MetLife 2002 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

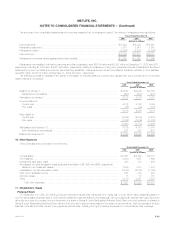

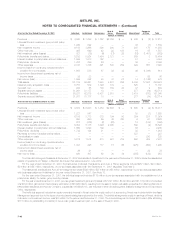

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

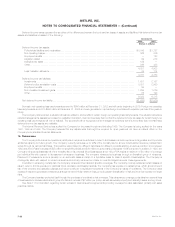

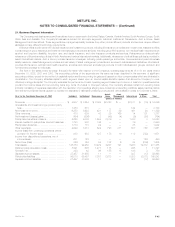

As part of the GenAmerica acquisition in 2000, the Company acquired Conning, the results of which are included in the Asset Management

segment due to the types of products and strategies employed by the entity from its acquisition date to July 2001, the date of its disposition. The

Company sold Conning, receiving $108 million in the transaction and reported a gain of approximately $25 million, in the third quarter of 2001.

The Corporate & Other segment consists of various start-up entities, including Grand Bank, N.A., and run-off entities, as well as the elimination of all

intersegment amounts. The principal component of the intersegment amounts relates to intersegment loans, which bear interest rates commensurate

with related borrowings. In addition, the elimination of the Individual segment’s ownership interest in Nvest is included for the year ended December 31,

2000.

Net investment income and net investment gains and losses are based upon the actual results of each segment’s specifically identifiable asset

portfolio adjusted for allocated capital. Other costs and operating costs were allocated to each of the segments based upon: (i) a review of the nature of

such costs, (ii) time studies analyzing the amount of employee compensation costs incurred by each segment, and (iii) cost estimates included in the

Company’s product pricing.

Revenues derived from any customer did not exceed 10% of consolidated revenues. Revenues from U.S. operations were $31,026 million,

$30,109 million and $30,006 million for the years ended December 31, 2002, 2001 and 2000, respectively, which represented 94%, 96% and 97%,

respectively, of consolidated revenues.

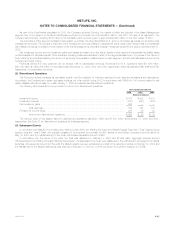

22. Discontinued Operations

The Company actively manages its real estate portfolio with the objective to maximize earnings through selective acquisitions and dispositions.

Accordingly, the Company sold certain real estate holdings out of its portfolio during 2002. In accordance with SFAS No. 144, income related to real

estate classified as held-for-sale on or after January 1, 2002 is presented as discontinued operations.

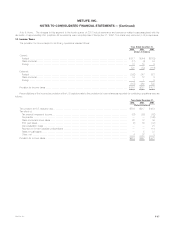

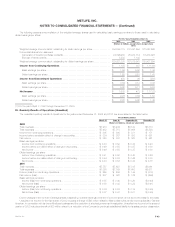

The following table presents the components of income from discontinued operations:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Investment income *************************************************************************** $ 375 $ 422 $ 418

Investment expense ************************************************************************** (251) (297) (297)

Net investment gains ************************************************************************* 582 — —

Total revenues*********************************************************************** 706 125 121

Provision for income taxes********************************************************************* 256 39 42

Income from discontinued operations *************************************************** $ 450 $ 86 $ 79

The carrying value of real estate related to discontinued operations was $223 million and $1,580 million at December 31, 2002 and 2001,

respectively. See Note 21 for discontinued operations by business segment.

23. Subsequent Events

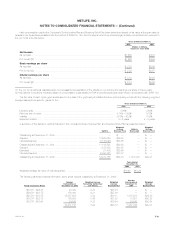

In connection with MetLife, Inc.’s initial public offering in April 2000, the Holding Company and MetLife Capital Trust I (the ‘‘Trust’’) issued equity

security units (the ‘‘units’’). Each unit originally consisted of (i) a contract to purchase, for $50, shares of the Holding Company’s common stock on

May 15, 2003, and (ii) a capital security of the Trust, with a stated liquidation amount of $50.

In accordance with the terms of the units, the Trust was dissolved on February 5, 2003 and $1,006 million aggregate principal amount

8% debentures of the Holding Company (‘‘MetLife debentures’’), the sole asset of the Trust, were distributed to the unitholders in exchange for the capital

securities. As required by the terms of the units, the MetLife debentures were remarketed on behalf of the debenture holders on February 12, 2003 and

the interest rate on the MetLife debentures was reset as of February 15, 2003 to 3.911% per annum for a yield to maturity of 2.876%.

MetLife, Inc. F-47