Mercury Insurance 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2MERCURY GENERAL CORPORATION

result of rate reductions taken in many states early in 2014

and increased distribution. For 2015, we expect to continue

[VPTWYV]LV\YNYV^[OWYVZWLJ[ZV\[ZPKLVM*HSPMVYUPHMYVT

our improved competitive position coupled with increased

advertising spend and distribution.

After tax investment income increased 1.8% to $111.5

million. The after-tax yield on investments of 3.5% in 2014

was slightly lower than the after tax yield of 3.6% in 2013.

The current low interest rate environment continues to put

downward pressure on our after tax yield as new money is

being invested at lower yields. Our investment base grew

7.8% to $3.4 billion and offset the slight decline in yield.

Going forward, we expect there will be continued downward

pressure on our after tax yield as bonds with higher coupons

mature or are called and the reinvestment of those proceeds

will most likely be made at lower after tax yields.

7YVÄ[HIPSP[`V\[ZPKLVM*HSPMVYUPH^HZTP_LK0UV\Y[^V

largest states, Florida and Texas, the private passenger auto

combined ratios were 96.6% and 96.1%, respectively. Flat

premium growth was achieved despite a 10% rate reduction

[HRLUPUIV[O[OLZLZ[H[LZPULHYS`K\L[VZPNUPÄJHU[

increases in new business sales of 87% and 92% in Florida

and Texas, respectively. However, we posted unacceptable

results in our next two largest states, New York and New

Jersey. Loss costs for the bodily injury coverages were

ZPNUPÄJHU[S`OPNOLY[OHUWYL]PV\ZLZ[PTH[LZ^OPJOSLK[V

adverse reserve development of $17 million and increased

our 2014 accident year loss estimates. To partially address

the poor results, we increased rates in New York by 3%

effective January 2015 and by 2% in New Jersey effective

-LIY\HY `;OL*VTWHU`PZHSZVTVUP[VYPUNOV^JOHUNLZ

in claims procedures, which include the speeding up of

claims settlement and case reserving, may be affecting our

loss reserve estimates with the possibility that the faster

settling and reserving of claims could lead to favorable

development in the future.

We have taken several steps over the past few years to

PTWYV]LV\YYLZ\S[Z V\[ZPKLVM *HSPMVYUPH 0U ^L

consolidated our claims and underwriting operations located

V\[ZPKLVM*HSPMVYUPHPU[VO\ISVJH[PVUZPU-SVYPKH5L^

Jersey and Texas. Other expense reduction measures were

also taken, including a new commission structure. These

changes have positively impacted our cost structure outside

VM*HSPMVYUPHHUK^LWSHU[VKVTVYL[VPTWYV]LV\YJVZ[

structure in the future.

Our combined ratio target for private passenger auto is 95%

and we generally price to that target. However, in states

V\[ZPKLVM*HSPMVYUPH^LWYPJLV\YWYVK\J[[VL_WLUZL[HYNL[Z

that we have not yet achieved, but expect to achieve over

the next several years. This pricing strategy will allow us

to be more competitive than we otherwise would be, but

it means that our margins will be lower than our long term

target for the next few years.

Part of our long-term strategy is to continue to grow our

/VTLV^ULYZHUK*VTTLYJPHSSPULZVMI\ZPULZZ0U(\N\Z[

^LSH\UJOLKHUL^/VTLV^ULYZWYVK\J[PU*HSPMVYUPH

^P[OYLÄULKWYPJPUNHUKUL^[LJOUVSVN`;OLUL^WYVK\J[

was very well received as new business applications

increased over 10% when the new product was launched.

*VTWHU`^PKLV\Y/VTLV^ULYZSPULNYL^PU[V

$369 million in premiums written and posted a combined ratio

VM 7YLTP\TZ^YP[[LUMVYV\Y*VTTLYJPHSH\[VSPUL^HZ

$136.6 million in 2014, a 30.2% increase and the combined

YH[PV^HZ 6\Y*VTTLYJPHSWYVWLY[`SPULWVZ[LKH

19.6% increase in premiums written to $58.6 million with

an 81.2% combined ratio. As the personal auto landscape

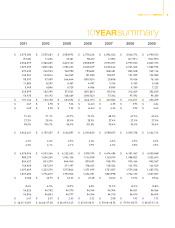

PREMIUMS WRITTEN

(in millions)

3,500

3,000

2,000

1,500

1,000

0

1495 96 97 98 99 00 01 02 03

2,500

500

04 05 06 07 08 09 10 11 12 13