

WE ARE FINDING WAYS TO GROW OUR COMPANY AND BE SUCCESSFUL DESPITE

THE LACKLUSTER ECONOMY BY CONTINUALLY LOOKING FOR WAYS TO IMPROVE

OUR PERFORMANCE AND LOWER OUR COSTS, INVESTING IN PROJECTS THAT WILL

MOVE US UP THE VALUE CHAIN AND PROVIDING SUPERIOR CUSTOMER SERVICE.