Kodak 2009 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2009 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

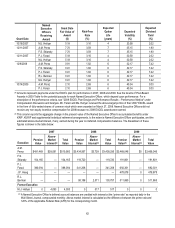

The Company believes that our tax-qualified retirement plans and non-qualified supplemental retirement plans effectively serve to attract

and retain employees.

Supplemental Individual Retirement Arrangements

We have also entered into individual letter agreements with Messrs. Perez, Faraci and Sklarsky to provide additional retirement benefits

beyond those available under our tax-qualified retirement plans and non-qualified supplemental retirement plans. For Messrs. Perez and

Faraci, these agreements provide for eligibility for the traditional benefit component of KRIP and KURIP and for additional years of service

in calculating those benefits. For Mr. Sklarsky, the agreement provides for credits to a phantom cash balance account. Supplemental

individual retirement arrangements were necessary to recruit these Named Executive Officers. The benefits provided to our Named

Executive Officers under any individual retirement arrangement are described on page 75 of this Proxy Statement.

Deferred Compensation Plan

The Company has maintained a non-qualified deferred compensation plan for its executives, known as the Eastman Kodak Company 1982

Executive Deferred Compensation Plan (EDCP). In 2009, the Committee froze the receipt of new monies into this plan indefinitely due to

the plan’s low utilization and administrative costs. Prior to 2009, the Committee had made annual decisions to freeze the receipt of new

monies in both 2007 and 2008. When in effect, the plan permitted the Company’s executives to defer a portion of their base salary for the

following year and up to a portion of any bonus earned under EXCEL the following year. The details of this plan are described under the

Non-Qualified Deferred Compensation Table on page 76 of this Proxy Statement.

Perquisites

The Company provides certain perquisites, which are reviewed periodically, to ensure the personal security of senior executives, to

maximize an executive’s time spent on Company business or to attract and retain them. The primary perquisites that our Named Executive

Officers receive are financial counseling services and personal umbrella liability insurance coverage. Home security services are provided

for Mr. Perez but were no longer reimbursed after January 2009 for Messrs. Sklarsky, Faraci, and Berman, and for Ms. Haag and Ms.

Hellyar.

Our executive security program requires our CEO to use Company aircraft for all air travel, whether personal or business. Our Named

Executive Officers, other than our CEO, are not permitted to use corporate aircraft for personal travel without approval from our CEO. This

restriction applies to personal travel of these Named Executive Officers as well as the travel of a spouse when accompanying the Named

Executive Officer on business travel.

The compensation attributed to our Named Executive Officers for 2009 for perquisites is included in the Summary Compensation Table on

page 61 of this Proxy Statement.

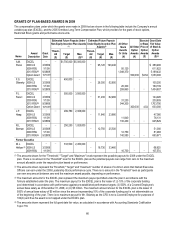

SEVERANCE AND CHANGE IN CONTROL ARRANGEMENTS

Severance Arrangements

Our Named Executive Officers are responsible for the continued success of the Company and the execution of the Company’s strategic

plan to grow our digital portfolio and manage a sustainable business model for our traditional businesses. The Committee believes that it is

important to provide our senior management some measure of financial security in the event their employment is terminated without cause.

Three of our Named Executive Officers have an individual letter agreement that provides various severance benefits in the event their

employment is terminated under various circumstances. These individual letter agreements were established at the time each Named

Executive Officer commenced employment with the Company, or later in connection with entering into a retention arrangement.

Additionally, when determining the appropriate severance arrangement for a Named Executive Officer, the Committee generally applies

pre-established guidelines. Under these guidelines, our Named Executive Officers may be eligible to receive a severance allowance equal

to one to two times their target cash compensation depending on their position, length of service and the circumstances surrounding their

departure. The individual letter agreements for Named Executive Officers are approved by the Committee and are consistent with

guidelines for executive severance that the Committee has established.

Our individual severance arrangements are designed to serve as a retention tool and to eliminate any reluctance of executives to

implement any transformational components of the Company’s strategic plan. In certain instances, an executive’s successful completion of

his or her responsibilities may result in the elimination of his or her job. These arrangements also provide an incentive for individuals to

sign a release of claims against the Company, to refrain from competing with the Company and to cooperate with the Company both

before and after their employment is terminated.

Mr. Perez’s individual severance arrangement provides him with severance benefits that are payable in the event his employment is

terminated by the Company without “cause” or if he terminates for “good reason.” Mr. Sklarsky’s arrangement provides him with severance

benefits for termination by the Company without “cause” or in the event of his long-term disability. Mr. Faraci’s agreement provided him

with severance benefits for termination by the Company without “cause,” but the provision expired on December 6, 2009. The definitions of

“cause” and “good reason” as applicable to Mr. Perez’s and Mr. Sklarsky’s letter agreements are set forth on pages 64 and 65 of this Proxy