Medtronic 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

&'#>cXdbZIVmZh

I]Zegdk^h^dc[dg^cXdbZiVmZh^hWVhZYdcZVgc^c\hWZ[dgZ^cXdbZ

iVmZhgZedgiZY[dg[^cVcX^VahiViZbZciejgedhZh#I]ZXdbedcZcihd[

ZVgc^c\hWZ[dgZ^cXdbZiVmZhVgZ/

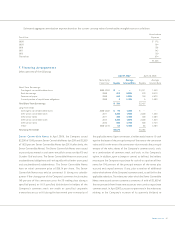

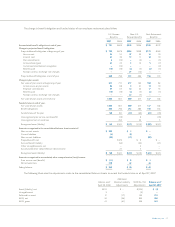

Fiscal Year

2007 2006 2005

U.S. $ 1,579 $ 1,581 $ 932

International 1,936 1,580 1,612

Earnings before income taxes $ 3,515 $ 3,161 $ 2,544

I]Zegdk^h^dc[dg^cXdbZiVmZhXdch^hihd[/

Fiscal Year

2007

2006

2005

Current tax expense:

U.S. $ 712 $ 471 $ 517

International 239 11 390

Total current tax expense 951 482 907

Deferred tax expense (benefit):

U.S. (216) 159 (192)

International (22) (27) 25

Net deferred tax expense (benefit) (238) 132 (167)

Total provision for income taxes $ 713 $ 614 $ 740

9Z[ZggZYiVmZhVg^hZWZXVjhZd[i]ZY^[[ZgZciigZVibZcid[

igVchVXi^dch[dg[^cVcX^VahiViZbZciVXXdjci^c\VcY^cXdbZiVm

VXXdjci^c\!`cdlcVhÆiZbedgVgnY^[[ZgZcXZh#ÇI]Z8dbeVcngZXdgYh

i]Z iVmZ[[ZXid[i]ZhZ iZbedgVgn Y^[[ZgZcXZh Vh ÆYZ[ZggZY iVm

VhhZihÇVcYÆYZ[ZggZYiVma^VW^a^i^Zh#Ç9Z[ZggZYiVmVhhZih\ZcZgVaan

gZegZhZci^iZbhi]ViXVcWZjhZYVhViVmYZYjXi^dcdgXgZY^i^cViVm

gZijgc^c[jijgZnZVgh[dgl]^X]i]Z8dbeVcn]VhVagZVYngZXdgYZY

i]ZiVmWZcZ[^i^ci]ZXdchda^YViZYhiViZbZcih d[ZVgc^c\h# I]Z

8dbeVcnZhiVWa^h]ZhkVajVi^dc VaadlVcXZh[dg YZ[ZggZYiVmVhhZih

l]Zci]ZVbdjcid[ZmeZXiZY[jijgZiVmVWaZ^cXdbZ^hcdia^`Zan

idhjeedgii]ZjhZd[i]ZYZYjXi^dcdgXgZY^i#I]Z8dbeVcn]Vh

ZhiVWa^h]ZYkVajVi^dcVaadlVcXZhgZaViZYidXZgiV^cVXfj^h^i^dchi]Vi!

^[cdijai^bViZangZfj^gZY!l^aagZhjai^cVgZYjXi^dcid\ddYl^aa0i]ZhZ

VaadlVcXZhlZgZoZgdVcY(&Vi6eg^a',!'%%,VcY6eg^a'-!'%%+!

gZheZXi^kZan#I]Z8dbeVcn]VhZhiVWa^h]ZYkVajVi^dcVaadlVcXZh[dg

XVe^iVaadhh XVggn[dglVgYhVcYYZ[ZggZYiVmZhl]^X]VgZXVe^iVa^c

cVijgZ^ci]ZVbdjci d[(*VcY&Vi6eg^a',!'%%,VcY 6eg^a'-!

'%%+!gZheZXi^kZan#>cVYY^i^dc!ViWdi]6eg^a',!'%%,VcY6eg^a'-!

