Lockheed Martin 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOCKHEED MARTIN CORPORATION 2007 ANNUAL REPORT

2

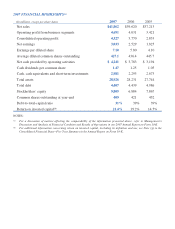

A STRONG FINANCIAL YEAR

As refl ected in these pages, 2007 was another

strong year for Lockheed Martin as we recorded $41.9

billion in sales, and grew our earnings per share for

the sixth consecutive year at a double-digit rate, from

$5.80 in 2006 to $7.10 in 2007.

One of the pillars of our strategy of disciplined

growth is balanced cash deployment. Lockheed Martin

closed the year with its twentieth consecutive quarter

of positive cash from operations and generated a record

$4.2 billion in operating cash for the year. In 2007, we

paid dividends totaling $615 million and repurchased

$2.1 billion of stock.

From 2001 to 2007, we generated more than

$20 billion in cash from operations, in part, due to

our rigorous cash management initiatives. This has

enabled us to return value to shareholders through

both dividends and share repurchases, and to remain

positioned to deploy cash for selected acquisitions. For

the fi fth year in a row, we have increased our dividend

payment at a double-digit rate.

DISCIPLINED GROWTH

Lockheed Martin has demonstrated the value of

acquisitions that add key capabilities, technologies, and

customers to our portfolio. Last year was no exception

as we closed three acquisitions that should continue to

aid us in future growth.

In 2007, we completed the acquisition of

Management Systems Designers Incorporated,

a provider of information technology to Federal

government customers such as the National Institutes

of Health, where Management Systems Designers

has successful client relationships spanning more

than 20 years. Other customers include the Internal

Revenue Service, Department of Homeland Security,

Department of Defense and intelligence agencies.

We acquired 3DSolve Inc., a privately-held

company that creates simulation-based learning tools

for government, military and corporate customers.

3DSolve complements and reinforces Lockheed

Martin’s initiatives in the training and simulation

arena. In December, PercepTek, Inc., a Colorado-based

provider of advanced software technologies for

applications in unmanned ground and aerial vehicles,

joined the Lockheed Martin team.

Recent acquisitions in 2006, such as Savi

Technologies Inc. and Pacifi c Architects and

Engineers, Inc. (PAE) have positioned Lockheed

Martin to compete for new opportunities – particularly

internationally – in logistics, cargo tracking, port

security, and infrastructure protection.