Motorola 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

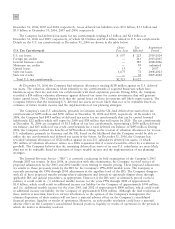

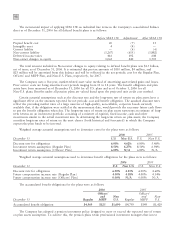

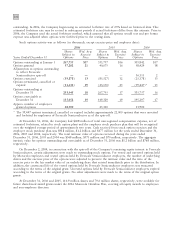

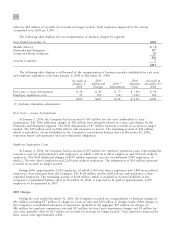

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Year

2007 $39

2008 37

2009 35

2010 34

2011 33

2012-2016 155

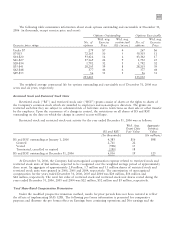

The health care trend rate used to determine the December 31, 2006 accumulated postretirement benefit

obligation is 10% for 2007. Beyond 2006, the rate is assumed to decrease by 1% per year until it reaches 5% by

2012 and then remains flat. The health care trend rate used to determine the December 31, 2005 accumulated

postretirement benefit obligation was 10% for 2005 with the trend rate expected to grade down 1% per year until

reaching 5% by 2011 and then remaining flat. Changes in the industry's projected health care costs have caused the

graded trend rate assumption to be reset to 10% as of December 31, 2006.

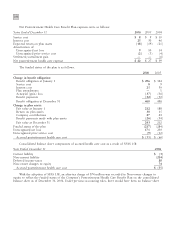

Changing the health care trend rate by one percentage point would change the accumulated postretirement

benefit obligation and the net retiree health care expense as follows:

1% Point 1% Point

Increase Decrease

Effect on:

Accumulated postretirement benefit obligation $21 $(22)

Net retiree health care expense 2 (2)

The Company maintains a life time cap on postretirement health care costs, which reduces the liability

duration of the plan. A result of this lower duration is a decreased sensitivity to a change in the discount rate trend

assumption with respect to the liability and related expense.

The Company has no significant postretirement health care benefit plans outside the United States.

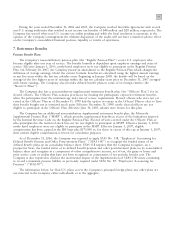

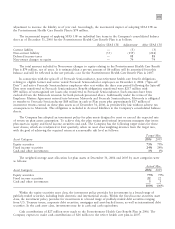

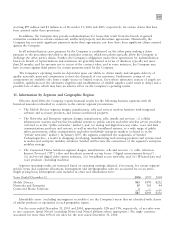

Defined Contribution Plan

The Company and certain subsidiaries have various defined contribution plans, in which all eligible employees

participate.

In the U.S., the 401(k) plan is a contributory plan. Matching contributions are based upon the amount of the

employees' contributions. Effective January 1, 2005, newly hired employees have a higher maximum matching

contribution at 4% on the first 6% of employee contributions, compared to 3% for employees hired prior to

January 2005. The profit sharing contribution for the year ended December 31, 2004 was $69 million. Before 2005,

profit sharing contributions were generally based upon pre-tax earnings, as defined, with an adjustment for the

aggregate matching contribution. Effective January 1, 2005, the plan was amended to exclude the profit sharing

component.

The Company's expenses, primarily relating to the employer match, for all defined contribution plans, for the

years ended December 31, 2006, 2005 and 2004 were $105 million, $105 million and $126 million, respectively.

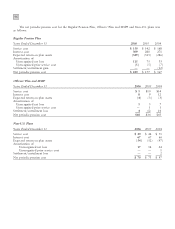

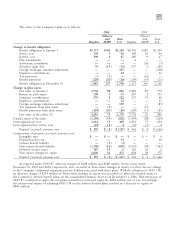

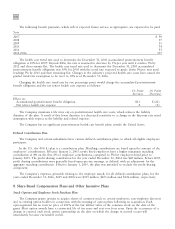

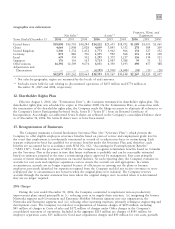

8. Share-Based Compensation Plans and Other Incentive Plans

Stock Options and Employee Stock Purchase Plan

The Company grants options to acquire shares of common stock to certain employees, non-employee directors

and to existing option holders in connection with the merging of option plans following an acquisition. Each

option granted has an exercise price of 100% of the fair market value of the common stock on the date of the

grant. Most option awards have a contractual life of ten years and vest over four years. Upon the occurrence of a

change in control, each stock option outstanding on the date on which the change in control occurs will

immediately become exercisable in full.