Kodak 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 32

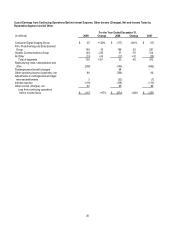

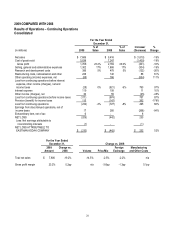

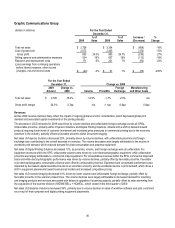

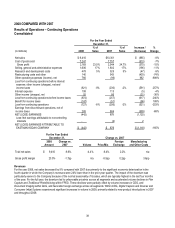

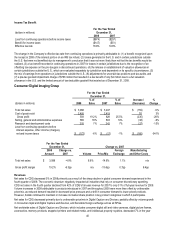

Revenues

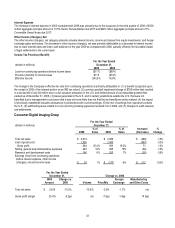

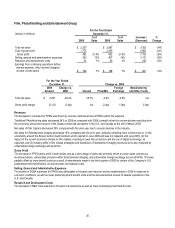

For the year ended December 31, 2009, net sales decreased compared with 2008 primarily due to volume declines within all three

segments driven by lower demand likely as a result of the global economic slowdown which began in the fourth quarter of 2008,

particularly within Digital Capture and Devices in the CDG segment and Prepress Solutions in the GCG segment, as well as

continued secular declines in Traditional Photofinishing and Film Capture in the FPEG segment. Foreign exchange negatively

impacted sales across all three segments, due to a stronger U.S. dollar. Unfavorable price/mix was primarily driven by Digital

Capture and Devices within CDG, Entertainment Imaging within FPEG, and Prepress Solutions within GCG.

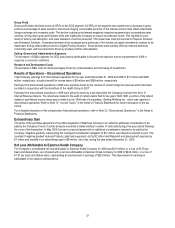

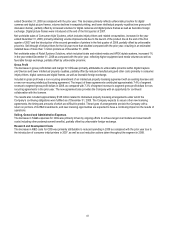

Gross Profit

Gross profit dollars declined in 2009, primarily due to unfavorable price/mix, which impacted all segments but was most prominent in

CDG, lower sales volumes as discussed above, and unfavorable foreign exchange. These items were partially offset by cost

improvements, largely driven by ongoing cost reduction efforts within CDG and FPEG, and lower benefit costs as a result of

amendments made in the third quarter of 2008 to certain of the Company’s U.S. postemployment benefit plans. Gross profit margin

as a percentage of sales increased slightly from prior year, as unfavorable price/mix (primarily within CDG) and unfavorable foreign

exchange impacts (across all segments) were more than offset by lower manufacturing and other costs for the Company.

Included in gross profit for the current year were non-recurring intellectual property licensing agreements within Digital Capture and

Devices in the CDG segment. These licensing agreements contributed approximately 5.7% of consolidated revenue to consolidated

gross profit dollars in 2009, as compared with 2.4% of consolidated revenue to consolidated gross profit dollars for non-recurring

agreements in 2008. The Company expects to secure other new licensing agreements, the timing and amounts of which are difficult

to predict. These types of arrangements provide the Company with a return on portions of its R&D investments, and new licensing

opportunities are expected to have a continuing impact on the results of operations.

Selling, General and Administrative Expenses

The decrease in consolidated selling, general and administrative expenses (SG&A) was a result of company-wide cost reduction

actions implemented in 2009 in response to current economic conditions.

Research and Development Costs

The decrease in consolidated research and development (R&D) costs was a result of focused cost reduction efforts.

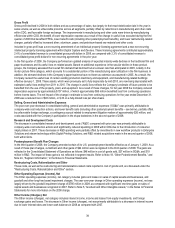

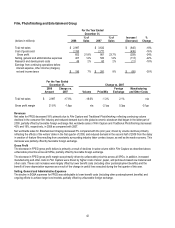

Restructuring Costs, Rationalization and Other

These costs, as well as the restructuring and rationalization-related costs reported in cost of goods sold, are discussed under the

"Restructuring Costs, Rationalization and Other" section.

Other Operating (Income) Expenses, Net

The other operating (income) expenses, net category includes gains and losses on sales of assets and businesses and certain

impairment charges. The current year amount primarily reflects a gain of approximately $100 million on the sale of assets of the

Company’s organic light emitting diodes (OLED) group. The prior year amount primarily reflects a $785 million goodwill impairment

charge related to the GCG business.

In November 2009, the Company agreed to terminate its patent infringement litigation with LG Electronics, Inc., LG Electronics USA,

Inc., and LG Electronics Mobilecomm USA, Inc., entered into a technology cross license agreement with LG Electronics, Inc. and

agreed to sell assets of its OLED group to Global OLED Technology LLC, an entity established by LG Electronics, Inc., LG Display

Co., Ltd. and LG Chem, Ltd. As the transactions were entered into in contemplation of one another, in order to reflect the asset sale

separately from the licensing transaction, the total consideration was allocated between the asset sale and the licensing transaction

based on the estimated fair value of the assets sold. Fair value of the assets sold was estimated using other competitive bids

received by the Company. Accordingly, $100 million of the proceeds was allocated to the asset sale. The remaining gross proceeds

of $414 million were allocated to the licensing transaction and reported in net sales of the CDG segment.