'%%+!Veegdm^bViZan)d[cdc"J#H#iVmadhhZhlZgZVkV^aVWaZ[dg

XVggn[dglVgY#I]ZhZXVggn[dglVgYhVgZd[[hZiWnkVajVi^dcVaadlVcXZh

VcY\ZcZgVaan YdcdiZme^gZ#I]ZXVe^iVaadhhXVggn[dglVgYhZme^gZ

l^i]^cdcZid[^kZnZVgh#9Z[ZggZYiVma^VW^a^i^Zh\ZcZgVaangZegZhZci

iVmZmeZchZgZXd\c^oZY^ci]ZXdchda^YViZY[^cVcX^VahiViZbZcih[dg

l]^X]eVnbZci]VhWZZcYZ[ZggZYdgZmeZchZ]VhVagZVYnWZZciV`Zc

VhVYZYjXi^dcdci]Z8dbeVcnÉhiVmgZijgc!Wji]VhcdinZiWZZc

gZXd\c^oZYVhVcZmeZchZ^ci]ZXdchda^YViZYhiViZbZcihd[ZVgc^c\h#

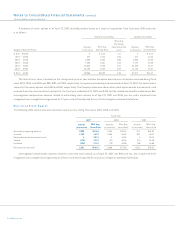

9Z[ZggZYiVmVhhZih$a^VW^a^i^ZhVgZXdbeg^hZYd[i]Z[daadl^c\/

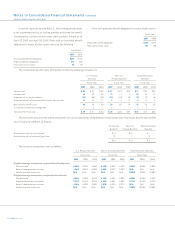

Fiscal Year

2007 2006

Deferred tax assets:

Inventory (intercompany profit in inventory and

excess of tax over book valuation) $ 235 $ 207

Convertible debt interest 314 197

Accrued liabilities 86 81

Allowance for doubtful accounts 52 62

Warranty reserves 13 20

Unrealized loss on minority investments 11 39

Unrealized loss on investments 37 Ñ

Pension and post-retirement benefits 29 Ñ

Stock-based compensation 71 3

Accrued losses on legal settlements Ñ9

Other 128 152

Total deferred tax assets 976 770

Deferred tax liabilities:

Intangible assets (280) (394)

Accumulated depreciation (13) (42)

Pension and post-retirement benefits Ñ(87)

Unrealized gain on investments Ñ(5)

Other (74) (67)

Total deferred tax liabilities (367)(595)

Deferred tax assets, net $ 609 $ 175

I]Z8dbeVcnÉhZ[[ZXi^kZ^cXdbZiVmgViZkVg^ZY[gdbi]ZJ#H#

;ZYZgVahiVijidgniVmgViZVh[daadlh/

Fiscal Year

2007 2006 2005

U.S. Federal statutory tax rate 35.035.0% 35.0%

Increase (decrease) in tax rate resulting from:

U.S. state taxes, net of Federal tax benefit 1.2 0.9 0.9

Research & development credit (0.4) (0.4) (0.6)

International

(12.9

)(10.9) (7.7)

Impact of repatriation, special,

restructuring, certain litigation,

and IPR&D charges 0.3 1.9 1.6

Reversal of excess tax accruals (3.7) (7.1) Ñ

Other, net 0.8 Ñ (0.1)

Effective tax rate 20.319.4% 29.1%

9jg^c\i]Z[djgi]fjVgiZgd[[^hXVanZVg'%%,!i]Z8dbeVcn

gZXdgYZYV&'.iVmWZcZ[^iVhhdX^ViZYl^i]i]ZgZkZghVad[ZmXZhh

iVmVXXgjVah^cXdccZXi^dcl^i]i]ZhZiiaZbZcigZVX]ZYl^i]i]Z>GH

^ckdak^c\i]ZgZk^Zld[i]Z8dbeVcnÉh[^hXVanZVg'%%(VcY[^hXVanZVg

'%%)YdbZhi^X^cXdbZiVmgZijgch!i]ZgZhdaji^dcd[XdbeZiZci

Vji]dg^in^hhjZh[dg[^hXVa nZVg&..' i]gdj\][^hXVanZVg'%%%!VcY

BZYigdc^X!>cX#,*