Kodak 2006 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

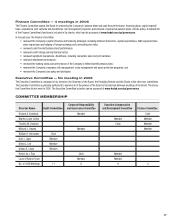

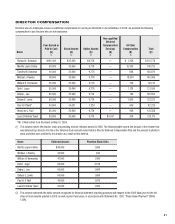

(4) The amount for L. D. Tyson represents the above-market interest earned by Dr. Tyson on her contributions to the Directors’ Deferred Compensa-

tion Plan.

(5) The amounts in this column include perquisites and other benefi ts provided to directors. The total incremental cost of all perquisites or other

benefi ts paid to our directors must be disclosed, unless the aggregate value of this compensation is less than $10,000. In 2006, all of our direc-

tors, except Gov. Collins and Dr. Hawley, received perquisites and other benefi ts that fell below this disclosure threshold. For R. S. Braddock, the

amount includes $1,356 for life insurance. For M. L. Collins, the amount includes $13,494 for the Charitable Award Program, $623 for personal

liability insuance, $205 for travel/accident and $1,008 for life insurance. For T. M. Donahue, the amount includes $648 for life insurance. For M.

J. Hawley, the amount includes $198 for Company equipment, $17,328 for Company-paid expenses to attend an event which the Company spon-

sors for promotional purposes, $623 for personal liability insurance, $205 for travel/accident and $180 for life insurance. For W. H. Hernandez,

the amount includes $708 for life insurance. For D. I. Jager, the amount includes $1,128 for life insurance. For D. L. Lee, the amount includes

$180 for life insurance. For D. E. Lewis, the amount includes $1,800 for life insurance. For P. H. O’Neill, the amount includes $900 for life insur-

ance. For H. de J. Ruiz, the amount includes $936 for life insurance. For L. D. Tyson, the amount includes $336 for life insurance.

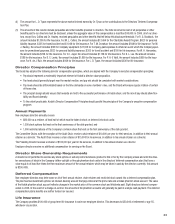

Director Compensation Principles

The Board has adopted the following director compensation principles, which are aligned with the Company’s executive compensation principles:

• Pay should represent a moderately important element of Kodak’s director value proposition.

• Pay levels should generally target near the market median, and pay mix should be consistent with market considerations.

• Pay levels should be differentiated based on the time demands on some members’ roles, and the Board will ensure regular rotation of certain

of these roles.

• The program design should ensure that rewards are tied to the successful performance of Kodak stock, and the mix of pay should allow fl ex-

ibility and Board diversity.

• To the extent practicable, Kodak’s Director Compensation Principles should parallel the principles of the Company’s executive compensation

program.

Annual Payments

Non-employee directors annually receive:

• $80,000 as a retainer, at least half of which must be taken in stock or deferred into stock units;

• 1,500 stock options that vest on the fi rst anniversary of the date granted; and

• 1,500 restricted shares of the Company’s common stock that vest on the fi rst anniversary of the date granted.

The Committee Chairs, with the exception of the Audit Chair, receive a chair retainer of $10,000 per year for their services, in addition to their annual

retainer as a director. The Audit Chair receives a chair retainer of $15,000 for his services, in addition to his annual retainer as a director.

The Presiding Director receives a retainer of $100,000 per year for his services, in addition to his annual retainer as a director.

Employee directors receive no additional compensation for serving on the Board.

Director Share Ownership Requirements

A director is not permitted to exercise any stock options or sell any restricted shares granted to him or her by the Company unless and until the direc-

tor owns shares of stock in the Company (either outright or through phantom stock units in the directors’ deferred compensation plan) that have a

value equal to at least fi ve times the then maximum amount of the annual retainer, which may be taken in cash by the director (currently, this amount

is $200,000).

Deferred Compensation

Non-employee directors may defer some or all of their annual retainer, chair retainer and restricted stock award into a deferred compensation plan.

The plan has two investment options: an interest-bearing account that pays interest at the prime rate and a Kodak phantom stock account. The value

of the Kodak phantom stock account refl ects changes in the market price of the common stock and dividends paid. Eight directors deferred compen-

sation in 2006. In the event of a change-in-control, the amounts in the phantom accounts will generally be paid in a single cash payment. The deferred

compensation plan’s benefi ts are neither funded nor secured.

Life Insurance

The Company provides $100,000 of group term life insurance to each non-employee director. This decreases to $50,000 at retirement or age 65,

whichever occurs later.