Mercury Insurance 2014 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2014 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

2014 ANNUAL REPORT

IN 2014, we continued making progress towards

improved operating results with growth in net premiums

written of 4.1% and improvement in our combined ratio

of 0.8 points. Our 2014 operating earnings were $2.28

per share, compared to $2.18 per share in 2013, a 5%

improvement. Excluding the impact of an unexpected

TPSSPVUÄULMYVT[OL*HSPMVYUPH+LWHY[TLU[VM

0UZ\YHUJL¸+60¹VWLYH[PUNLHYUPUNZ^LYLWLY

share, a 28% improvement over 2013. The adjusted

operating earnings of $2.78 per share provided an 8.3%

return on average shareholders’ equity in 2014, which

was better than the 6.5% return in 2013, but still below

our double digit targeted return.

(ZTLU[PVULKHIV]L[OL+60HZZLZZLK[OL*VTWHU`

^P[OHTPSSPVUÄULIHZLKVU[OL*VTTPZZPVULY»Z

KL[LYTPUH[PVU[OH[4LYJ\Y`]PVSH[LK*HSPMVYUPH»ZYH[LSH^Z

HUK[OH[[OL*VTWHU`»ZPUZ\YHUJLIYVRLYZ^LYLKLMHJ[V

HNLU[Z;OLPZZ\L^HZYHPZLKI`[OL+60VU[OLOLLSZVM

a private civil litigation in Krumme v. Mercury that was

decided in 2003. In the Krumme decision, the judge

ruled that based on the mountain of evidence reviewed

I`[OLJV\Y[[OH[UVÄUHUJPHSYLZ[P[\[PVU^HZ^HYYHU[LK

PUSPNO[VM[OL+60»ZSVVZLWYHJ[PJLZPUJS\KPUN[OLSHJR

of guidance provided as to what constitutes a broker or

HUHNLU[0[PZV\YZ[YVUNILSPLM[OH[[OL*VTTPZZPVULY»Z

determination and penalty assessment is contrary to

*HSPMVYUPH»ZYH[LSH^ZK\LWYVJLZZHUKIHZPJUV[PVUZ

of fairness. We intend to vigorously litigate this matter

of law and we expect to ultimately prevail on the merits

in a court of law.

The improvement in our 2014 operating results was

primarily due to better margins on policies issued in

*HSPMVYUPH,_JS\KPUN[OLÄUL^LWVZ[LKHJVTIPULK

YH[PVVM PUV\Y*HSPMVYUPHWYP]H[LWHZZLUNLYH\[VSPUL

compared to 101% in 2013. Higher average premiums

HPKLKV\Y*HSPMVYUPHWYP]H[LWHZZLUNLYH\[VYLZ\S[ZPU

as we implemented a 6.9% personal auto rate increase

PU1\S`HUK6J[VILYMVY*HSPMVYUPH(\[VTVIPSL

0UZ\YHUJL*VTWHU`YLWYLZLU[PUNVMV\Y[V[HS

companywide premiums. In addition, we implemented

HYH[LPUJYLHZLPU4LYJ\Y`0UZ\YHUJL*VTWHU`PU

January 2014, representing about half of our companywide

premiums written.

;OL*HSPMVYUPHYH[LPUJYLHZLZV\[WHJLKSVZZJVZ[[YLUKZHZ

personal auto frequency and severity were fairly benign;

up in the low single digits in 2014. However, we did experience

the typical seasonal spike in frequency and severity in

the fourth quarter and we are closely monitoring the

impact that lower gasoline prices and the improvement

in the unemployment rate may have on driving habits. To

HJOPL]LV\Y[HYNL[LKWYVÄ[HIPSP[`SL]LSZHUK[VRLLW\W

with trend, we requested a 6.9% rate increase which is

WLUKPUNHWWYV]HSMYVT[OL+60MVYIV[O4LYJ\Y`0UZ\YHUJL

*VTWHU`HUK*HSPMVYUPH(\[VTVIPSL0UZ\YHUJL*VTWHU`

*VTWHU`^PKLWYLTP\TZ^YP[[LUNYL^[VIPSSPVU

PU*HSPMVYUPHJVU[PU\LK[VL_WLYPLUJLWVZP[P]L

premium growth as rate increases more than offset

SV^LYWVSPJ`ZHSLZ/V^L]LYNYV^[OPU*HSPMVYUPH^PSS

be challenging in 2015 as private passenger auto new

business sales were down 17% in 2014 and the impact

of the lower new business sales in 2014 will negatively

PTWHJ[V\YYLUL^HSWYLTP\TZ6\[ZPKLVM*HSPMVYUPH

and excluding our Mechanical Breakdown product, we

posted negative growth of 3.9% in 2014 compared to

negative growth of 7.6% in 2013. However, in the fourth

X\HY[LYVMNYV^[O^HZÅH[L_JS\KPUN[OL4LJOHUPJHS

Breakdown product. The improvement in growth outside

VM*HSPMVYUPHPZH[[YPI\[HISL[VPUJYLHZLKWVSPJ`ZHSLZHZH

LETTER TO SHAREHOLDERS

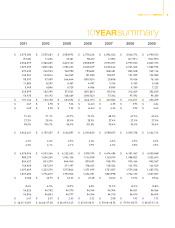

COMBINED RATIO VS. INDUSTRY

(in percent)

103

100

91

88

85

94

97

1405 06 07 08 09 10 11 12 13

Mercury General U.S. Industry Source for Industry Data: A.M. Best Company