Motorola 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

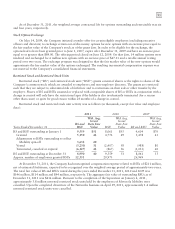

The Company contributed $489 million to its U.S. pension plans during 2011, compared to $157 million

contributed in 2010. In January 2011, the Pension Benefit Guaranty Corporation (“PBGC”) announced an

agreement with Motorola Solutions under which the Company would contribute $100 million above and beyond

our legal requirement to its U.S. noncontributory pension plan (“Regular Pension Plan”) over the next five years.

The Company and the PBGC entered into the agreement as the Company was in the process of separating Motorola

Mobility and pursuing the sale of certain assets of the Networks business. The Company made an additional $250

million of pension contributions to the Regular Pension Plan over the amount required, in the fourth quarter of

2011, of which $100 million was intended to fulfill the PBGC obligation.

The Company expects to make cash contributions of approximately $340 million to its U.S. pension plans and

approximately $30 million to its non-U.S. pension plans in 2012.

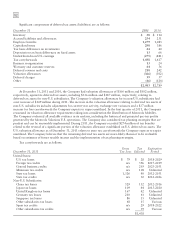

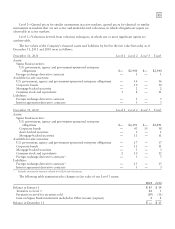

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Year Regular

Officer’s

and

MSPP

Non

U.S.

2012 $ 247 $2 $38

2013 261 2 39

2014 271 2 40

2015 286 3 42

2016 305 3 42

2017-2021 1,850 18 232

Postretirement Health Care Benefits Plan

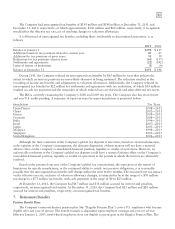

Certain health care benefits are available to eligible domestic employees meeting certain age and service

requirements upon termination of employment (the “Postretirement Health Care Benefits Plan”). For eligible

employees hired prior to January 1, 2002, the Company offsets a portion of the postretirement medical costs to the

retired participant. As of January 1, 2005, the Postretirement Health Care Benefits Plan has been closed to new

participants. The benefit obligation and plan assets for the Postretirement Health Care Benefits Plan have been

measured as of December 31, 2010.

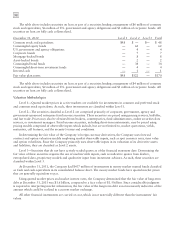

The assumptions used were as follows:

December 31 2011 2010

Discount rate for obligations 4.75% 5.25%

Investment return assumptions 8.25% 8.25%

Net Postretirement Health Care Benefits Plan expenses were as follows:

Years Ended December 31 2011 2010 2009

Service cost $4 $6 $6

Interest cost 22 23 27

Expected return on plan assets (16) (16) (18)

Amortization of:

Unrecognized net loss 10 77

Unrecognized prior service cost — (2) (2)

Net Postretirement Health Care Benefit Plan expenses $20 $18 $20