MasterCard 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

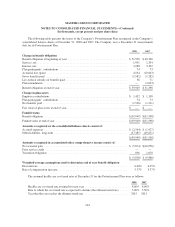

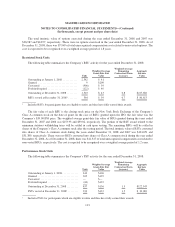

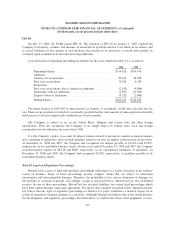

The fair value of each PSU is the closing price on the New York Stock Exchange of the Company’s Class A

common stock on the date of grant. With regard to the performance units granted in 2008, the ultimate number of

shares to be received by the employee upon vesting will be determined by the Company’s performance against

predetermined net income (two-thirds weighting) and operating margin (one-third weighting) goals for the three-

year period commencing January 1, 2008. With regard to the performance units granted in 2007, the ultimate

number of shares to be received by the employee upon vesting will be determined by the Company’s

performance against equally weighted predetermined net income and return on equity goals for the three-year

period commencing January 1, 2007. The weighted average grant-date fair value of PSUs granted during the year

ended December 31, 2007 was $106.29. There were no PSUs granted prior to this period. There were no PSUs

converted into shares of Class A common stock during the years ended December 31, 2007 and 2006. As of

December 31, 2008, there was $43,261 of total unrecognized compensation cost related to non-vested PSUs. The

cost is expected to be recognized over a weighted average period of 1.8 years.

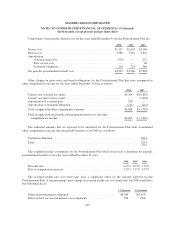

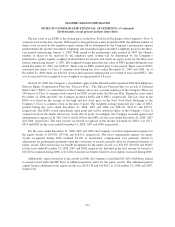

On July 18, 2006, the Company’s stockholders approved the MasterCard Incorporated 2006 Non-Employee

Director Equity Compensation Plan (the “Director Plan”). The Director Plan provides for awards of Deferred

Stock Units (“DSUs”) to each director of the Company who is not a current employee of the Company. There are

100 shares of Class A common stock reserved for DSU awards under the Director Plan. During the years ended

December 31, 2008 and 2007, the Company granted 4 DSUs and 8 DSUs, respectively. The fair value of the

DSUs was based on the average of the high and low stock price on the New York Stock Exchange of the

Company’s Class A common stock on the date of grant. The weighted average grant-date fair value of DSUs

granted during the years ended December 31, 2008, 2007 and 2006 was $284.92, $139.27 and $45.79,

respectively. The DSUs vested immediately upon grant and will be settled in shares of the Company’s Class A

common stock on the fourth anniversary of the date of grant. Accordingly, the Company recorded general and

administrative expense of $1,209, $1,051 and $1,050 for the DSUs for the years ended December 31, 2008, 2007

and 2006, respectively. The total income tax benefit recognized in the income statement for DSUs was $371,

$413 and $381 for the years ended December 31, 2008, 2007 and 2006, respectively.

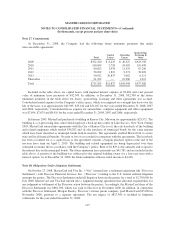

For the years ended December 31, 2008, 2007 and 2006, the Company recorded compensation expense for

the equity awards of $59,761, $57,162 and $18,131, respectively. The total compensation expense for equity

awards recognized during 2006 included $4,109 of incremental compensation cost primarily related to

adjustments for performance premiums upon the conversion of awards, partially offset by assumed forfeitures of

equity awards. The total income tax benefit recognized for the equity awards was $18,323, $19,828 and $6,091

for the years ended December 31, 2008, 2007 and 2006, respectively. Included in the total income tax benefit of

$18,323 recognized during 2008, is $13,466 of income tax benefit related to stock options exercised during 2008.

Additionally, upon conversion of the awards in 2006, the Company reclassified $51,209 of liabilities related

to awards issued under the EIP Plans to additional paid-in capital for the equity awards. The additional paid-in

capital balance attributed to the equity awards was $135,538 and $114,637 as of December 31, 2008 and 2007,

respectively.

114