Memorex 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{1} Imation Annual Report

Dear fellow Imation shareholder:

I am very pleased to be able to share our solid financial results for fiscal

year 2006 – one of the most successful in Imation’s 10-year history. Our 2006

performance reinforces our confidence in our strategy and business direction.

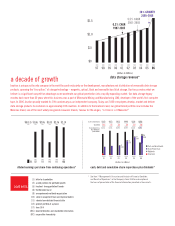

Last year, we celebrated our 10th anniversary as an independent company,

as we recorded our highest revenue growth in our history. This achievement

capped a decade of growth in our data storage business even as we divested

non-core businesses in the earlier years. Our decade of growth has been

driven by overall industry growth, new products and new formats, entry into

new markets, strategic alliances, joint ventures and acquisitions.

Let me begin by giving you an update on the four priorities we stated in last

year’s Letter to Shareholders. Our top priority every year is to meet or exceed

our financial targets. I am pleased to report that revenue grew 26 percent, to

$1.585 billion and fueled by the Memorex acquisition, is near the high end of

our targeted range. Operating income of $108.2 million – a near record for

the company – and diluted earnings per share from continuing operations

of $2.14 were well above our targeted range in last year’s Annual Report.

We continue to make significant progress on becoming a lean enterprise,

last year’s second priority. The implementation of lean operating principles,

focused on increasing speed and quality and reducing costs, is an ongoing

journey. In 2006, more than 1,000 employees participated in training on

lean or in actual lean kaizen events. We have seen significant productivity

improvements, as illustrated by our experience in our Camarillo, California

plant, described in the narrative on page 8.

Achieving our third priority – to drive internal growth and entrepreneurship

– enabled us to offset declines in older tape formats with growth in optical,

flash and newer tape formats. We also brought innovative new products

to market. For example, our recently introduced Odyssey™ technology is a

removable 2.5-inch SATA hard drive and external docking station, which offers

an attractive backup solution for small and medium business applications.

Our fourth priority, to expand the company through external growth, was

addressed by Imation’s first major acquisition, the purchase of the Memorex

brand and business. This acquisition, the result of a deliberate evaluation

of strategic opportunities that began in early 2005, increases not only

our revenues, but also the pace of change and evolution at Imation. We

announced the acquisition in January of 2006, closed on May 1 and completed

essentially all scheduled integration activity by the end of January 2007.

Now, I would like to share our priorities for the coming year:

1. Meet or exceed our financial targets – For 2007, we have targeted

revenue in the range of $1.775 billion to $1.825 billion, or growth of

12 to 15 percent; operating income in the range of $124 million to

$129 million and diluted earnings per share from continuing operations

between $2.29 and $2.42. While these goals were current at the time

we reported year-end results, they are subject to risks and uncertainties.

See Management’s Discussion and Analysis, 2007 Outlook and Risk Factors

in the accompanying Form 10-K.

2. Strengthen employee engagement by investing in employee development

programs, communicating our strategic direction and continuing to

reinforce our culture of ethical business practices.

3. Expand our brand portfolio by investing in brand promotion, leveraging

our product portfolio and market position across all geographic regions

and strengthening our OEM relationships.

4. Build on our organizational expertise in brand portfolio management,

end user knowledge and lean enterprise principles.

5. Position the company for sustainable profitable growth by optimizing

existing businesses, leveraging our technology capabilities across the

portfolio and exploiting new growth markets such as flash, advanced

optical and HDD, while continuing our strategic development activities.

Finally, I want to acknowledge the contributions of Bruce Henderson, who

took a leave of absence from his role as Imation’s CEO due to health reasons.

Under Bruce’s leadership, Imation identified and closed on the Memorex

acquisition, and his passionate commitment to lean principles has given

Imation a valuable tool to improve speed, cost and quality. Both contributions

will have lasting, positive impacts on Imation.

We look forward to updating all our shareholders throughout the year as

we progress against each of these priorities. I invite you to read through

the following pages, which describe our solid platform for growth, our broad

portfolio of brands and more detail on some of our successes described above.

Our global organization remains focused and passionate about the business,

and this management team remains committed to building shareholder value.

Sincerely,

Frank P. Russomanno

Acting Chief Executive Officer, President and Chief Operating Officer

letter to

shareholders

february 22, 2007