Motorola 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

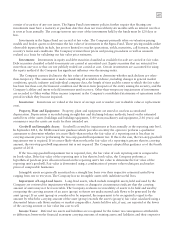

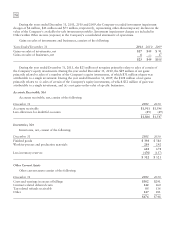

Property, Plant and Equipment, Net

Property, plant and equipment, net, consist of the following:

December 31 2011 2010

Land $69$71

Building 774 804

Machinery and equipment 2,052 2,094

2,895 2,969

Less accumulated depreciation (1,999) (2,047)

$ 896 $ 922

Depreciation expense for the years ended December 31, 2011, 2010 and 2009 was $165 million, $150 million

and $170 million, respectively.

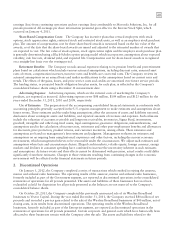

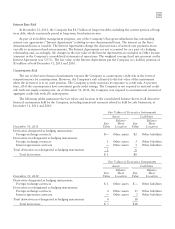

Other Assets

Other assets consist of the following:

December 31 2011 2010

Intangible assets, net of accumulated amortization of $1,114 and $947 $48 $246

Long-term receivables, net of allowances of $10 and $1 37 251

Other 209 237

$294 $734

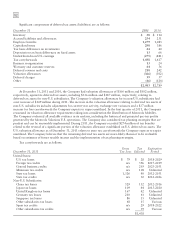

Accrued Liabilities

Accrued liabilities consist of the following:

December 31 2011 2010

Deferred revenue $ 774 $ 746

Compensation 471 558

Billings in excess of costs and earnings 250 226

Tax liabilities 126 179

Customer reserves 125 117

Networks purchase price adjustment 96 —

Distribution related obligation 75 —

Dividend payable 70 —

Other 734 748

$2,721 $2,574

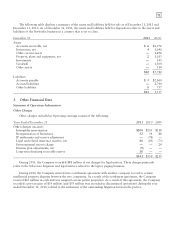

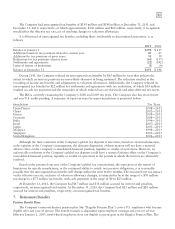

Other Liabilities

Other liabilities consist of the following:

December 31 2011 2010

Defined benefit plans, including split dollar life insurance policies $2,675 $2,113

Postretirement health care benefits plan 295 277

Deferred revenue 275 272

Unrecognized tax benefits 112 70

Other 353 313

$3,710 $3,045