Nucor 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Nucor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

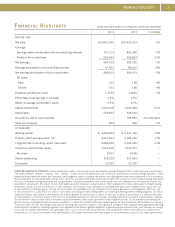

Scrap and scrap substitutes are the most significant element in the total cost of steel production. The average cost of scrap and

scrap substitutes used decreased 8% from $407 per ton in 2012 to $376 per ton in 2013. A raw material surcharge implemented

in 2004 assists Nucor in maintaining operating margins and in meeting our customer commitments during periods of highly volatile

scrap and scrap substitute costs.

Steel mills are large consumers of electricity and natural gas. Total energy costs decreased approximately $1 per ton from 2012

to 2013, primarily due to the negative impact of natural gas hedge settlements on our overall natural gas costs in 2012. Because

of the efficiency of Nucor steel mills, the 2013 energy costs were less than 6% of the net sales dollar.

The operations in the rolling mills are highly automated, resulting in employment costs of less than 8% of the net sales dollar in

2013. Employee turnover in Nucor mills is extremely low. All employees have a significant part of their compensation based on

their productivity. Production employees work under group incentives that provide increased earnings for increased production.

This additional incentive compensation is paid weekly.

MARKETS AND MARKETING

Approximately 86% of the steel shipments in 2013 were to outside customers, and the balance was primarily used internally by the

steel products segment. Steel shipments to outside customers increased from 17,473,000 tons in 2012 to 17,733,000 tons in 2013.

Nucor’s operations include several international trading and distribution companies that buy and sell steel manufactured by the

Company and other steel producers.

Our steel mill customers are primarily manufacturers, steel service centers and fabricators. The sheet mills continue to build

long-term relationships with contract customers who purchase more value-added products. We enter 2014 with approximately

45% of our estimated sheet mill volume committed to contract customers. Contract terms are typically less than 12 months in

length with various renewal dates. These contracts are generally non-cancelable agreements with a pricing formula that varies

based on raw material costs and/or market-based indices.