Medtronic 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

gZi^gZbZciZa^\^W^a^in^hWZ^c\gZXd\c^oZYdkZgi]ZhiViZYkZhi^c\

iZgbd[i]Z\gVci# >[ i]Z8dbeVcn]VY]^hidg^XVaan VXXdjciZY[dg

hidX`"WVhZYVlVgYhbVYZidgZi^gZbZciZa^\^WaZ^cY^k^YjVahjcYZgi]Z

gZfj^gZbZcihd[H;6HCd#&'(G!i]Zegd[dgbVZmeZchZY^hXadhZY

WZadlldjaY ]VkZWZZc ^cXgZVhZYWn'[dgi]Z [^hXVa nZVgZcYZY

6eg^a'-! '%%+# I]ZgZlVhcdhidX`"WVhZY XdbeZchVi^dc ZmeZchZ

XVe^iVa^oZYVh^ilVhYZZbZY^bbViZg^Va#

I]ZVbdjcid[hidX`"WVhZYXdbeZchVi^dcZmeZchZgZXd\c^oZY

Yjg^c\ V eZg^dY ^h WVhZY dc i]Z edgi^dc d[ i]Z VlVgYh i]Vi VgZ

jai^bViZanZmeZXiZYidkZhi#I]Z8dbeVcnZhi^bViZhegZ"kZhi^c\

[dg[Z^ijgZhVii]Zi^bZd[\gVciWnVcVano^c\]^hidg^XVaYViVVcY

gZk^hZh i]dhZZhi^bViZh^c hjWhZfjZci eZg^dYh ^[VXijVa[dg[Z^ijgZh

Y^[[Zgh^\c^[^XVcian[gdbi]dhZZhi^bViZh#Jai^bViZan!i]ZidiVaZmeZchZ

gZXd\c^oZYdkZgi]ZkZhi^c\eZg^dYl^aaZfjVai]Z[V^gkVajZd[VlVgYh

i]ViVXijVaankZhi#

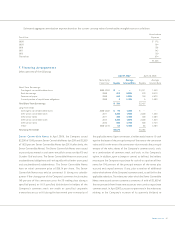

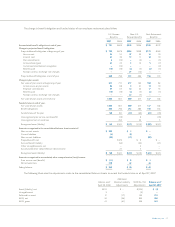

I]Z [daadl^c\ iVWaZ egZhZcih i]Z hiViZbZci d[ ZVgc^c\h

XaVhh^[^XVi^dc d[egZ"iVmhidX`"WVhZY XdbeZchVi^dc ZmeZchZ![dg

dei^dch!:HEE!VcYgZhig^XiZYhidX`VlVgYh!gZXd\c^oZY[dgi]Z[^hXVa

nZVgZcYZY6eg^a',!'%%,/

Fiscal Year

2007

Cost of sales $ 19

Research and development expense 39

Selling, general and administrative expense 127

$ 185

I]Z[daadl^c\iVWaZ^aajhigViZhi]ZZ[[ZXidccZiZVgc^c\hVcYcZi

ZVgc^c\heZgh]VgZ[dg[^hXVanZVgh'%%+VcY'%%*^[i]Z8dbeVcn]VY

Veea^ZY i]Z[V^gkVajZ gZXd\c^i^dcegdk^h^dchd[ H;6HCd#&'(id ^ih

hidX`"WVhZYZbeadnZZXdbeZchVi^dc/

Fiscal Year

2006 2005

Net earnings, as reported $ 2,547 $ 1,804

Add: Stock-based compensation expense included in

net earnings& 16 12

Less: Stock-based compensation expense determined

under fair value based method for all awards& (142) (224)

Pro forma net earnings $ 2,421 $ 1,592

Basic earnings per share:

As reported $ 2.11 $ 1.49

Pro forma $ 2.01 $ 1.32

Diluted earnings per share:

As reported $ 2.09 $ 1.48

Pro forma $ 1.98 $ 1.31

' 9ecf[diWj_ed[nf[di[_id[je\h[bWj[ZjWn[\\[Yji$

IVm>beVXihd[HidX`"7VhZY8dbeZchVi^dcEg^dgidi]ZVYdei^dc

d[H;6HCd#&'(G!WZcZ[^ihd[iVmYZYjXi^dch^cZmXZhhd[gZXd\c^oZY

h]VgZ"WVhZY XdbeZchVi^dc ZmeZchZ lZgZ gZedgiZY dc i]Z

Xdchda^YViZYhiViZbZcid[XVh][adlhVhdeZgVi^c\XVh][adlh#JcYZg

H;6HCd#&'(G!hjX]ZmXZhhiVmWZcZ[^ihVgZgZedgiZYVh[^cVcX^c\

XVh][adlh#6ai]dj\]idiVaXVh][adlhjcYZgH;6HCd#&'(GgZbV^c

jcX]Vc\ZY [gdb l]Vi ldjaY ]VkZ WZZc gZedgiZY jcYZg eg^dg

VXXdjci^c\hiVcYVgYh!cZideZgVi^c\XVh][adlhVgZgZYjXZYVcYcZi

[^cVcX^c\XVh][adlhVgZ^cXgZVhZYYjZidi]ZVYdei^dcd[H;6H

Cd#&'(G#;dgi]Z[^hXVanZVgZcYZY6eg^a',!'%%,!i]ZgZlZgZZmXZhh

iVmWZcZ[^ihd[(+!l]^X]VgZXaVhh^[^ZYVh[^cVcX^c\XVh][adlh#;dg

i]Z[^hXVanZVghZcYZY6eg^a'-!'%%+VcY6eg^a'.!'%%*!i]ZgZlZgZ

ZmXZhhiVmWZcZ[^ihd[..VcY+&!gZheZXi^kZan!l]^X]lZgZXaVhh^[^ZY

VhdeZgVi^c\XVh][adlh#

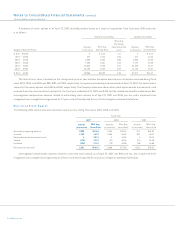

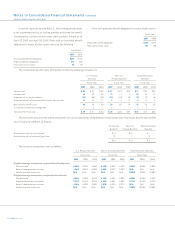

HidX`Dei^dchI]Z[daadl^c\iVWaZhjbbVg^oZhVaahidX`dei^dcVXi^k^in!^cXajY^c\VXi^k^in[gdbdei^dch^hhjZYVhVgZhjaid[VXfj^h^i^dch[gdb

[^hXVanZVg'%%'VcYeg^dg!Yjg^c\[^hXVanZVgh'%%,!'%%+!VcY'%%*/

Fiscal Year

2007 2006 2005

Options

^ci]djhVcYh

Wtd. Avg.

Exercise Price

Options

_dj^ekiWdZi

Wtd. Avg.

Exercise Price

Options

_dj^ekiWdZi

Wtd. Avg.

Exercise Price

Beginning balance

88,838

$ 46.23 87,655 $ 43.65

83,240

$ 41.18

Granted

10,529

48.64 13,740 56.16

15,884

50.02

Exercised (6,089) 37.37

(10,617

) 37.53 (9,107) 31.19

Canceled (2,372) 50.22 (1,940) 47.59 (2,362) 47.08

Outstanding at year-end

90,906

$ 46.99 88,838 $ 46.23

87,655

$ 43.65

Exercisable at year-end

67,017

$ 45.47 63,123 $ 44.13

62,948

$ 42.63

BZYigdc^X!>cX#,(