Nokia 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

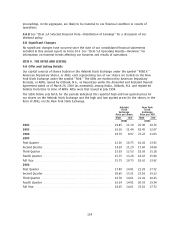

Table 1 Transaction foreign exchange position ValueAtRisk

VaR 2006 2005

EURm EURm

At December 31 ******************************************************** 21.6 12.4

Average for the year **************************************************** 24.6 10.2

Range for the year****************************************************** 17.134.6 3.329.3

Since Nokia has subsidiaries outside the Eurozone, the eurodenominated value of the shareholders’

equity of Nokia is also exposed to fluctuations in exchange rates. Equity changes caused by

movements in foreign exchange rates are shown as a translation difference in the Group

consolidation. Nokia uses, from time to time, foreign exchange contracts and foreign currency

denominated loans to hedge its equity exposure arising from foreign net investments.

Interest rate risk

The Group is exposed to interest rate risk either through market value fluctuations of balance sheet

items (i.e. price risk) or through changes in interest income or expenses (i.e. reinvestment risk).

Interest rate risk mainly arises through interestbearing liabilities and assets. Estimated future

changes in cash flows and balance sheet structure also expose the Group to interest rate risk.

Treasury is responsible for monitoring and managing the interest rate exposure of the Group. Due to

the current balance sheet structure of Nokia, emphasis is placed on managing the interest rate risk

of investments.

Nokia uses the VaR methodology to assess and measure the interest rate risk in the investment

portfolio, which is benchmarked against a combination of threemonth and onetothreeyear

investment horizon. The VaR figure represents the potential fair value losses for a portfolio resulting

from adverse changes in market factors using a specified time period and confidence level based on

historical data. For interest rate risk VaR, Nokia uses variancecovariance methodology. Volatilities

and correlations are calculated from a oneyear set of daily data. The annualized VaRbased interest

rate risk figures for the investment portfolio calculated from oneweek horizon and 95% confidence

level are shown in Table 2, below.

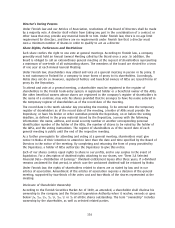

Table 2 Treasury investment portfolio ValueAtRisk

VaR 2006 2005

EURm EURm

At December 31 ********************************************************** 4.8 6.9

Average for the year ****************************************************** 6.3 10.0

Range for the year ******************************************************** 4.49.3 6.915.3

Equity price risk

Nokia has certain strategic minority investments in publicly traded companies. These investments are

classified as availableforsale. The fair value of the equity investments at December 31, 2006 was

EUR 8 million (EUR 8 million in 2005).

There are currently no outstanding derivative financial instruments designated as hedges of these

equity investments. The VaR figures for equity investments, shown in Table 3, below, have been

calculated using the same principles as for interest rate risk.

124