MetLife 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 and are applicable to all guarantees issued by the guarantor subject to the provisions of FIN 45. The initial recognition and initial measurement

provisions of FIN 45 are applicable on a prospective basis to guarantees issued or modified after December 31, 2002. The Company does not expect

the initial adoption of FIN 45 to have a significant impact on the Company’s consolidated financial statements. The adoption of FIN 45 requires the

Company to include disclosures in its consolidated financial statements related to guarantees.

In June 2002, the FASB issued SFAS No. 146, Accounting for Costs Associated with Exit or Disposal Activities (‘‘SFAS 146’’), which must be

adopted for exit and disposal activities initiated after December 31, 2002. SFAS 146 will require that a liability for a cost associated with an exit or disposal

activity be recognized and measured initially at fair value only when the liability is incurred rather than at the date of an entity’s commitment to an exit plan

as required by Emerging Issues Task Force (‘‘EITF’’) 94-3, Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an

Activity (including Certain Costs Incurred in a Restructuring). In the fourth quarter of 2001, the Company recorded a charge of $330 million, net of income

taxes of $169 million, associated with business realignment initiatives using the EITF 94-3 accounting guidance.

In April 2002, the FASB issued SFAS No. 145, Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB Statement No. 13, and

Technical Corrections (‘‘SFAS 145’’). In addition to amending or rescinding other existing authoritative pronouncements to make various technical

corrections, clarify meanings, or describe their applicability under changed conditions, SFAS 145 generally precludes companies from recording gains

and losses from the extinguishment of debt as an extraordinary item. SFAS 145 also requires sale-leaseback treatment for certain modifications of a

capital lease that result in the lease being classified as an operating lease. SFAS 145 is effective for fiscal years beginning after May 15, 2002, and the

initial application of this standard did not have a significant impact on the Company’s consolidated financial statements.

Investments

The Company had total cash and invested assets at December 31, 2002 of $190.7 billion. In addition, the Company had $59.7 billion held in its

separate accounts, for which the Company generally does not bear investment risk.

The Company’s primary investment objective is to maximize net investment income consistent with acceptable risk parameters. The Company is

exposed to three primary sources of investment risk:

)credit risk, relating to the uncertainty associated with the continued ability of a given obligor to make timely payments of principal and interest;

)interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates; and

)market valuation risk.

The Company manages risk through in-house fundamental analysis of the underlying obligors, issuers, transaction structures and real estate

properties. The Company also manages credit risk and market valuation risk through industry and issuer diversification and asset allocation. For real

estate and agricultural assets, the Company manages credit risk and valuation risk through geographic, property type, and product type diversification

and asset allocation. The Company manages interest rate risk as part of its asset and liability management strategies, product design, such as the use of

market value adjustment features and surrender charges, and proactive monitoring and management of certain non-guaranteed elements of its products,

such as the resetting of credited interest and dividend rates for policies that permit such adjustments.

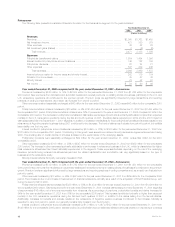

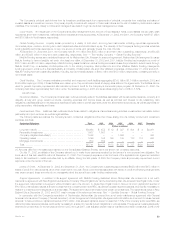

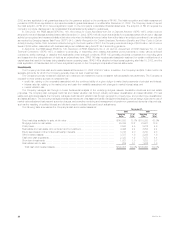

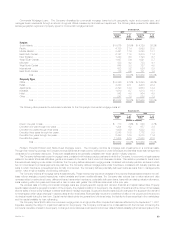

The following table summarizes the Company’s cash and invested assets at:

December 31,

2002 2001

Carrying % of Carrying % of

Value Total Value Total

Fixed maturities available-for-sale, at fair value ***************************************** $140,553 73.7% $115,398 68.0%

Mortgage loans on real estate******************************************************* 25,086 13.2 23,621 13.9

Policy loans ********************************************************************** 8,580 4.5 8,272 4.9

Real estate and real estate joint ventures held-for-investment***************************** 4,496 2.4 4,054 2.4

Equity securities and other limited partnership interests ********************************** 3,743 2.0 4,700 2.8

Other invested assets ************************************************************* 3,727 1.9 3,298 1.9

Cash and cash equivalents ********************************************************* 2,323 1.2 7,473 4.4

Short-term investments ************************************************************ 1,921 1.0 1,203 0.7

Real estate held-for-sale *********************************************************** 229 0.1 1,676 1.0

Total cash and invested assets**************************************************** $190,658 100.0% $169,695 100.0%

MetLife, Inc.

26